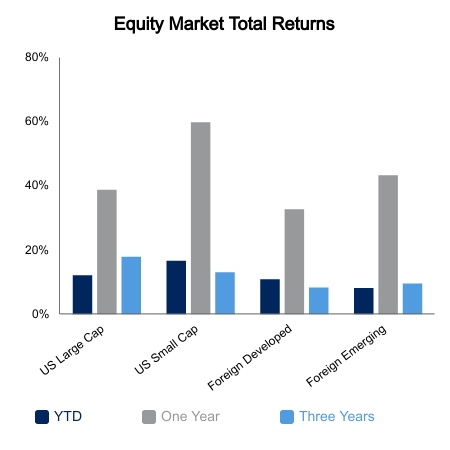

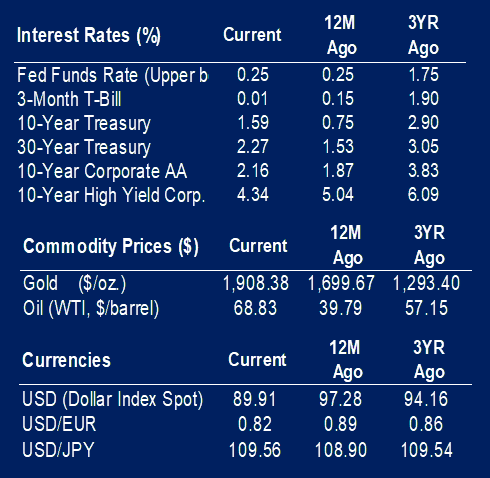

Equity indices languished on the week inside a very tight range. The S&P 500 gained 0.3% and the NASDAQ Composite gained 0.2% as heavyweights stalled. However, oversold names rallied as did small caps. The Russell 2000 Index was up 2.2% on the week. Emerging markets led the way amid dollar weakness with gains of 2.8%. The Bloomberg Barclays Aggregate Bond Index was down 0.1% with yields showing little movement.

On a sector level, energy continues to lead the way. The S&P 500 Energy Sector added 5.9% on the week as oil moved to a one-year high near $70/barrel. OPEC went ahead with their planned output increase, but the market appears more focused on improving demand and potential regulatory issues. Domestic oil and gas inventories are running below the five-year average. Royal Dutch Shell, a major oil producer based in Europe, was ordered by a court to cut emissions by 45% by 2030. This would be impossible even if they quit drilling for any new oil. An ESG hedge fund, combined with support from ETF fund families, was able to get multiple new board seats on Exxon Mobil’s board. This is expected to force an acceleration in decarbonization at the firm. Should oil production be curtailed in the coming years combined with demand that always goes up absent global recessions, the release valve will be higher prices.

Lumber prices have been the talk all year, but they have fallen about 20% from recent highs in quick order. This has emboldened chatter that inflation will be transitory. What is not making headlines is the CRB Raw Industrials popped last week to its highest level since 2011. This index has a decent historical correlation with growth and inflation cycles.

The Federal Reserve announced they will sell down their corporate bond and ETF holdings that were implemented during the worst of the 2020 market selloff. They did not have a large position, but this action was the backstop that caused risk sentiment to turn. Their previous interest rate cuts and policies did little to alleviate the market selloff. Wednesday’s announcement did not have an initial market impact, but it is clearly a move toward tapering. It will also require a higher hurdle to reimplement the plan again versus adding more to existing holdings should markets falter in coming years.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.