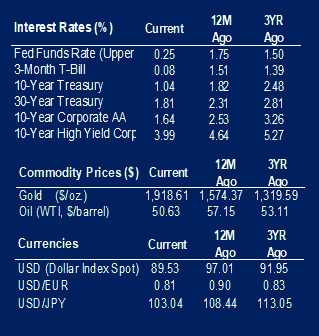

The Energy and Financials sectors have started off the new year on the right foot. The Energy sector is up 7.8% in the first three trading days of the year and the Financials sector is up 3.42%. This comes after a year where Energy underperformed by 33.68% and Financials were down 1.69%. The recent performance in Energy comes on the heels of production limitations from OPEC countries and the expectation for increased demand for the commodity from current levels. Year-to-date, WTI Crude Oil is up 4.72%. Over the three-month period, the commodity is up 27.15%. The commodity closed yesterday at $50.63/bbl.

The final number for November’s durable goods orders were released this week. The update confirmed the strength in durable goods orders with growth of 0.97% over the month. This is the seventh consecutive month orders have grown. Orders for transportation equipment continue to be a driving factor for growth. These equipment orders have grown six out of the last seven months.

Expectations for growth in manufacturing continue to be positive. Numbers from both the Markit and ISM Purchasing Managers’ Indexes (PMI) for December show purchasing managers are expecting more orders. The Markit PMI number of 57.1 is one of the stronger numbers we have seen in a few years. The expectation was for the number to come in at 56.5. The positivity is led by managers in the manufacturing equipment sector. Consumer goods producers are a little more pessimistic. This pessimism can be attributed to the increase in COVID-19 cases.

The ADP Employment Survey shows 123,000 jobs were lost in December. The data comes from a survey of roughly 225,000 employers covering 14 million employees. Large companies saw the largest reduction, losing 147,000 jobs. Small company jobs contracted by 13,000. There was some growth in the medium-sized company space with the addition of 37,000 jobs. The impact of this contraction in jobs was most felt by service companies, which lost 105,000 jobs. Companies that provide goods only lost 18,000 jobs. The month’s reading is the first decline since April.

The meeting minutes from the Federal Open Market Committee December meeting were released this week. The committee voted to keep benchmark short-term interest rates where they are at, close to zero. The minutes indicate the Fed’s intention to give the public advance notice before deciding to scale back on bond purchases.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.