AI Frenzy Continues Amid Record Sector Dispersion

AI related stocks surged again this week. The big gains were Friday and Monday due to a keynote speech by NVIDIA’s CEO, Jensen Huang, at a technology conference in Taipei over the weekend. Apparently even Uber drivers were asking passengers if they had watched the speech. AI mentions during earnings calls have gone up from about 6,000 toward 25,000 this quarter.

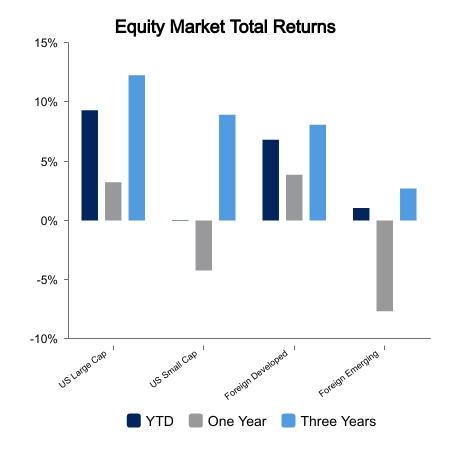

NVIDIA gets most of the press, but the best performing stock has been Super Micro Computer, which is up more than 500% from its 52-week low. This is twice NVIDIA’s advance of 250%. Semiconductor stocks were up about 11.5% on the week, which dragged the S&P 500 up 1.6%. The Dow Jones Industrial Average was up just 0.4% and small caps were down 0.9%. Foreign developed equities lost 2%.

The NASDAQ finished May with a gain of 5.9% whereas the Dow Jones Industrial Average was down 3.2%. Going back to the creation of the NASDAQ in 1971, there have only been eight other months where the spread was wider. Semiconductors were up more than 16% on the month. As AI related names surged, there were seven S&P 500 sectors down more than 4% in the month of May. Somehow the S&P 500 was up 0.4% on the month when most sectors fell more than 4%.

Debt Ceiling Poised to Reach Conclusion

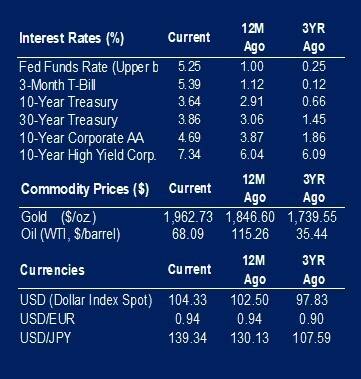

The debt ceiling issues appear to be in the final stages as the House passed a bill. The long, fear driven campaign saw credit default swaps on the U.S. surge to three times any previous peak. A Senate passage is expected quickly and then we have a deluge of Treasury issuance. Normally a large issuance of Treasuries is a drain on liquidity and a headwind to equities. We also have signs of liquidity in China falling materially and thus the passage of a debt ceiling bill may not be an all clear for equities.

Economic Data Turns Down

Economic data has started to weaken across the board.

- The Citi Economic Surprise Index for Major Economies has fallen sharply over the last two months.

- China data has been especially weak.

- The Chicago Purchasing Managers’ Index and Institute for Supply Management had a sharp drop in the month of May.

- 40% of commodities are down 40% from their 52-week high, a clear sign of demand weakness.

But employment continues to hold up as ADP employment change was well above expectations. Will Friday add to the record streak of nonfarm payroll’s coming in ahead of expectations? The current consensus is 195,000 and we will find out Friday morning.

|

|

Source: BTC Capital Management, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.