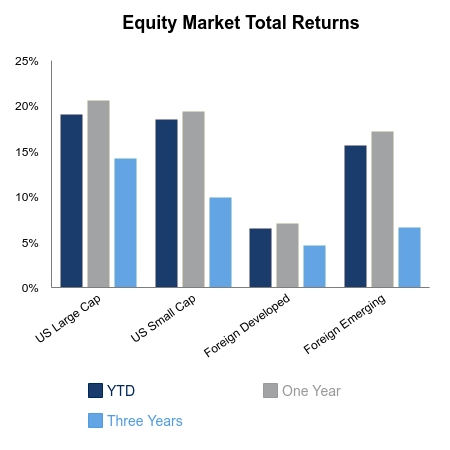

Equities inched up on the week with the S&P 500 gaining 0.80%. Small caps continue to perform well following a stellar November. They gained 2.7% on the week. The NASDAQ also did well with gains outpacing the broader S&P 500, which was held back by a pause in energy stocks. Emerging market and foreign developed equities tagged along to post gains as well. The Bloomberg Barclays Aggregate Bond Index was up slightly on the week.

Economic data has come in soft recently with some speculating the Fed would immediately act more accommodative at their Federal Open Market Committee (FOMC) meeting this week. Initial jobless claims jumped to 853,000 and erased two months’ worth of improvement. Retail sales came in well below expectations. Retail sales excluding autos and gas fell 0.8% in November versus an expectation of a slight gain. High frequency data points are also weak following recent lockdowns in various cities.

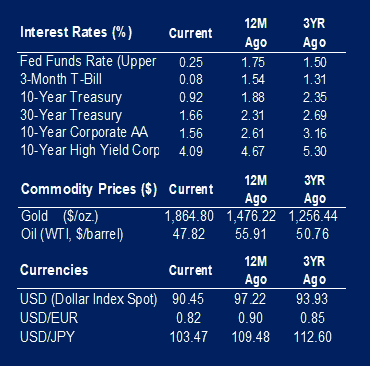

The FOMC kept interest rates at zero and left policy support broadly unchanged. They failed to surprise the market with more maneuvers to boost asset prices. Despite this, the equity market was unphased and finished the day on solid footing. The Fed continues to maintain a “do whatever it takes” rhetoric that is viewed positively by the market.

A recent update on markets has the S&P 500 sitting right at all-time highs. Oil has continued its move higher to trade back to March levels. Commodity prices have made significant moves with copper trading at seven-year highs. Raw industrial prices are at a two-year high. Lumber prices went parabolic this summer to all-time highs and after a pullback still sit two standard deviations above the 20-year average. And, to round it out, some of the largest fixed income managers in the world are racing to see who can put the highest price target on Bitcoin. Bitcoin hit an all-time high this week after a string of large institutional players commented on their recent investment.

Looking forward the market will be watching for fiscal stimulus updates and Tesla inclusion into the S&P 500. Tesla will begin trading in the S&P 500 on Monday. There is speculation that because of its size and much higher implied volatility, it could have negative short-term implications on the derivatives markets and ultimately the price of the S&P 500, given the interconnection of the two.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.