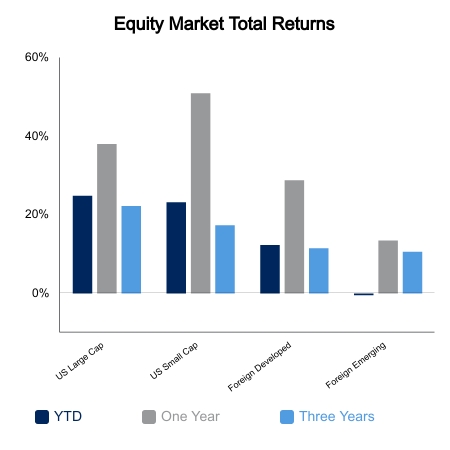

Equity markets were up every day this week as small caps staged a huge breakout. Equities rallied into the Federal Open Market Committee (FOMC) meeting despite a cautionary tone from the bond markets. The initial reaction after the meeting was met with more equity buying and a rise in bond yields. The S&P 500 was up 2.4% this week and it was interesting to see both the NASDAQ and Russell 2000 outperform. The NASDAQ added 3.8% and the Russell 2000 blasted through its eight-month consolidation with a 6.8% gain. This propelled the Value Line Geometric Index, a proxy for the median stock, to also breakout to a new high.

The Employment Cost Index of Private Workers was up 4.6% versus the prior year, by far the largest in the 10-year series history. On the bright side, the ISM Manufacturing Index is still registering readings near 60 despite all kinds of evidence we are poised for a notable deceleration in the manufacturing cycle. If readings can stay sticky up at these levels, then the underlying strength of recovery is more robust than the message the bond market is sending. ISM Services came in way better than expected with a reading of 66.7, the highest reading in the 14-year series.

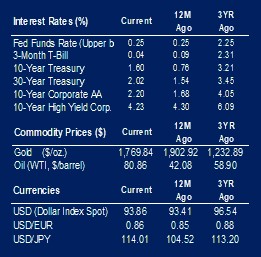

As expected, the FOMC announced the tapering of quantitative easing. They did not ease off on the timing, in what would be viewed as a dovish pivot, but rather accelerated the timing. Still, the embedded expectations were for hawkish comments that the Fed may be behind the curve on fighting inflation. No such comments were made, and the equity market took that as an all-clear. Aggressive bond positions were unwound with yields backing up on the day, although they are lower today and reversing yesterday’s action.

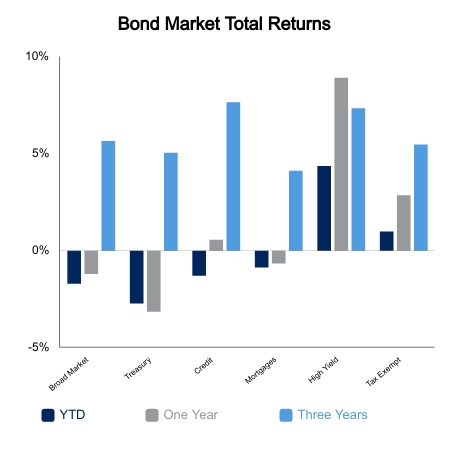

The result is that the Fed is now planning on having the balance sheet peak around $9 trillion, or double where they thought the last peak would be during the previous economic expansion. The entire Treasury curve has negative real rates for the first time ever. Core Personal Consumption Expenditures will likely be above 2% for 15 straight months by June of next year, which is expected to be the earliest that an increase in the federal funds rate would take place. Against this backdrop, somehow a hike in June is deemed hawkish by the bond market, whereas equities still see the pedal to the metal.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.