The second estimate of fourth quarter GDP was front and center this week as a slew of economic data releases took place. The revised result was weaker than expected with a reading of 2.7% compared to an expectation of 2.9%. One of the factors contributing to the weaker result relative to the initial estimate was a downward revision of consumer spending during the period. The revision took the original estimate down from 2.1% for the quarter to 1.4%. Other positive contributors included inventory investment and government spending. Housing continued to be a detractor.

Weakness in Housing

The weakness in the housing sector was also seen in the most recent results from the S&P/Case-Shiller US National Home Price Index released this week. The latest data, which is as of December 2022, indicated a 0.50% month-over-month decline for the 20-city composite. The year-over-year figure also reflected ongoing weakness as the increase in prices decelerated from 6.8% in November to 4.6% in December.

Consumer Results

Despite the reduction in estimated fourth quarter GDP growth the U.S. consumer provided some stronger than expected results in this week’s data. Personal income and expenditures were both significantly higher than their prior readings as of the end of January. Income increased by 0.60% compared to the prior period’s 0.30% and expenditures rose by a robust 1.8% compared to -0.10% for the month of December. Interestingly, as consumers saw their incomes and expenditures increase in January their confidence actually declined in February according to the Conference Board. The index, which is currently at 102.9, declined from a prior reading of 106.0. This example of conflicting data, stronger consumer spending alongside declining confidence is making it difficult for investors to have a high level of conviction in trying to discern the strength and direction of the overall economy.

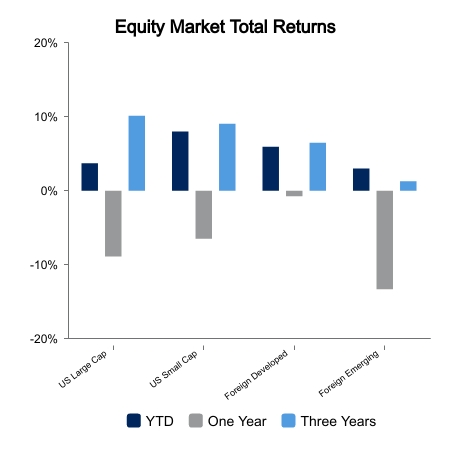

Equity Markets

Equity markets reacted negatively to the data released over the past week as both domestic and international markets registered declines. In the U.S., the MSCI USA Index fell 1.0% for the week while the EAFE Index, which measures returns for developed foreign markets, declined by 0.3%. Countering the negative result from large cap equities were positive returns for small cap issues. Both the MSCI Small Cap Index and the Russell 2000 Index were marginally positive for the week and continue to outpace the large cap indices on a year-to-date basis with returns of 8.6% and 8.0%, respectively.

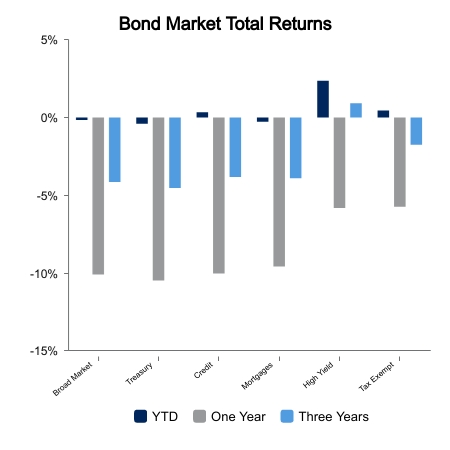

Negative Bond Returns

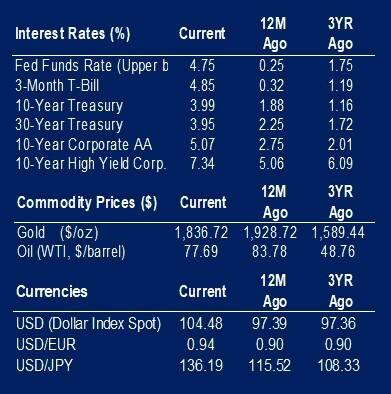

Bonds also experienced negative returns for the week with aggregate indices declining approximately 0.5%. Year-to-date returns were pushed into negative territory as well, as aggregate indices now register a return of approximately -0.2%. Concerns that the Federal Reserve will pursue a “higher for longer” approach to interest rate policy is weighing on fixed income investors as the 10-year U.S. Treasury yield rose from 3.92% to 3.99% for the week.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.