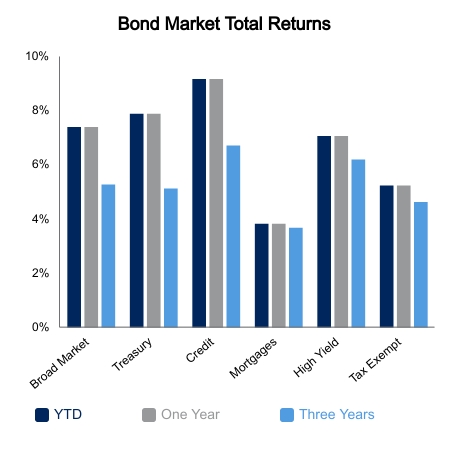

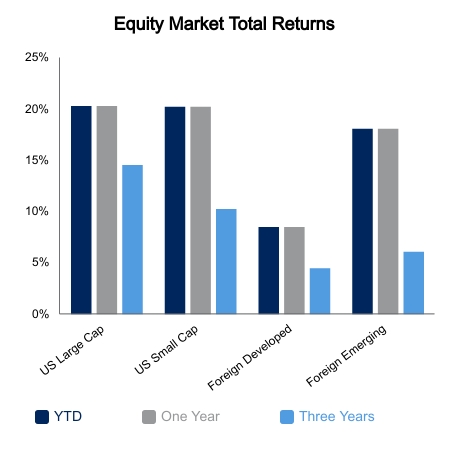

Equities moved higher on the week to cap off a strong year. The S&P 500 was up 1.2% on the week, whereas the Russell 2000 Index of small caps pulled back 1.3%. Strength was seen in overseas markets where the MSCI EAFE Index and emerging markets gained 2.3% and 2.5%, respectively. The Bloomberg Barclays Aggregate Bond Index was up 0.3%. As we wrap up the year, all asset classes posted solid gains. The NASDAQ led the way with gains of 45%. The S&P 500 was well back, but still posted above-average gains of 18%. Emerging markets also added 18%, while foreign developed stocks lagged with gains of 9%. Fixed income returns will be positive as the Bloomberg Barclays Aggregate Bond Index is in-line for 7% gains.

This week the Brexit saga reached a conclusion after four long years. Beginning in January, the United Kingdom will no longer be in the European Union customs union and single market. While there remain some final wording agreements to be ironed out, this should put the whole topic out of mind for financial market participants.

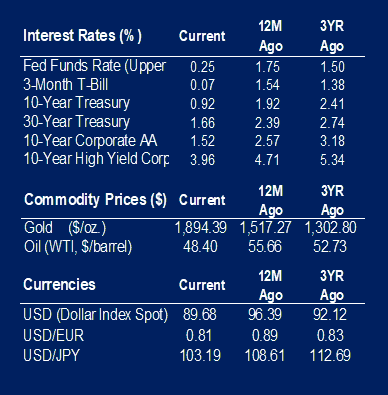

This year will surely go down as one of the most surprising in terms of market performance, especially if one dives down to some of the single name equity performances. Looking at the yearly charts can help set a big picture view. We will close out the year with all the major U.S. equity indices recording their highest yearly close and all major U.S. Treasury tenors setting their lowest yields for a calendar end.

As we look forward to 2021 there appears to be a consensus view that recent trends will persist. Often shocks can occur when an overwhelming consensus viewpoint is proven wrong. According to Bank of America, technology is the most crowded trade despite posting back-to-back yearly gains of more than 40%. This is very rare for a sector to do, and in 10 of the prior 11 instances, the sector was down the following year. There has also been a near record inflow into equities from retail traders and foreign investors. Fund manager cash levels are at near record lows. We could be set to get an early read on consensus breaks when the Georgia Senate run-off takes place on Tuesday. Current betting odds give about a 65% chance of a win to Republicans, but early statistics show this could be too aggressive. A Democrat win could set the stage for a wild ride in the first two months of the year as stimulus euphoria faces off against rising bond yields, rising taxes and increasing regulation.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.