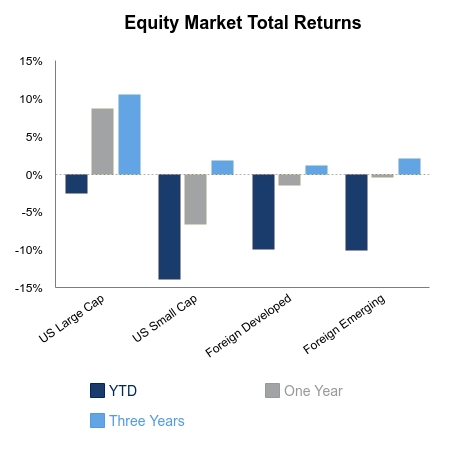

Equity markets fell sharply last Thursday in what was the largest drop since March. The S&P 500 was down almost 6% as COVID-19 cases are rising around the globe. Stocks would claw their way back with the S&P 500 ending down 2.4% for the week. The NASDAQ continues to be the outperformer in down markets and emerging markets held in with modest losses during the week. The Bloomberg Barclays Aggregate Bond Index was flat on the week.

Economic data came in better than expected. Retail sales posted their largest monthly gain at 17.7% for the May reading. This was well ahead of expectations, although should not be very surprising given the large jump in personal income that was highlighted in a previous Weekly Insight. This helped propel stocks to a sizeable gain on the day. The early read on regional PMI indices point to a more optimistic outlook for the manufacturing sector.

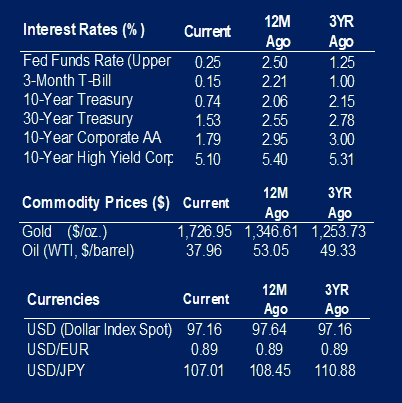

The Federal Reserve (Fed) has demonstrated a more proactive approach during this recession. The National Bureau of Economic Research recently made it official that the recession started in February 2020. The Fed announced they would begin buying individual corporate bonds instead of an emphasis on exchange traded funds. This makes it easier for the Fed to have an impact on corporate bond spreads versus the methods announced in March. Corporate bond spreads now sit right at their 10-year average in part to heavy central bank intervention.

The AAII Investor Sentiment poll shows that only 24% of investors are bullish, which is about 14% below the long-term average. They do not believe the rally is for real, possibly due to central bank actions or due to the rise of the “Robinhood” trader, which has gained a lot notoriety lately. There has been a surge in new accounts at Robinhood, Schwab, and other online brokers as the pandemic, lack of sports, and stimulus checks has propelled a jump in new traders. Warren Buffet dumped his airline stocks and then the new traders quickly bid them up 100-200% in two weeks. Hertz filed for bankruptcy, but its shares jumped 600% in a week as it appears momentum and low-dollar priced stocks are hard to ignore for new traders. These kinds of actions make it easy for investors to think it’s all a house of cards that could unravel at any moment. Despite the silliness, long-term returns are quite strong when pessimism is high.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.