Equities Remain Resilient as Banking Woes Persist

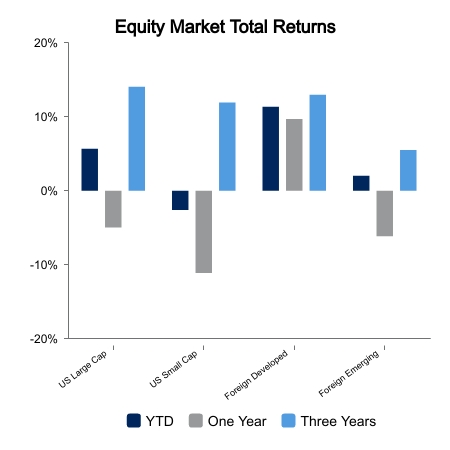

Equities held on to weekly gains as earnings upside gave way to more banking headwinds in recent days. The NASDAQ was up 1.5% and led the way as small caps were again laggards. Foreign developed markets and emerging markets were up fractionally on the week. Core fixed income was up 0.6% and rounded out a positive week in all major asset classes.

Economic Data Surprises to the Upside

GDP for the first quarter was initially reported at 1.1% growth, which was below consensus estimates of 1.9%. The internals were much stronger with growth of 3.4% when excluding inventories. A side measure of consumer spending is real final sales to private domestic purchasers. This metric was up 2.9% and recorded its highest reading in eight quarters.

Real disposable personal income was up 8% as income gains persist and inflation falls back. This is supportive of the stronger forward consumer spending versus the consensus recession outlook. ADP reported private payroll growth of 296,000, which was almost double the consensus estimate and is a rather remarkably strong number.

ISM Manufacturing came in at 47.1 and beat consensus. New orders were weak at 45.7 but up sequentially. Prices paid surprised on the high side and got the stagflation narrative into the headlines. ISM Services was also up sequentially at 51.9. New orders surged from 52.2 to 56.1. The ISM Services new orders remain way above where they should be tracking with the Leading Economic Index in such negative territory.

There are signs that maybe the economic weakness has bottomed, but this may not necessarily be robust for stocks as inflation will face difficult headwinds in the coming months. We could see growth and inflation surprise to the high side and get the Fed back in the hiking camp. But all bets are off if something breaks in the financial system, which is in play with the action in bank stocks.

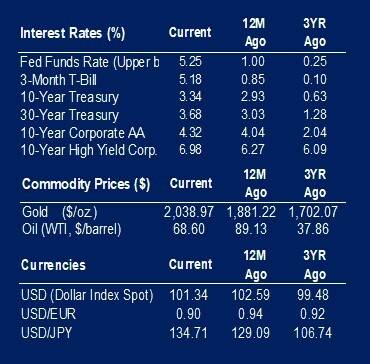

The Fed Raises Rates

The Federal Reserve raised interest rates 25 basis points to 5.25% and suggested a pause is clearly in play. The Fed also noted they don’t see a need to cut rates anytime soon. It was only a couple hours later when PacWest Bancorp said they were exploring strategic alternatives and its stock dropped 50%. Another notable West Coast bank is down 40% today. The broad regional bank index is down about 12% in three days and roughly 17% below the Silicon Valley Bank crisis low. It doesn’t appear the banking crisis is contained, and the narrative is quickly turning against Fed Chair Powell. The market is pricing in a 25% chance of a cut at the next meeting.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.