Tightening Monetary Policy and Rate Hikes

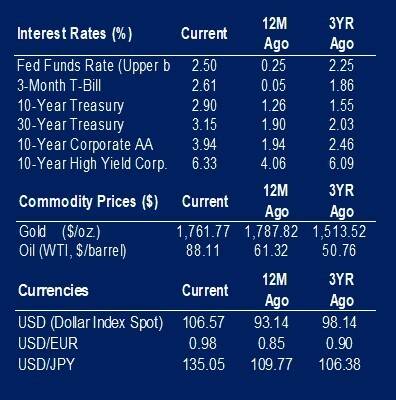

This week’s release of the Federal Reserve’s (Fed) July meeting minutes drew focus from investors looking to see if any consideration was made by the Fed regarding when it would pivot away from tightening monetary policy and slow down the pace of rate hikes. Following the Fed’s July 26-27th meeting, Chair Jerome Powell’s comment that he could see a point where the central bank would stop raising overnight rates has sent equity markets up 8.4%.

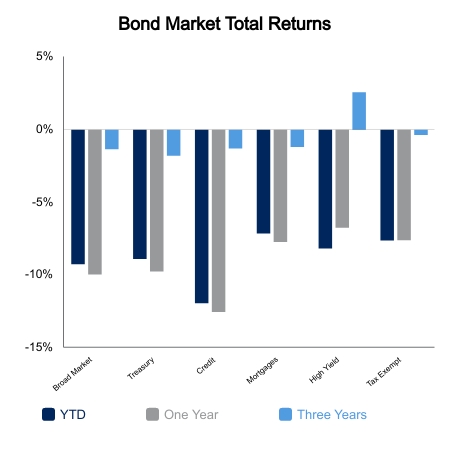

Equity Markets

Equity markets as measured by the MSCI USA Index gained 0.75% during the week, driven by gains in apparel and specialty retailers. This is not a surprise as July retail sales excluding autos and gas climbed 0.7% showing strong demand as lower fuel prices provided room in consumer budgets for spending. July saw online sales for July climb by 2.7%. However, signs of discounts and excess inventory were evident in department store sales, which fell 0.5%. Overseas markets were also up for the week with a 0.71% increase for the MSCI ACWI Ex USA Index. Japan’s NIKKEI Index led other markets, up 4.0% in local terms, or 2.2% for U.S. investors. Year-to-date the NIKKEI Index has posted a positive 1.68% return versus -10.7% for equity markets in the United States, a reminder of the importance of diversification provided by those BTC Capital strategies that include overseas exposure.

Consumer Sentiment and Inflation Expectations

Last Friday’s University of Michigan Consumer Sentiment Index beat expectations recording a reading of 55.1 compared to economist expectations of 52.5. This diffusion index measures consumer attitudes and expectations about subsequent discretionary expenditures. Released along with consumer sentiment was a long-term inflation expectation index showing that consumers see price increases broadening beyond gas prices. This may be construed as a signal that further aggressive rate hike action may be needed to curb inflation expectations. Buying conditions for durable goods dropped to the lowest on record as the post-pandemic shift from buying durable goods to buying services continues.

Housing Market Update

The U.S. Census Bureau reported that construction starts fell to the slowest pace in July since early 2021 while deal cancelations rose. This report showed that housing starts declined 9.6% month-over-month to a 1.45 million annualized rate and that the outlook continues to deteriorate. A report Monday showed homebuilder sentiment slid for an eighth-straight month in August, making this the worst stretch since 2007. Higher inventories of available homes, rising mortgage cost, affordability, and builders being unable to fill open positions have been cited for the slowdown.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.