Headline Consumer Price Index (CPI) was hotter than expected with a gain of 5.0% versus the previous year. Core CPI was up 3.8% versus the prior year, its highest reading since 1992. Despite the hotter number, bond yields fell to multi-month lows by the end of the day in anticipation of peak inflation as energy related factors rolled off. However, the highest component of CPI is shelter with a weighting of 32%. This continues to be suppressed in the reports with a yearly gain of just 2.2%, despite never falling below 3.0% in the four years prior to the pandemic. Thus, CPI shelter is being reported well below average while the Case-Shiller 20-City Home Price Index is up 13.2% versus the prior year and double the five-year average.

In May, China shut down two of the world’s five largest ports as a reaction to local virus cases. The effect has been that the Shanghai to Los Angeles Freight Index has gone up 50% in two months and there remains a significant log jam. This will continue to put pressure on supply chains with consumer prices moving up to offset the increase in shipping costs. There are also increasing reports of potential large food price increases due to capacity cuts in 2020, higher feed costs, and drought conditions.

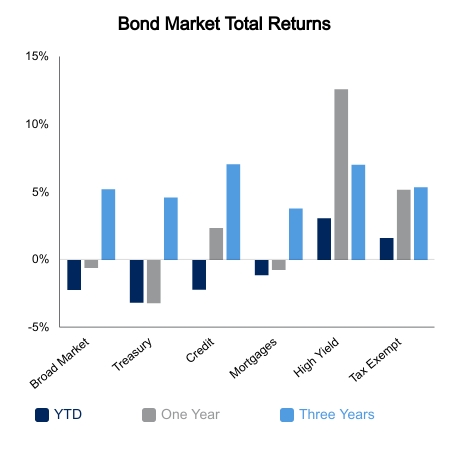

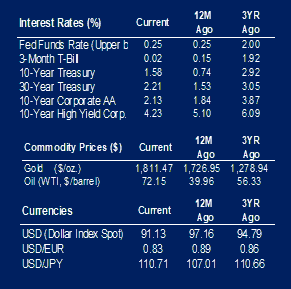

The Federal Reserve left interest rates unchanged but came in much more hawkish than market participants had expected. The “not thinking about thinking about raising rates” approach has been pulled. However, a very subtle change was when Fed Chair Powell mentioned the Fed has started to discuss tapering. Not raising rates but tapering. The 2023 median forecast went from zero hikes to two hikes. The forecast for 2022 also moved close to implying a rate hike. The reaction to the release was a big jump in yields with the 10-year Treasury ending at 1.57% compared to its close of 1.43% after the CPI release.

It was very interesting the NASDAQ outperformed amid the yield spike while gold got crushed. The past several months has seen these move together as they take their cue from the direction of real interest rates. The S&P 500 reversed after reaching an all-time high and finished the week up 0.1%. It bears watching to see if equities can move higher should real rates move up despite being well below historical averages, or if the rate of change continues to be the dominant factor.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.