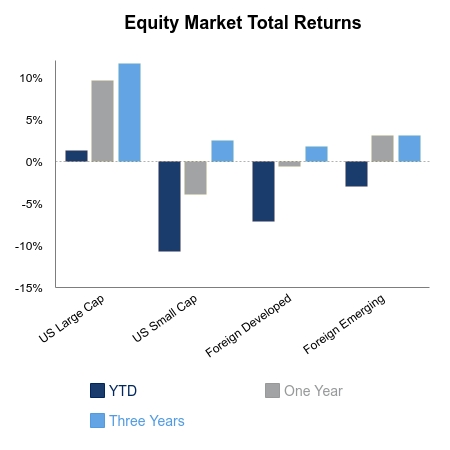

Equities advanced on the week despite initial weakness from increasing lockdown measures across the country. The S&P 500 advanced 1.8% on the week, but this time it was led by value and laggard names. The momentum equities came under pressure causing the NASDAQ to lag with a gain of 0.6%. Small-cap domestic equities performed the best with a jump of 3.6%. Emerging market equities ended the week in the red. The Bloomberg Barclays Aggregate Bond Index advanced 0.3%.

Economic data was light on the week. Initial jobless claims remain elevated and companies are starting to cut jobs as the depth of the downturn starts to sink in. Airlines are making big cuts, and so are retailers and industrial companies. Permanent job losses are rising at the fastest pace on record.

Stocks continue to rise on COVID-19 vaccine trial headlines despite a fair amount of uncertainty on safety and timing. It is reminiscent of the trade war with China and the daily Twitter headlines that a deal was close. Market participants were leery to be short on fears of a big jump at any moment if officials said a deal was close. This dragged on for many months, keeping a floor under the market, before a rather soft deal was finally agreed to with China. Optimistic vaccine headlines usually see the cyclicals rally and the NASDAQ come under pressure. This was the case on Monday where most of the big winners in the recent rally had large drawdowns of 8-10%. Monday saw Tesla stock rise 15% in early trading, but then finish the day down 3% in a stunning reversal.

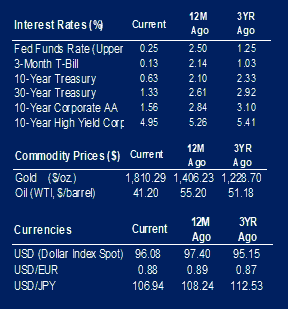

Despite these frequent one-day reversals, value stocks have been unable to demonstrate sustained outperformance. The Russell 1000 Growth Index is up 15.1% year-to-date whereas the Russell 1000 Value Index is down 13.2%. Since the beginning of 2017, the Russell 1000 Growth Index has generated almost seven times the total return of its value counterpart. Energy equities have lagged for quite some time, but financials have been soft with interest rates near the zero bound. It should come as no surprise the U.S. sector performance is following a similar path exhibited by Japan and Europe once their interest rates fell toward zero. After the ECB took rates to zero at the beginning of 2016, the MSCI European Growth Index has generated 10 times the returns of the MSCI European Value Index, with both underperforming the U.S. markets by a large amount. The same dynamic has also played out in Japan.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.