Stocks Rally as Jobs Remain Strong and Big Tech Gets Bigger

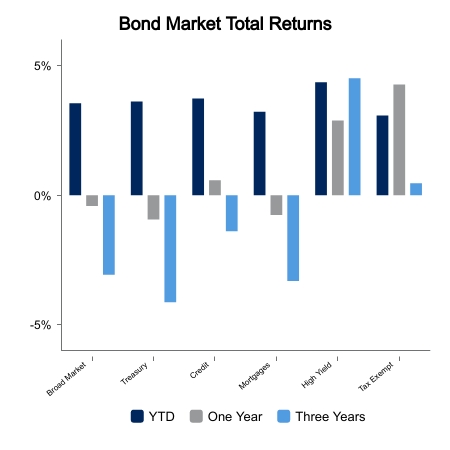

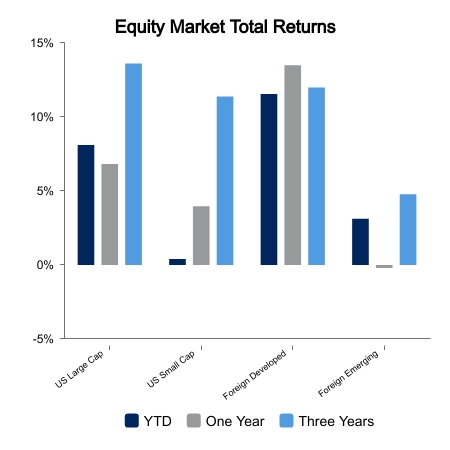

Equities moved higher as a stronger than expected jobs report helped alleviate recession fears. The S&P 500 advanced 1.2% on the week. The NASDAQ continued its relative strength by posting gains of 2.4%. Core bonds were down 0.5% as interest rates moved up on the week.

Jobs Continue to Surprise

Economic data was highlighted by a better-than-expected jobs report on Friday.

- Non-farm payrolls increased by 253,000.

- This has beaten consensus expectations for a record thirteenth consecutive month.

- The unemployment rate fell to 3.4%.

These results shouldn’t come as a surprise given the strong ADP report released a couple days earlier and the large amount of smoothing embedded in the payrolls report. At times this would be bad for the market, but with inflation coming down the market rallied strongly on the day. Better economic data that reduces recession probabilities is likely going to initially be favorable for stocks. This is a pivot from when inflation was extremely elevated and strong growth meant a more restrictive Fed.

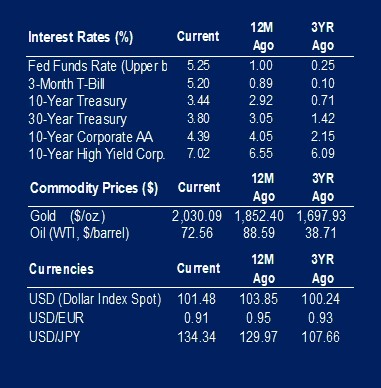

The Consumer Price Index (CPI) came in-line with expectations as headline inflation was up 4.9% versus the prior year and core CPI was up 5.5%. Core CPI has remained sticky with monthly readings of 0.4% whereas 0.2% is needed for annualized inflation of 2%. The Atlanta Fed Core Sticky CPI Excluding Shelter is at 3.6% on a three-month annualized basis and more supportive of lower inflation outlooks. We now have the Federal Funds rate above the CPI rate, which occurred in previous cycles and gives the Fed room to pause. Other Fed officials this week suggested rates may still need to go higher. Given these various inflation measures, it is possible the Fed’s reaction function to incoming data becomes less predictable.

Odd Lots

Apple added more than $100 billion to its market cap this week after the stock moved higher post earnings. Bitcoin enthusiasts tout the limited supply as the primary allure, but the supply always increases. Apple, on the other hand, has reduced shares outstanding by 40% since 2013. As of this morning, Google has added $127 billion to its market cap in two days after its AI presentation was viewed favorably. If it holds this would be the second largest two-day gain on record.

Warren Buffet was a bit pessimistic on the outlook for the economy in his annual shareholder meeting last weekend. And lastly, renowned investor Stan Druckenmiller was even more dire during an investment conference this week. He said he was looking at the biggest broad asset bubble he has ever studied.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.