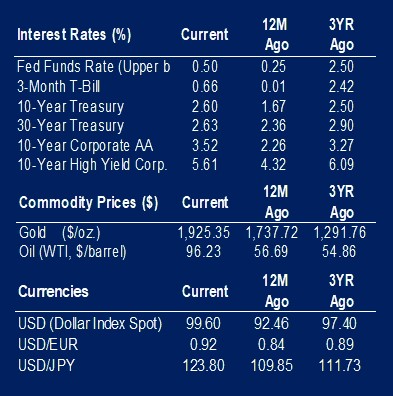

The Federal Reserve (Fed) rhetoric was a headwind to risk assets this week. Current and former governors spoke openly about increasing interest rates in an “expeditious” manner. This leaves multiple 50 basis points hikes on the table for upcoming meetings. The market is pricing in an 86% chance of a 50-point increase at the next meeting on May 4. It is also pricing in a peak Fed Funds Rate above 3.25% in 2023. The last cycle the Fed Funds Rate peaked at 2.5%. The only other time since 1980 that the Fed Funds Rate exceeded a prior peak was in June 2000 when the Fed increased their target rate by 50 basis points. They ended up cutting rates 425 basis points in 2001 as the tech bubble unraveled.

Fed Minutes Released

The Fed minutes were released this week and highlighted the plan for quantitative tightening:

- The plan for quantitative tightening is expected to begin in May.

- The plan is to reduce the balance sheet by up to $95 billion per month, or more than $1 trillion per year.

- The current balance sheet is just under $9 trillion, which is almost exactly double the level from when they tried quantitative tightening the first time.

Equity Rally Fades

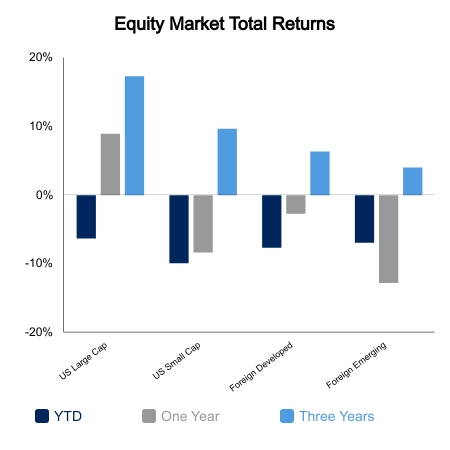

The recent equity rally faded this week amid weakening economic data and expectations of an unfriendly Fed. The S&P 500 was down 2.6% and fared better than both small caps and the NASDAQ, which were both down more than 3.5%. Defensive sectors have held up the market in recent days as cyclical areas such as trucking, home building, and semiconductors approach or breach their year-to-date lows. Industry dispersion has been a major factor this year with a notable gap between the best and worst industries. The oil services industry is up 50% year-to-date while home construction is down 30%.

Missed Expectations

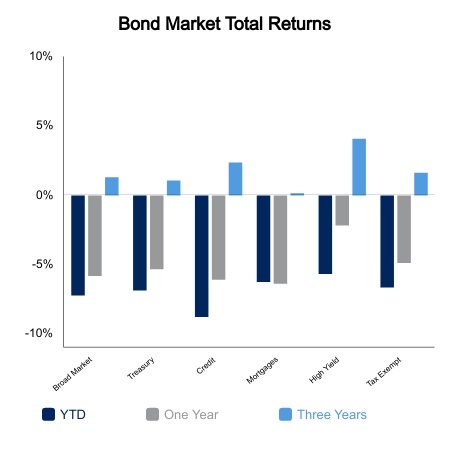

Economic data for the week garnered more attention given some high-profile misses. Employment remained strong with non-farm payrolls up 431,000 and the unemployment rate falling to 3.6%. The ISM Manufacturing Report came in at 57.1, well above 50, but missed expectations of 59.0. More importantly, the new orders component fell sharply from 58.5 to 53.8. The new orders to inventories ratio, a lead proxy for the Purchasing Managers’ Index in coming months, fell below 1.0 for the first time this cycle. Inventories have significantly aided the last two GDP reports and declining new orders is getting attention. Despite this, long-end Treasuries sold off and set a new cycle high in yields across all tenors.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.