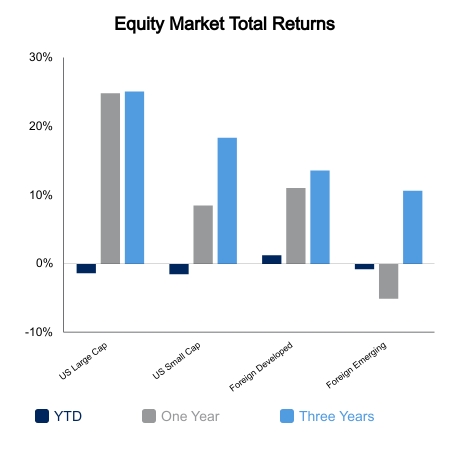

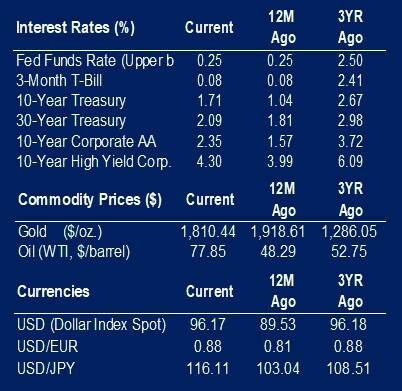

U.S. equity markets have welcomed us into 2022 with major market moves. Apparently, volatility is the appropriate New Year’s gift in 2022. The S&P 500 closed the first day of the year strong, up 0.64% for that day. The third day was a lot weaker, down 1.93%. Minutes from the Federal Open Market Committee’s December meeting indicate an increased probability of a March rate hike. These comments from the Fed led to Wednesday’s drawdown. Rising inflation and a tight job market were the primary reasons they gave to explore lifting rates in March. There was also talk of shrinking their $8.76 billion bond portfolio. Easy monetary policy was a contributing factor to the strong equity market returns we saw last year. Equity markets are down 1.36% in 2022.

Economic data this week was mediocre. Nothing really good, but nothing really bad either. The final readings for the Purchasing Manager’s Index (PMI) for December were released. The PMI composite was at 57 for the month. The manufacturing and services PMIs were at 57.7 and 57.6 respectively. PMIs stayed above 50 all through 2021. Readings over 50 are considered indicators of economic expansion.

In November, the number of job openings dipped down 529,000 from the previous month to 10.56 million. The largest decrease in job openings came from accommodation and food service industries. Construction and non-durable goods manufacturing also saw significant decreases. However, job openings in finance and insurance companies increased. High JOLTS numbers have been a concern for over a year, contributing to a tight job market.

In December, non-farm private sector employment increased by 807,000. This is from the ADP National Employment report. The increase is significantly higher than expected. An addition of 400,000 was expected. For reference, 504,900 jobs were added in November.

The first few days of 2022 have seen sharp increases in the price of oil. A barrel of brent crude is up 3.83%. Current projections have oil prices staying flat through the year as supply catches up to demand. U.S. producers are expected to put shutdown wells back online.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.