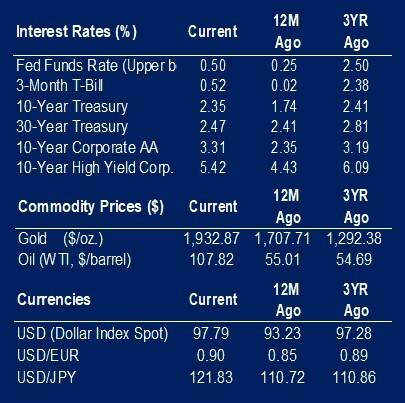

Weakness in housing continued this week but is not necessarily indicative of a significant reduction in demand. Pending home sales dropped by 4.1% in February from January. All regions were down outside of the Northeast. Year-over-year, pending home sales were down 5.4%. The primary reason given for the decline was the lack of inventory of homes available for sale. Buyers may want to lock in rates now as the Federal Reserve starts on the path of raising the Fed Funds Rate.

In February, durable orders were down 2.2%. The decrease was led by a sharp drop in the orders for transportation equipment of 5.6%. The decrease in transportation equipment comes after three consecutive months of increases.

The mood is not great. The Michigan Sentiment Index is down to 59.4 in March. This is the lowest reading of the index since 2011. Increasing prices and the Russia – Ukraine conflict have contributed to reduced optimism for the economy. The Federal Reserve has indicated they are willing to do what it takes to bring inflation back to around 2%.

Consumer confidence on the other hand, was up to 107.2 in March. The increase comes after two consecutive months of decreases. Despite the increase, the reading is still under the five-year average of 118.35. The lower-than-average reading has also been attributed to increased prices, especially of gas, and the Russia – Ukraine conflict.

The Purchasing Managers’ Indexes (PMI) saw increases in March. The Markit Manufacturing PMI is up to 58.5. This is up from 57.3 in January. The expectation was for a slight dip to 56.5. The Services Index is at 58.9 from 56.5 in January, with 56 expected. Anything over 50 for these indexes is considered positive.

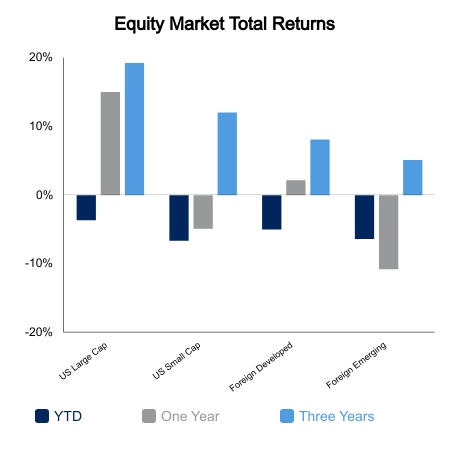

Equity markets were up this week led by the Real Estate sector. The S&P 500 increase of 3.30% saw all sectors up. The Real Estate sector performance of 5.62% for the week was led by a sharp increase of 8.71% in Hotel and Resort real estate investment trusts. Utilities, up the most this month at 10.55% was the second-best performing sector. Independent power and renewable energy companies drove performance here.

There was a little bit of a reprieve in increases for oil prices this week. WTI Crude Oil was down 4.84% this week. This comes after a 44% increase this year.

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.