Tough Quarter Ends on a Positive Tone

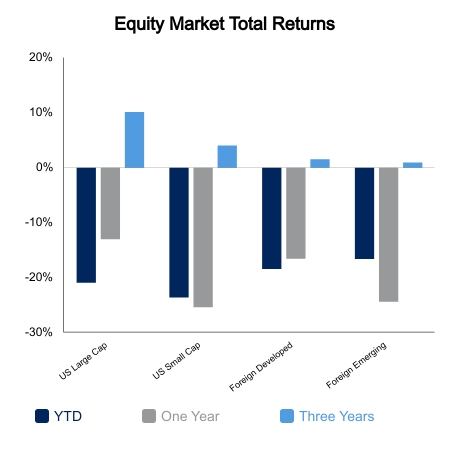

Equities staged a strong rally off their monthly lows as quarter-end rebalancing forces drove the action. As target date fund assets under management have grown, this has created a mean reverting force at quarter end. In recent years, equity indices have staged large rallies just prior to quarter end when their trailing 90-day return was negative. This time the S&P 500 rallied more than 6%, but the fade appears to be setting in with weakness in recent days. The S&P 500 finished the week up 1.6% but is posed to post one of the five worst quarters in the last 40 years.

Economic Update

- The U.S. Citi Economic Surprise Index is at one of its lowest readings over the last 10 years

- Manufacturing surveys globally showed sharp deceleration

- Most commodities are down at least 30% from their year-to-date high

- May home sales jumped in a rare sign of consumers front-running inflation

- May CapEx orders surprised to the upside and remain stable

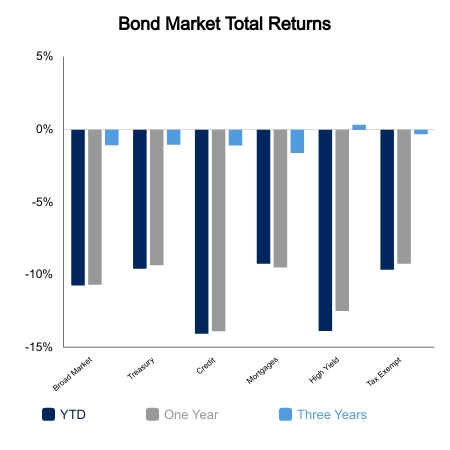

Is the Bond Market Signally Looming Economic Weakness?

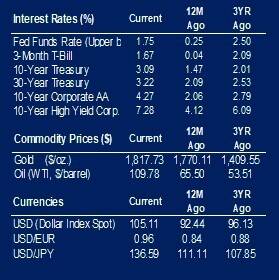

Treasuries reversed course mid-month as yields fell on weaker economic data. The 10-year Treasury yield hit 3.50% mid-month and now resides at 3.01%. The market has moved the peak Fed Funds Rate from 4.25% to 3.75% in just two weeks. Corporate bond spreads have taken on notable weakness of late. Previously, corporate bonds had been resilient and performed far better than their historical correlation during equity drawdowns. This eroded as the quarter went on. In fact, the cost to insure against high-yield defaults had its second-largest quarterly surge in the 10-year series’ history. High-yield CDS spreads widened more than 200 basis points (bps) in the second quarter and now reside over the 500 bps “danger zone” that is associated with rising default rates and liquidity stress.

Investment grade corporate bond spreads are now above 150 bps on the index level. Wider spreads and higher Treasury yields are a double whammy. Corporate bonds were down 7.7% in the first quarter, which was their worst quarterly return since 1980. This quarter the returns are poised to be down another 7%. There has only been one other quarter since 1980 with a 7% loss (third quarter of 2008) and we are likely looking at back-to-back, which highlights the uniqueness of the current market environment.

Against this difficult market environment, the Fed continues to hike aggressively with a greater than 50% chance of another 75-bps hike at the July meeting. Only one other time since 1990 has the Fed hiked rates with investment grade corporate bond spreads above 150 bps.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.