Employment

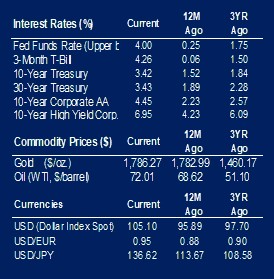

Employment data was at the forefront of this week’s economic calendar. Despite concerns regarding an impending recession the employment picture continues to be resilient as the unemployment rate remained unchanged at 3.7%. Non-farm payrolls rose by 263,000, higher than the forecasted increase of 200,000. In addition to the above expected level of job growth, hourly earnings also surpassed expectations registering 5.1% for November compared to an anticipated increase of 4.6%. Labor market strength enhances the commitment by the Federal Reserve to further increase interest rates to rein in the rate of inflation. Later this month it is widely expected that the Federal Reserve’s key short-term rate, the Federal Funds Rate, will be increased by another half a percent.

ISM Results

Institute of Supply Management (ISM) results for November were mixed with the manufacturing index registering a result of 49.0 while the services component of the economy came in above consensus at a level of 56.5. Readings under 50 suggest a contraction while those over 50 indicate growth. November’s results indicate a manufacturing sector that is very close to the growth/contraction line of demarcation while the service sector remains solidly in growth mode. To lend some perspective to this differential, manufacturing represents only about 11% of the U.S. economy while services have the dominant share.

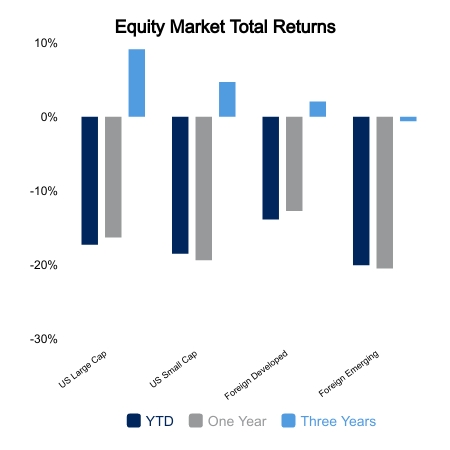

U.S. Equity Markets

The first week of December proved to be a difficult one for U.S. equity markets as declines were seen across the board. Large cap stocks did experience a smaller decline of -3.7% for the Russell 1000 Index relative to small caps which came in at -4.2% as measured by the Russell 2000 Index. Historically, the month of December has seen positive returns for U.S. equities 73% of the time for the S&P 500 Index with an average return of 1.4%. International equities had a better start to the month with a return of -1.3% for the MSCI ACWI ex U.S. Index. For the quarter-to-date period a dead heat exists between domestic and international equities with the Russell 3000 Index and the MSCI ACWI ex U.S. registering returns of 9.7%.

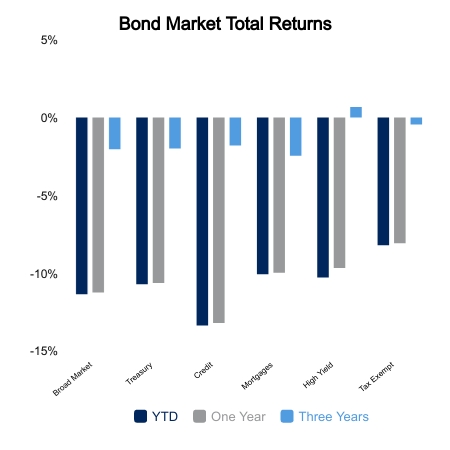

Interest Rates

Also declining over the past week were interest rates. The benchmark 10-year U.S. Treasury saw its yield decline to 3.41% from 3.60% while a two-year issue experienced a very minimal decline to 4.26% from the prior week’s level of 4.31%. With the probability of recession increasing, fixed income investors are looking beyond further increases in the Federal Funds Rate to a weaker economy, which leads to a lower rate environment.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.