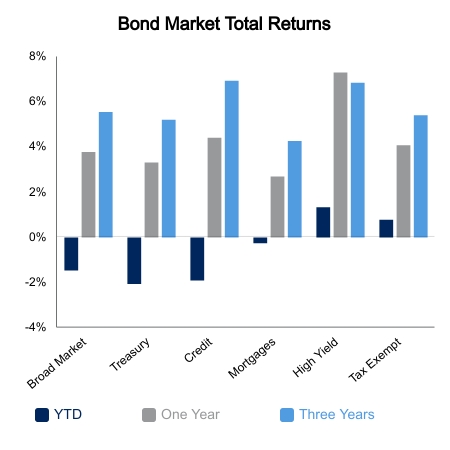

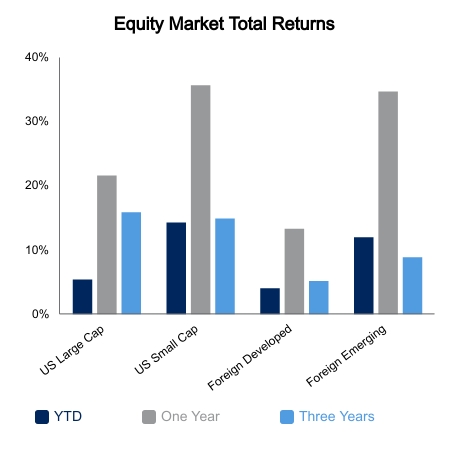

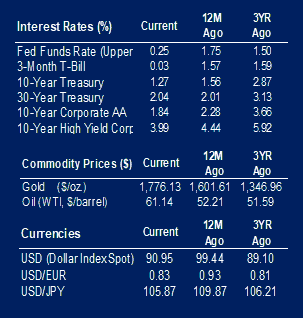

Equities inched up on the week, setting new highs in the process. The S&P 500 advanced 0.6%, but there was notable rotation under the surface. The energy sector jumped 4.0% as freezing temperatures across the country forced oil shut-ins and boosted demand for natural gas and other related commodities. Offsetting this was a 2.6% drop in the technology sector as fear of rising interest rates weighed on equities with rich valuations. The 10-year Treasury yields moved up 18 basis points on the week to end at 1.30%. This pushed the Bloomberg Barclays Aggregate Bond Index to a weekly loss of 0.6%. The bond index is down 1.5% year-to-date and it is the second worst start to a year since 1992. The only year with a worse start was 2018, which was a down year for stock indices amid significant volatility. Gold is down more than 6% year-to-date, its worst start to a calendar year in 30 years.

The economic data was light but generated some buzz. Initial jobless claims have failed to improve for nearly five months. The University of Michigan inflation expectation for the next year has jumped to 3.3%, its highest level since 2014. Part of the link in sustained rising inflation is a spill-over into expectations which allows the feedback cycle to continue. Producer prices also came in well above expectations which caused a jump in bond yields. Retail sales for the month of January far exceeded expectations. Core retail sales jumped 11.8% versus the prior year to post the largest gain in the 30-year history and more than double the average.

It has been suggested fiscal stimulus targeted to lower incomes would create more economic growth, due to this income demographic’s higher marginal propensity to spend. On the other hand, quantitative easing results in an asset allocation transfer among those with a high savings propensity and does not filter into the real economy. We are seeing evidence of this theory panning out in the initial phases of recovery. Continued stimulus checks may enable this situation to continue. This could force the Federal Reserve into a corner quicker than many assume, as the market has started pushing up rate hike expectations to the back half of 2023. It could manifest in rising volatility across all asset classes as the year progresses.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.