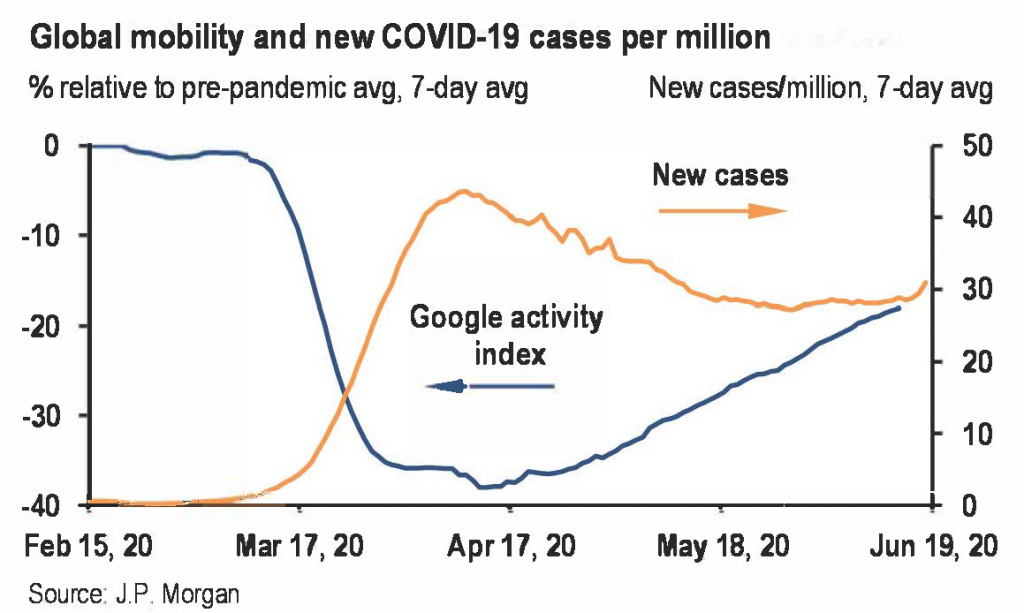

There was a decline in domestic equity markets this week. The S&P 500 Index was down 2.01%. Global increases in COVID-19 cases have led to increased fears of a pronounced “second-wave.” The Google Activity Index, the blue line in the graph below, shows increasing global mobility as lockdowns ease. More people are going out. This index measures activity based on cellphone data. We’ve also seen a recent increase in the number of new cases. The increase in new cases contributed to the market’s underperformance this week.

In other macroeconomic news, the Purchasing Managers’ Index (PMI) numbers were better than expected. The Markit Manufacturing PMI’s June reading is 49.6. The initial estimate was for a reading of 46.0. The Service PMI was lower at 46.7, but better than the expected 45. Economic activity continues to pick up as economies reopen.

The Richmond Fed Index, covering activity in D.C., Maryland, North Carolina, South Carolina, Virginia and most of West Virginia, showed better than expected activity despite growth being flat. The reading of 0 is better than the estimated decline of 3.5. At this point, any growth number that is not negative is seen as positive.

Housing reports were a mixed bag this week. Sales of existing homes were lower than anticipated in May. 3.91 million homes were sold compared to the expected 4.15 million and the previous month’s 4.33 million. New home sales on the other hand, were better than expected. May saw sales of 676,000 new homes. The expectation was for 632,000. April saw sales of only 580,000 new homes.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.