The housing market continues to be hot. In November, 6.690 million existing homes were sold. This number compares favorably to the expected 6.685 million. Construction on 1.547 million homes began in November as measured by the housing starts number, which is also stronger than the expected 1.525 million. Additionally, more building permits were issued than anticipated. The 1.639 million building permits issued was higher than the expected 1.550 million. New home sales, on the other hand, came in lower than expected at 841,000, which was close to 150,000 less than the expected 990,000.

Consumer confidence took a dip in December. Forecasters expected 97, instead of the actual 88.6. The number may be a result of perceptions of the impact of increased COVID-19 cases. Negative news continued with the Philadelphia Federal Reserve Index number. The Philly Fed Index measures manufacturing activity in the Third Federal Reserve District. More firms recorded increases in activity than decreases. The increases, however, were lower than expected. The reading of 11.1 compares unfavorably with the expected 20.

Orders for durable goods continued to be strong in November. The preliminary number for durable goods orders of 0.90% is higher than the expected 0.60%. This is the seventh month in a row we have seen growth in durable goods ordering. Orders for transportation equipment continue to be the largest contributor to this growth. These orders are up for the sixth month out of seven.

In November, personal income decreased by 1.1%, or $221.8 billion. Personal Consumption Expenditure (PCE) also decreased by 0.4%, or $63.3 billion. The personal income decrease was impacted by a decline in Paycheck Protection Program loans. A decrease in governmental social benefits, specifically, the Lost Wages Supplemental Payments, also contributed to the decline. The decrease in PCE was due to a reduction in spending on goods and services. However, PCE is up 1.1% over the year.

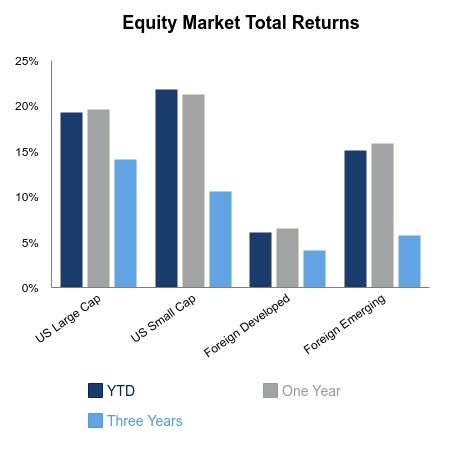

Equity markets, as measured by the S&P 500 Index are down 0.28% this week. We approach the end of the year on strong equity market footing. Year-to-date performance is at 16.28%. This is incredibly strong performance considering we were in a recession earlier in the year.

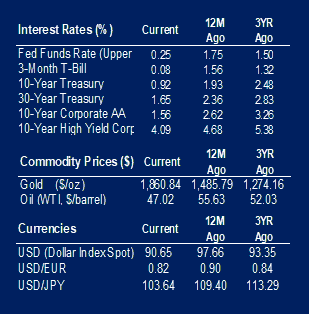

There was a dip in WTI Crude Oil pricing as energy markets react to the potential for continued slowed demand amid increasing COVID-19 restrictions.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.