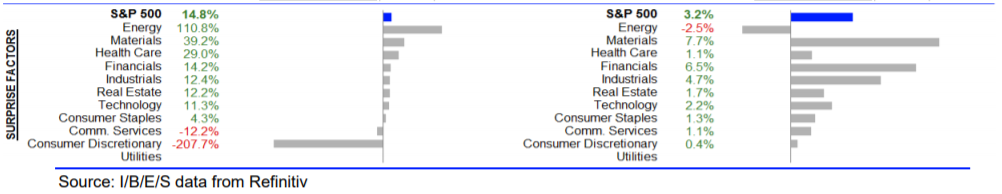

U.S. companies continued announcing second quarter earnings this week. With 15% of S&P 500 companies reporting, earnings and sales are better than expected. Earnings growth is 14.8% higher than estimated. This positive surprise has been led by Energy and Materials sectors. Sales growth was 3.2% better than expected, led by Materials and Health Care sectors. The figure below shows how sector results are coming in relative to expectations. Current analyst estimates have earnings for the quarter declining by 41.2% and a decline in sales of 10.7%. The second quarter is expected to be the quarter worst hit by COVID-19 lockdowns. This expectation may change as more states record increasing numbers.

We saw indications of consumer strength in June. Retail sales for the month were up 7.5%. The month-over-month growth was led by growth in sales for electronic and appliance stores, furniture and home furnishing stores and clothing stores. Year-over-year (YOY), sales grew by 1.1%. The YOY growth has been led by significant increases in online sales. Growth in nonstore retailers over the period was 23.5%.

Housing was a mixed bag this week. Housing starts were better than anticipated at 1.186 million versus 1.163 million. On the other hand, the sale of existing homes was lower than expected. Sales numbers were at 4.72 million which compares unfavorably with the expected 4.9 million. The number of building permits issued was also lower than expected at 1.241 million versus 1.28 million. Despite some housing numbers being weaker than expected, we are seeing a strengthening housing market as indicated by earnings results coming in from home builders. The reopening of local economies and low mortgage rates are leading to increases in home purchases.

Unemployment insurance claims continue to be elevated. The July 11 reading of 1.3 million indicates the recovery may not be as quick as some have thought.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.