The Consumer Price Index (CPI) number for June came in this week. The month-over-month price increase was higher than expected at 0.3%, excluding food and energy. The previous month’s CPI numbers have been pretty anemic. This is the largest increase in core CPI in the last 18 months. The expectation was for June’s number to be the same as May’s – 0.1%. The growth was led by an increase in prices of apparel, autos and household furnishings. Month-over-month headline CPI, which includes food and energy, was flat with growth of 0.1%. Cheap gas and food prices kept the number low. Year-over-year, core CPI grew by 2.1% and headline CPI was up 1.6%. It is not likely these recent price changes will strongly impact the coming Federal Reserve interest rate decisions. The month-over-month Producer Price Index (PPI) growth numbers for the period were the same as the CPI numbers.

Consumers are spending. Retail sales for June were stronger than expected. Online, restaurant and bar, and car sales were the major contributors to the growth. E-commerce and other nonstore retailers increased sales by 1.7% from May. Food services and drinking establishments increased sales by 0.9%. Motor vehicles and parts dealers increased sales by 0.7%. The biggest drag on the sales number was lower gas station sales. The sales numbers show some strength in consumer spending. This offsets some of the weakness we have seen in business investments.

On the other hand, growth in business inventories was lower than expected in May. The reading of 0.3% was short of the expected 0.4% and last month’s 0.5%. However, Business sales were up 0.2% from April, better than the previous month’s dip of 0.2%. This brings the total business inventories/sales ratio for May to 1.39, a slight increase from the previous month’s 1.34. The initial decrease in sales could be the reason businesses are easing back on how much inventory they hold.

There was some weakness in housing in June. Housing starts dipped to 1.253 million from 1.265 million. The expectation was for construction to start on 1.265 million houses in June. However, the number of building permits issued was 1.22 million, lower than the expected 1.3 million and the previous month’s 1.299 million. The low interest rates should be a boon for housing, but we haven’t seen much strength in the sector.

Contributed by | Kuuku Saah, CFA, Investment Analyst

Contributed by | Kuuku Saah, CFA, Investment Analyst

Kuuku is an Investment Analyst with seven years experience in the Wealth Management division of Bankers Trust, most recently on the Trading Desk as a Securities/Trading Specialist. Kuuku’s primary responsibilities include supporting our portfolio managers in security and portfolio analysis. Kuuku attended Drake University and double-majored in finance and economics. During that time he interned with BTC Capital Management.

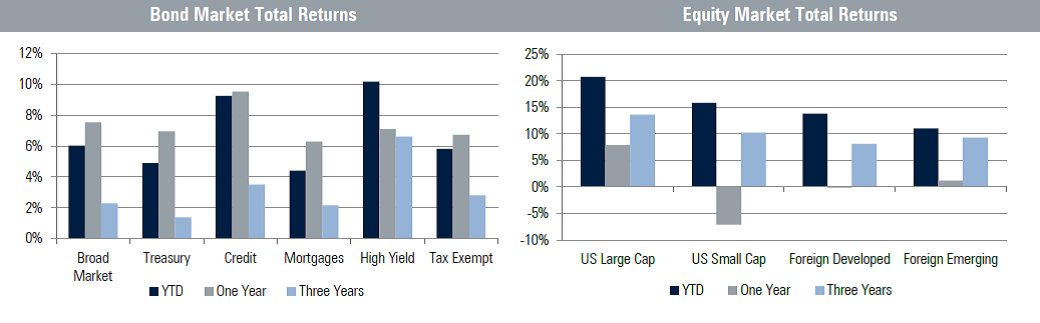

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.