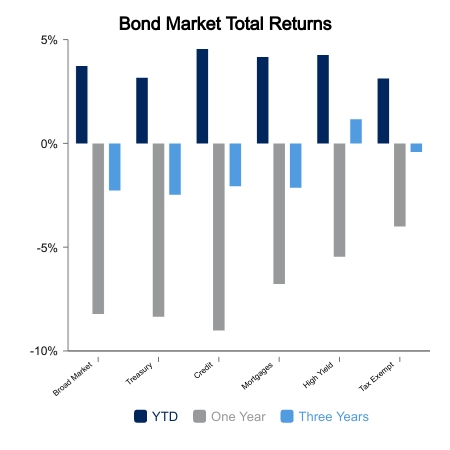

U.S. equity markets as measured by the MSCI USA Index gained 0.6% this week finishing out January up 5.5%. This past month bond markets climbed 3.1% as interest rates continued to drop across the yield curve. This positive kickoff to 2023 comes as a relief after 2022 was the worst combined bond/stock return for several generations of investors.

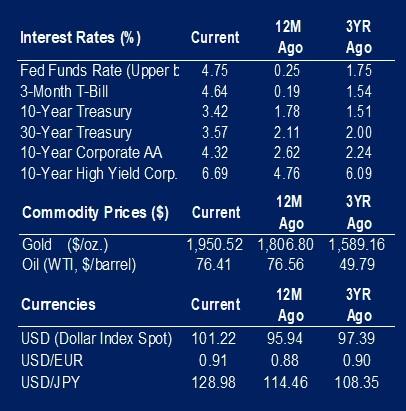

The Federal Reserve’s Open Market Committee (FOMC) provided confirmation of its resolve to lower inflation by raising the cost of overnight borrowing by 0.25% to 4.75%. This follows a 0.50% increase last December for a total increase of 4.50% since this time last year. The slower rate of increase is justified given recent softer-than-expected inflation readings since the FOMC’s December meeting. The objective of raising the cost of credit, is to reduce demand for goods and services and return to a period of price stability, a core mandate of our central bank. The statement provided after the Fed’s meeting indicated that committee members remain hawkish hinting at their resolve to raise rates above 5.00%. In the post-meeting conference, Chair Jerome Powell acknowledged that signs of disinflation have appeared, but his preferred inflation metric – Personal Consumption Expenditures Price Index core services excluding rents – has stabilized at about 4% over the past year and shows few signs of slowing to the Fed’s target of 2.0%.

A factor keeping the Fed steadfast on lower inflation is the ongoing strength of employment and the resulting impact on wage inflation. The number of available positions climbed to a five-month high of just over 11 million in December from 10.4 million a month earlier according to the Labor Department’s Job Openings and Labor Turnover Survey, or JOLTS. The ratio of openings to unemployed people rose to 1.9 from 1.7 a month earlier compared to an average of 1.2 before the pandemic. While hiring edged higher in industries like construction, retail trade and health care, layoffs also ticked up. Separate figures earlier in the week from the ADP Research Institute showed private hiring moderating last month to the slowest pace in two years, noting inclement weather in the Midwest during December.

Fourth quarter GDP reported a 2.9% annualized growth rate down from 3.2% previously reported for the third quarter. Despite this positive outcome the underlying details show signs of an economy losing momentum. The Conference Board Consumer Confidence Index slipped to 107.1 down slightly in January and worse than consensus expectations. The survey showed consumers are less upbeat on the jobs market, business conditions and the overall economy, despite getting some relief on the inflation front.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.