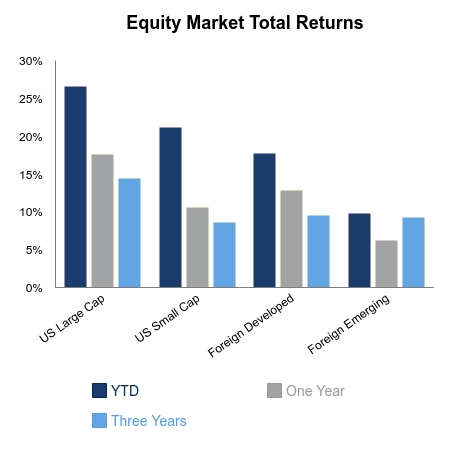

Equities started the month off on a soft note with the S&P 500 falling 1.3% over the past week. Domestic small caps were down a similar number while foreign developed equities fared better with a 0.9% decline. Despite the equity drop, fixed income didn’t provide any offset as the Bloomberg Barclays Aggregate Bond Index was flat on the week. Gold mining stocks provided the hedge with gains north of 3% following a recent bout of weakness. Gold mining stocks have had a good run over the past year with gains of 42% as measured by the NYSE ARCA Gold Mining Index.

Equity markets had one of the bigger drops in the last two months following remarks from President Trump that indicated a more hawkish tone on tariffs. This was regarding China as well as potential new proposed tariffs on French goods in retaliation for their digital taxes on U.S. companies. Markets quickly bounced; however, as unnamed sources said a China deal was close. We are approaching the December 15 deadline where tariffs are scheduled to increase. This will cut through much of the phony headlines and make it clear as to how close both sides are in reaching an agreement.

The beginning of the month usually brings out a full slate of economic data. We can ignore the Black Friday or Cyber Monday online sales jump headlines, because we would need to be in an economic depression for online sales to fall year-over-year. One of the primary market moving indicators in focus remains the ISM Manufacturing survey, which was much softer than expectations with a 48.1 reading. This helped contribute to a down day to start the month for equity markets. The following day the ISM Non-manufacturing Index missed consensus and declined sequentially. ADP Employment, which is a first look at private sector job growth, showed only 67,000 net gains. This was the second lowest point since the Great Recession, and both low points have occurred this year. The three-month and 12-month moving average for ADP job gains are at their lowest levels since the recovery of the last recession.

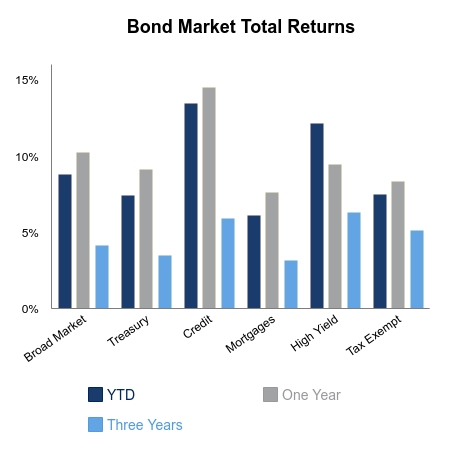

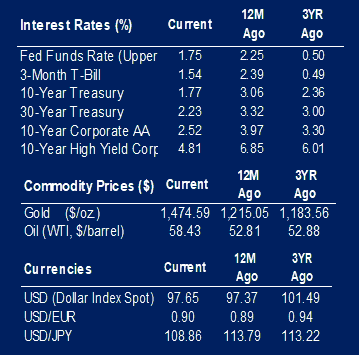

Bond yields have been creeping higher as oil prices and commodities attempt to firm up. The economic data remains soft despite some pockets of optimism that the worst is over. Could bond yields be anticipating the early innings of a recovery? Equity markets seem to be beholden to trade headlines so we should expect some jump conditions as we head toward the December 15 deadline.

|

|

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.