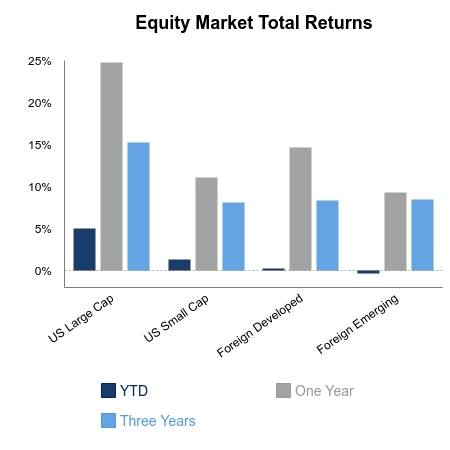

Global equities were positive on the week. The S&P 500 gained 1.4% and outpaced small cap domestic stocks. Emerging markets bounced back a little with gains of 1.9%. The Bloomberg Barclays Aggregate Bond Index gained 0.3% on the week. Panning out to the year-to-date timeframe, we already see some divergences becoming evident. The trends of the last several years appear to be regaining momentum. The S&P 500 is up 4.8% year-to-date whereas small caps are up just 1.3%. Emerging markets are down on the year and foreign developed is up less than 1%. The Russell 1000 Growth Index is up 8.2% versus a much smaller gain of 1.4% for the Russell 1000 Value Index.

Non-farm payrolls advanced 225,000, which exceeded expectations. Benchmark revisions took away more than 500,000 jobs for 2019, which was foreshadowed in earlier publications. Still, employment growth of 1.4% versus the prior year is well ahead of the working age population growth. On the negative side, job openings have been in free fall, now down 14% versus the prior year. This is a worrisome sign but is not confirmed by other indicators. The labor market diffusion index remains strong with a majority of industries increasing employment.

According to FactSet, with 64% of the companies in the S&P 500 reporting fourth quarter 2019 results, the blended earnings growth rate is 0.7%. The percentage of companies beating their earnings per share estimate as well as the earnings surprise percentage are below the five-year average. Forward guidance has also been weak.

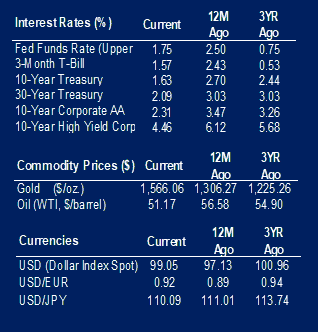

The Euro has weakened of late and now sits at its lowest level since 2017 relative to the U.S. dollar. Despite this, gold prices remain elevated and near a seven-year high. Gold prices have been supported by increasing central bank asset purchases and low real yields. Other commodities have been hit hard on concerns Chinese demand will be weak due to the virus outbreak. Copper fell for 13 straight days, a record, but has since made a small bounce in recent days. Oil prices fell sharply to trade under $50 a barrel despite trading above $65 in the early part of the year. Looking forward there remains several catalysts such as a clarity on who will emerge in the Democratic party and whether the virus outbreak will become more of a global threat.

|

|

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.