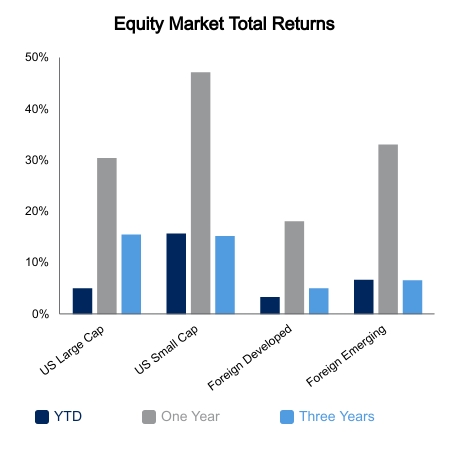

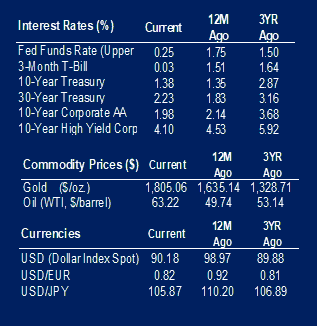

Equities bounced back mid-week amid sector divergences. The S&P 500 was down 0.1%, balanced by declines in high growth stocks and gains in so-called value stocks. Rising interest rates put pressure on growth stocks nearly every day, although some days witnessed mid-day buying to limit the damage. The S&P 500 Energy sector was up 8.3% on the week while the S&P 500 Technology sector was down 3.2%. Energy is now outpacing the Technology sector by more than 35% year-to-date. Back-end interest rates continue to move higher with the 10-year Treasury up 10 basis points on the week and the 30-year Treasury up 20 basis points. The Bloomberg Barclays Aggregate Bond Index was down 0.7% for the week and continues to be on pace for one of its worst years ever.

Reports of robust economic data continued this week. Building permits came in well above expectations with a 10.4% monthly increase. This was a 22.8% jump versus the prior year and the biggest jump since 2015. Some of this enthusiasm was muted later in the week when mortgage applications fell 11.4%. This could be triggered by the recent rise in mortgage rates. The average 30-year fixed mortgage rate has jumped above 3.0% as interest rates move higher. Regional manufacturing indices continue to outpace expectations with close attention being paid to the skyrocketing prices paid component. Commodity prices continued their straight line up. Copper prices are up more than 20% this month and now sit at a 10-year high. Lumber prices are up nearly 300% from last year’s low and well into record territory.

Federal Reserve chair Jerome Powell gave testimony to the U.S. House Financial Services Committee. Attention was focused on how he would respond to questions regarding rising back-end interest rates. He came off dovish in the sense that there was no indication of yield curve control and instead said it may take three years to reach their inflation target. The next day the 30-year Treasury was up more than 10 basis points before giving some of it back. The more the Federal Open Market Committee thinks inflation is transitory, the more likely long-end bond yields can push higher and more closely align with nominal gross domestic product. Implied inflation over the next five years currently sits at an eight-year high. The steepening of the Treasury curve is reaching a point that historically been associated with rising volatility across asset classes.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.