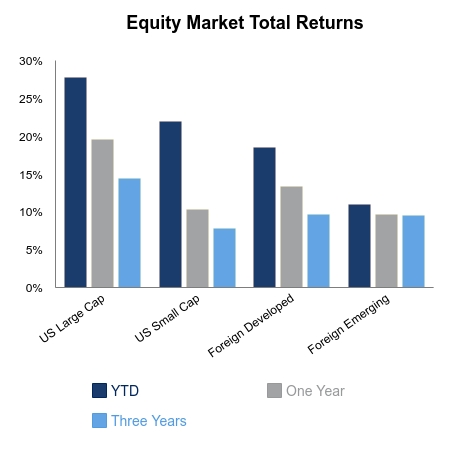

Equities continued to bleed higher and tacked on another 1% for most large cap indices. Domestic small caps popped 2.1%. The headlines seem to attribute daily equity gains to U.S.- China comments ad nauseum, but the driving force is participants forced to buy back into a rising market. Both retail and hedge fund risk positioning have been extremely defensive despite the strong gains realized year-to-date, and over the last decade. The notion of this being the most hated bull market continues to be a valid point with significant buying power still on the sidelines.

Aside from the favorable set-up due to bearish sentiment, the Russell 2000 hit a one-year high this week. Foreign equities continue to underperform, but the global equity benchmark, MSCI ACWI Index, is within 1% of hitting a new high. It has been over 475 days since the last high occurred. Usually when there is a lengthy period between new highs, forward 1-year returns are above average.

The Conference Board’s Leading Economic Index was weak, but stable with a year-over-year growth rate of 0.3%. This is a good gauge of recession probabilities but is often weak when the economy goes through a growth deceleration. There are many instances where similar levels did not result in a recognized recession. The diffusion index, or percentage of indicators rising, has slipped to 50%, but this would need to drop below 40% for consecutive months to really raise any alarm bells. The biggest contributor this period was building permits while ISM new orders was the biggest detractor.

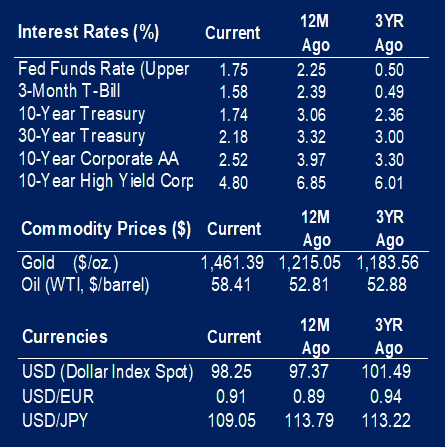

It wouldn’t be a normal week if there wasn’t commentary from the Federal Reserve. This week’s tidbit came from a top voice in the Federal Open Market Committee, Lael Brainard. She emphasized capping interest rates and overshooting inflation in growth phases to achieve an average cycle inflation of 2%. Expect upcoming news headlines to emphasize the fact that last December witnessed the biggest drop in the S&P 500 since the Great Depression. History would suggest a mirror image is very unlikely as the S&P 500 has only been down in consecutive December’s three times since the early 1940s. And, usually big down years are followed by big up years. There are few things more bullish than scared investor psychology, which is something to think about if you overhear ranting about an imminent demise in the market amid your Thanksgiving feast. Happy Thanksgiving!

|

|

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.