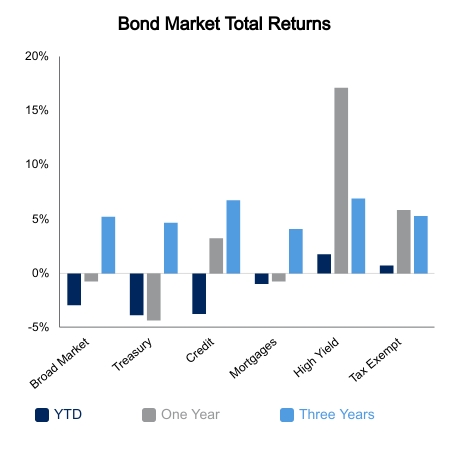

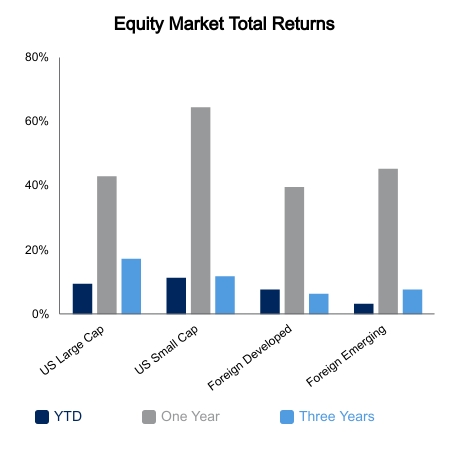

Equities rebounded amid a down month with the S&P 500 advancing 1.4% on the week. Higher beta stocks had a better bounce with the Russell 2000 Index up 2.8% and the NASDAQ Composite up 2.1%. Foreign developed equities were up but lagged versus the United States. The Bloomberg Barclays Aggregate Bond Index eked out a tiny gain. Equities remain down for the month, with weakness being seen in the NASDAQ Composite and other richly valued growth stocks. Adding to the woes, the Bloomberg Barclays Aggregate Bond Index is down and crypto currencies have plunged in recent days.

Economic data continues to disappoint versus expectations. The Citi Economic Surprise Index is at its lowest reading in a year. Unrealistic expectations are likely to blame instead of weakening trends. Forecasters love to extrapolate, but this was never going to happen given most of the data was two to three times better than any other time in history. Retail sales for April came in flat compared to an expectation of a 1% gain. It was up 10.7% in March and it would be tough to get sequential improvement in the month post stimulus checks. The two-year rate of change on retail sales was 21.0% versus 21.4% in the previous month, with both exceeding any other time in the series history.

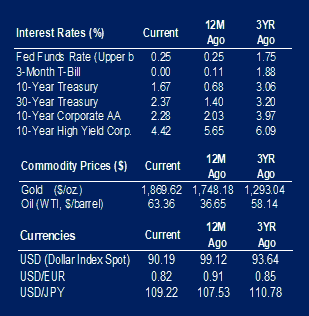

Producer prices followed a hot Consumer Price Index reading with a higher-than-expected print. This was followed up by the University of Michigan’s one-year inflation expectation surging to 4.6%, its highest reading in a decade. Housing starts were down 9.5% as lumber prices and other inputs skyrocketed. There are reports of many homebuilders seeing daily price increases in material costs. They have shifted to purposely slowing the pace and delaying the sales process until further into the build where costs can be better estimated.

The Federal Open Market Committee minutes were released this week and the initial reaction was that some members may want to begin the tapering process sooner. This helped push up yields on the day; however, this was reversed today as a closer inspection led many to come to a different conclusion. You can judge for yourself, but there does seem to be quite a few qualifiers before a discussion can begin.

Here is the final statement of the minutes, “A number of participants suggested that if the economy continued to make rapid progress toward the Committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases.”

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.