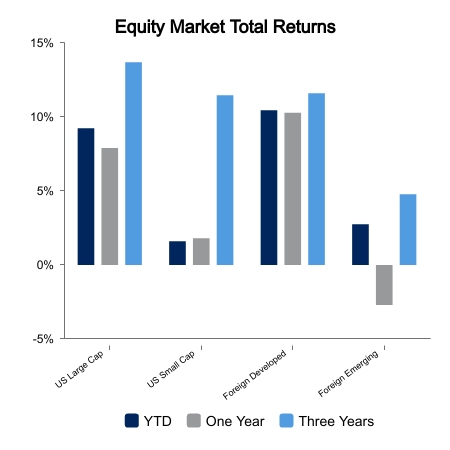

This week, equity investors were heartened by the news that rival political parties were in negotiations to resolve the nation’s debt ceiling issue. As measured by the Russell 3000 Index of domestic equities, stocks returned 1.1% for the week. Growth stocks provided all of the momentum to the weekly return as the Russell 1000 Growth Index returned 2.2% for the week while the Russell 1000 Value Index saw a return that was slightly negative at -0.2%. These returns continue the transition that has taken place so far in 2023 with growth stocks wrestling market leadership from the value issues that provided vastly superior returns in 2022. Small cap stocks also enjoyed a strong return on the week as evidenced by the Russell 2000 Index which registered 1.5% for the period.

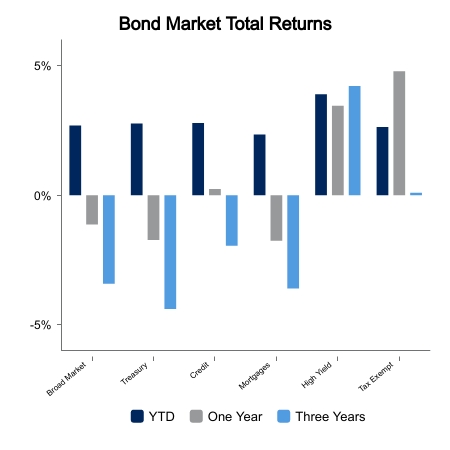

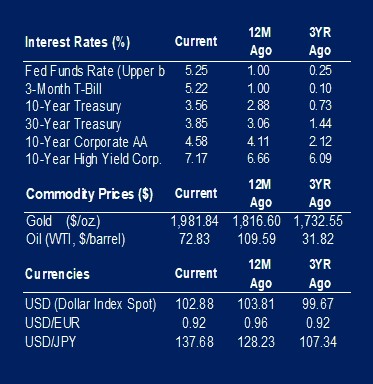

On the fixed income front the week proved to be less rewarding as the broad bond market returned -0.9%. Driving the negative return was a slight increase in rates as evidenced by the 10-year U.S. Treasury which saw its yield increase from 3.44% to 3.57%. Contributing to the rise in the 10-year yield is the normalization process taking place in the fixed income markets. This process represents a steepening of the yield curve to a more typical position where longer term issues have higher yields than shorter term issues. While the yield curve remains inverted with the shortest maturities yielding significantly more than longer term issues, we are seeing this normalization taking place across certain segments of the maturity spectrum.

Housing was a major theme for economic data released this week. Prominent among these was the NAHB Housing Market Index. The reported level of 50 was up from the prior period’s measure at 45 and the highest level seen in the last 10 months. And while a reading of 50 indicates a neutral position between growth and contraction, it did represent increased confidence on the part of homebuilders. One of the factors driving this improvement is the limited supply of existing homes for sale which puts an enhanced emphasis on new construction. A 2.2% increase in housing starts in April versus an estimated result of -1.4% supports the increased focus on new construction.

Inflation was also a component of the week’s economic releases as the Producer Price Index came in with lower readings than expected for both the month-over-month and year-over-year time periods.

Going forward investors will continue to focus on the debt ceiling and the level of progress being made to avoid default. Market volatility could be heightened as this process unfolds.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.