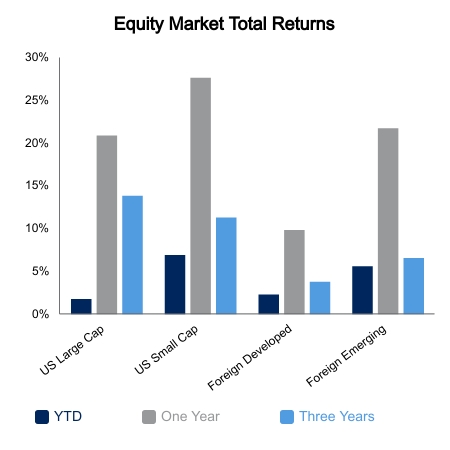

Equities posted a strong week with broad strength across global markets. The S&P 500 advanced 1.7% but was outpaced by both the NASDAQ and Russell 2000. The NASDAQ gained 3.1% with small caps up 2.6%. And emerging markets saw gains of 3.7%. South Korea has been leading the way since October with benchmark gains more than doubling the S&P 500. The Bloomberg Barclays Aggregate Bond Index was flat on the week as yields move up to hit cycle highs, before retracing somewhat.

The economic data was a mixed bag. The ISM Services Index came in better than expected with a 57.2 reading on the diffusion index. Services have been lagging the robust manufacturing rebound. New orders remain solid, but employment took a dip below the expansion level and is notably lower than the level three months ago. Thus, it was not a shock when the Bureau of Labor Statistics labor report showed private payrolls declined 95,000 in December. This was the sixth straight monthly decline. Hospitality and Leisure shed 498,000 jobs and therefore the report is being written off in expectation that a vaccine will open this segment of the economy in the coming months.

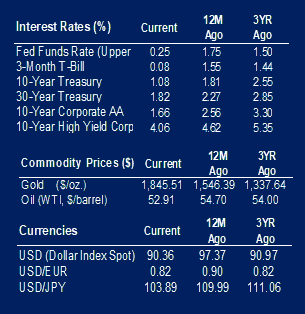

The Consumer Price Index (CPI) came in at 1.4% versus the prior year whereas core CPI was 1.6%. With oil prices up more than 250% from the April monthly close, it is all but assured CPI will rise notably off these base effects. Rising energy prices also tend to bleed into the core reading as well. Therefore, we could see some high inflation readings this year. The five-year inflation breakeven rate is now above 2.0%. If it can sneak above 2.17% then it will be an eight-year high.

Last year, the Federal Open Market Committee made a major policy shift to move away from countercyclical policy to pro-cyclical in the hopes of driving higher inflation expectations. Instead of raising rates as unemployment falls, they will instead seek flexible average inflation targeting. They want to average 2% inflation over a cycle, and this means it must run above 2% for a good chunk of the time. They cite that increasing the federal funds rate to prevent inflation disproportionally curtails minority employment. This could be true, but high inflation is not exactly a picnic for low-income households either. And just yesterday the Fed Vice Chair said he does not expect to raise rates until inflation is above 2% for an entire year.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.