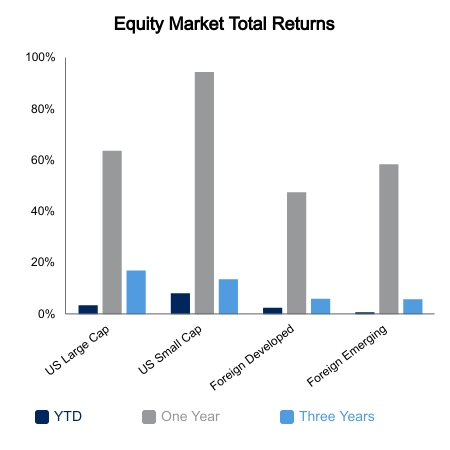

Equities came under pressure this week as the anticipated stimulus pop failed to materialize. The S&P 500 was down 2.1% on the week, but there was significant dispersion with many popular stocks down much more. Traders that jumped into recent winners were stung as the small cap value stocks dropped 8.7% on the week. Solar, electric vehicle and concept stocks continue to face serious selling pressure. Utilities and consumer staples were up more than 1% and helped support the indices, although they remain under-owned in many mutual funds.

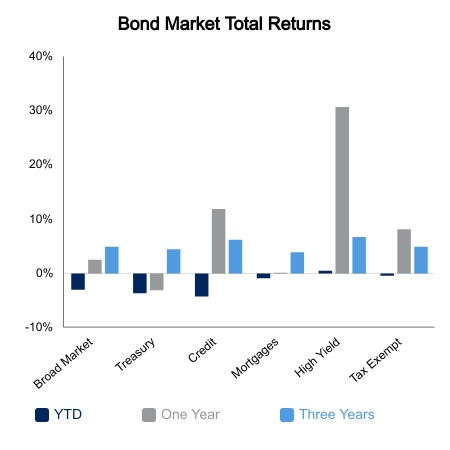

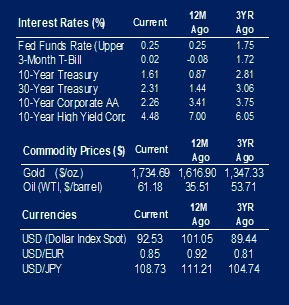

The 10-year Treasury yield rose after the Federal Reserve (Fed) meeting, but then fell 12 basis points to end lower on the week. This helped the Bloomberg Barclays Aggregate Bond Index post a weekly gain. Energy made the headlines with a 10% drop over four days, the largest move over this span in six months. Increasing inventories and lockdowns in Europe were to blame, but it is likely fast money made a quick exit as well. Red-hot copper prices have softened of late and gold prices are down more than 8% year-to-date. Chinese equities, especially popular technology names that trade in the U.S., have come under pressure as relations between the two countries faced scrutiny this week. A recent summit was viewed adversely, and the U.S. sanctioned several Chinese officials.

Despite the softness in some re-opening stocks as well as energy, manufacturing data continues to be robust. The Philadelphia Fed Business Outlook came in well above expectations for its March reading. It was the topmost reading since 1973 with the prices paid component reaching its highest level since 1980. It is against this backdrop the Fed remains committed to not raising rates until at least 2023 based on their latest guidance. The bond market started the year expecting the first federal funds hike to come in 36 months, but this has fallen to 20 months due in part to robust economic data.

So far data shows stimulus check money is not flowing into the market as surveys had indicated. The retail call option on open interest has tailed off as it appears money is being diverted into the real economy. On top of this, taxes will be due for all the new retail traders in the coming weeks. Whether these factors cause a sizeable correction remains to be seen as exchange-traded equity fund flows continue to be quite steady.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.