Optimists Rejoice a More Data-Dependent Fed

Equities surged on Wednesday as Chairman Powell spoke following another 75-basis-point increase in the federal funds rate. This helped bring equities into the green for the week. The S&P finished the week up 1.6%. The NASDAQ was up over 4% on Wednesday, its largest one-day move since the COVID bottom. Still, this only offset weakness earlier in the week driven by subpar earnings. Fixed income returns were up 1.5% as yields are moving lower at a quick pace.

Central Banks Go Big

Central banks were center stage this week. The Bank of Japan remained super accommodative and has no plans to raise rates. The Yen is down more than 30% versus the U.S. Dollar since the start of 2021. The European Central Bank (ECB) surprised many with a 50-basis-point hike and ended eight years of negative interest rate policy. The ECB also eliminated forward guidance. Unlike Japan, the ECB cited a weaker Euro as the reason for upsizing. The Euro only remains modestly above its level prior to the announcement. The currency had fallen to parity this month, which was the first occurrence in 20 years.

The Fed was last to go and met expectations with a second consecutive 75-basis-point increase despite acknowledging the economy had slowed. We are up to 2.5% with all the recent increases. Powell moved away from forward guidance, although not to the same extent as the ECB. Forward guidance helped calm markets in the past, but recently has shown that it is more of a burden. It hinders the flexibility of central banks, creates excessive market volatility when a change is required, and ultimately assumes central banks are good forecasters. History has shown otherwise. But by limiting forward guidance, the market rallied strongly on the anticipation the Fed can now react in a timelier manner. Powell also noted rate hikes would eventually need to be slowed, which served as a catalyst for the market rally.

Weak Economic Data Sends Bond Yields Lower

• The Philadelphia Fed New Orders fell to the lowest level since 1979.

• The S&P Services PMI came in at 47.0 compared to expectations of 52.7.

• New home sales were well below expectations and negative versus the prior month.

• GDP put in the second consecutive negative print at -0.9%.

• Backing out inventories and trade resulted in a very weak -0.3% growth, a level associated with recession in the last 60 years except on one occasion.

• The 10-year Treasury yield is down more than 75 basis points in six weeks.

|

|

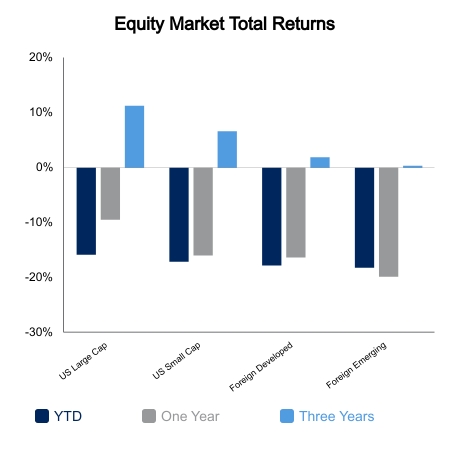

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.