Corporate earnings continue to be front‑of‑mind. Nvidia Corporation (NVDA) was the most recent example, beating expectations with revenue and earnings‑per‑share coming in better than consensus. NVDA was up +30% pre-market this morning, so much that it is on track to exceed $1 trillion in market capitalization. This would put NVDA in a unique club of companies whose market cap exceeds $1 trillion, joining Apple Inc. (AAPL), Microsoft Corporation (MSFT) and Amazon.com, Inc. (AMZN).

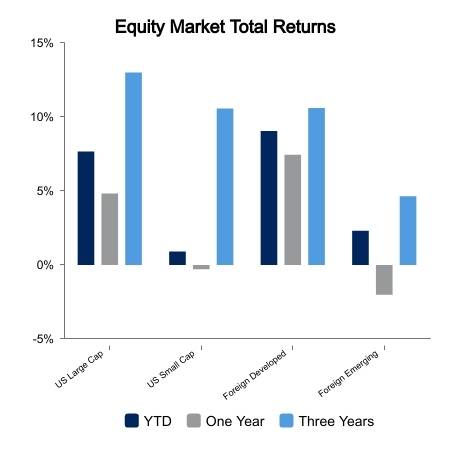

The year‑to‑date (YTD) return for NVDA also highlights the thin breadth of companies driving YTD performance of major equity indexes. Per FactSet, NVDA has risen +108.9% YTD, modestly exceeding the +107.1% YTD advance of Meta Platforms Inc. Class A (META; formerly Facebook). These outsized gains have heightened the attribution of YTD returns of other mega-market cap companies like AAPL (+32.3%), MSFT (+30.9%) and AMZN (+39.0%). The top 10 companies of the Russell 3000, based on market capitalization, represent 25% of the total index market cap. When considering the performance of these companies, eight exhibit YTD returns that exceed 30%. Note the Russell 3000 has increased 7.3% YTD; the median YTD constituent return within this index is ‑3.2%.

With first quarter earnings season ending, corporate profitability has surprised to the upside. As of last Friday, according to Refinitiv, of the 471 companies in the S&P 500 that have reported earnings to date, 76.9% have reported earnings above analyst estimates, which exceeds the long-term average of 66.3% and the prior four quarter average of 73.5%. Similarly, 74.1% of companies have reported revenues above analyst expectations which exceeds a long-term average of 62.1% and the average over the past four quarters of 70.6%. Also, upward revisions by analysts for the next 12 months outpace downward revisions, a trend exhibited since late April. This outlook regarding forward earnings has been augmented by the beat rate for this past quarter coupled with positive revisions, which collectively have been the most important components driving positive sentiment toward equities.

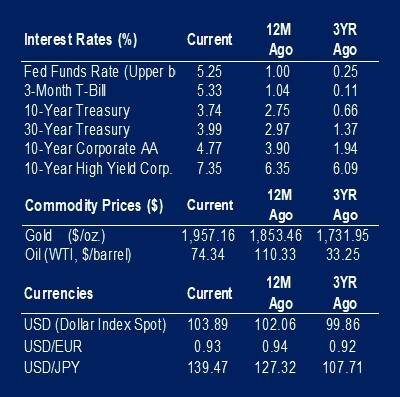

On the macro‑front, the second estimate of first‑quarter GDP was released this morning. The quarter‑over‑quarter rate of growth was revised upward 0.2% to 1.3%, exceeding both consensus and the initial estimate of 1.1%. Personal consumption was revised upward by 0.1% to 3.8%, its highest level since the second quarter of 2021. Inflation remains sticky as Core Personal Consumption Expenditures, a favorite measure of inflation by the Fed, was revised upward 0.1% to 4.9%. Today’s report continues to reflect economic resilience despite the year‑long Fed rate hike cycle.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.