Durable orders decreased for the second month in a row. The October drop of 0.5% or $1.2 billion was driven by a decrease in the ordering of transportation equipment. Transportation equipment ordering has been down three of the last four months. Excluding transportation, orders were up 0.5%. An increase of 0.2% in durable orders was expected. The drop comes in lower than September’s decline of 0.4%.

More existing homes were sold than expected in October. The 6.34 million homes sold reflects an increase of 0.8% from September. This is the second consecutive month of growth. Low inventory has been a contributor to price increases. The stability of mortgage payments relative to increasing rents may have been another contributor to more people buying homes.

The final reading of building permits issued came out this week. In October, 1.653 million permits were issued. This shows a small increase from September’s 1.650 million.

The preliminary November numbers for the Markit Purchasing Managers’ Index (PMI) composite are out. The reading of 56.5 is lower than October’s 57.6. The expected number was 58.2. The composite number was negatively impacted by PMI Services, down to 57.0 from 58.7 last month. The PMI Manufacturing number held up at 59.1. Last month’s reading was 58.4. These numbers being greater than 50 continue to indicate economic strength.

The U.S. Leading Economic Index was up 0.9% in October. An increase of 0.80% was expected, which would have been an increase from the previous month’s 0.2%. The index is a composite of 10 leading indicators aggregated and published by The Conference Board. According to The Conference Board, the sharp rise indicates economic expansion will continue into 2022. Inflation continues to be a 2022 headwind. Elevated prices are not expected to detract enough to cause economic contraction.

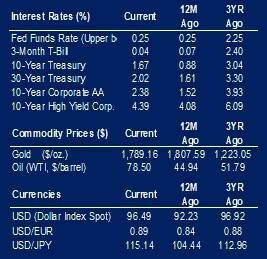

Oil prices dropped this week after President Biden announced the release of U.S. oil reserves. The Department of Energy is expected to release 50 million barrels of oil held in reserves. It is anticipated that the release will bring prices of the commodity down. Tightness in global supply of oil has contributed to increasing prices at the gas pump.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.