Inflation Drops – And Sets a Trap for the Bulls

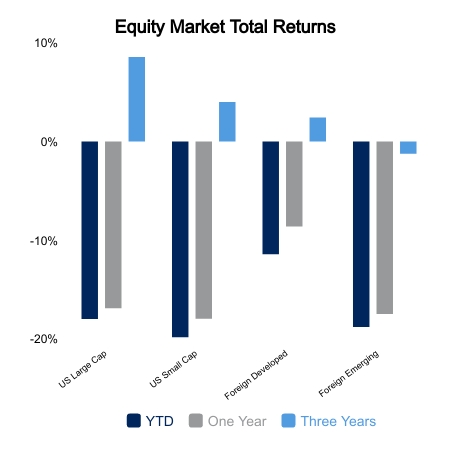

Equities rallied on the week in anticipation of a better-than-expected Consumer Price Index (CPI) report and a dovish pivot from the Federal Reserve. The S&P 500 finished the week up 1.6% with core bonds flat. However, it was likely a more painful ride for investors than the return numbers would suggest.

Most analysts were predicting the CPI would come in lower than expected and that stocks would surge. JP Morgan, for example, issued comments that the S&P 500 could go up 10% in one day if the CPI came in low enough. This is some evidence of euphoria and fear of missing out, the kind of thoughts that central banks have been pushing back against in recent months.

CPI Drops

The CPI did indeed come in below expectations.

- Core CPI rose 0.2% versus the previous month and below the 0.3% expectation.

- November headline CPI fell to +7.1% versus the prior year and down from +7.7% in October.

- Real earnings were down for the 20th consecutive month.

The S&P 500 futures were up 0.9% ahead of the release to go along with a gain of more than 1% on the previous day. On the release the futures surged an additional 3.1% to reach a pre-market gain of +4%. As of this writing, the S&P 500 futures are down 6.0% from their intraday high in just over two days. This is yet another case of buy the rumor and sell the news. Those looking for V-shaped recoveries continue to be pushed back.

Central Banks Remain Hawkish

The Federal Open Market Committee (FOMC) meeting on Wednesday was again bought into as the market was ready for a Chair Powell pivot so it could be off to the races. The S&P 500 was up almost 1% going into the meeting. It would fall more than 2.5% from its high before recovering some of the losses into the close.

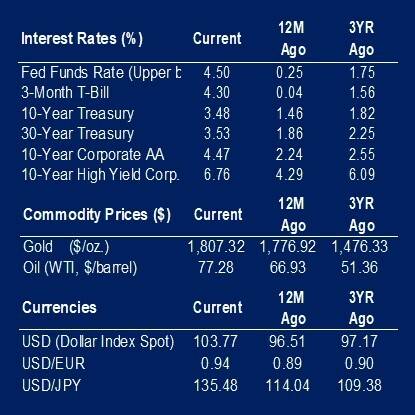

- The FOMC raised interest rates 50 basis points (bps) to 4.5% at the upper range.

- The FOMC remained hawkish, signaling a likelihood of “ongoing increases,” in the Federal Funds Rate.

- The terminal rate is forecast at 5.1%, but attention was drawn to the fact that seven members have an upper level of 5.5%.

- Chair Powell noted that goods deflation is occurring, but that service sector inflation needs to come way down.

The European Central Bank follows the Fed and they raised rates by 50 bps today. Usually much more dovish than the Fed, they pivoted to a surprisingly hawkish tone. Chair Lagarde indicated there is potentially several more 50 bps increases even though she acknowledged the expectation that the region is already in recession.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.