The markets were positioned for this to be one of the highest-volatility elections ever. As of this writing, there are several states extremely close in their counts. Scrutiny on the ballot counting process added fuel to the fire, and it will likely be a lengthy process before a conclusion is reached. Other swing states will take until Friday to count. Arizona and Georgia were called but have been retracted by most news outlets. Recounts seem likely, and both sides are determined to get an accurate as possible count, including using available legal options. Despite what would appear to be as much uncertainty as possible, equity volatility plunged on Wednesday, which propelled stocks to significant gains. Buy the rumor, sell the news.

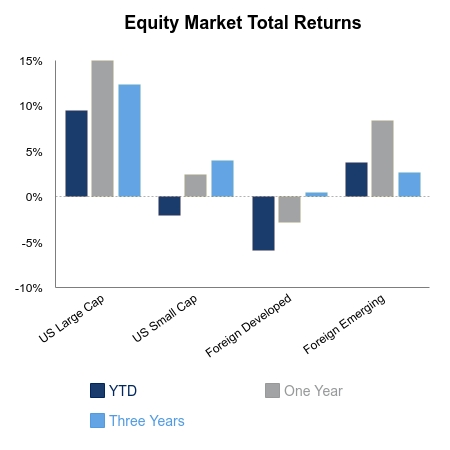

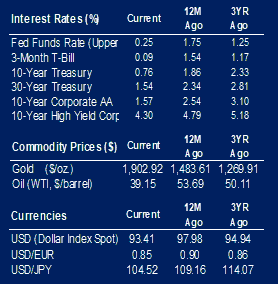

Republicans are expected to hold the Senate, which the market is treating as the best-case scenario. The market view is this would stop most proposals from Democrats should they win the other branches. There was no blue-wave or red-wave. Infrastructure and solar stocks were sold as big stimulus seems unlikely. Banks were hit as yields plunged by more than 15 basis points in the 10-year Treasury. It was the largest single-day drop since April, again reflecting a diminished outlook for a big stimulus package. And so, it was back to business as usual with technology leading the way. The NASDAQ jumped as much as 4.5% and significantly outpaced small caps on Wednesday. Further big gains in technology appear in store on Thursday based on early trading indications.

The potential problem is the huge move in early trading could leave sidelined investors feeling rushed to get back in. It is very likely news headlines will break for both parties on some scale over the coming days and weeks. It remains to be seen whether the big jump on Wednesday will prove to be a trap for investors as election chaos does indeed escalate going forward.

On the economic front, manufacturing remains robust with the ISM Manufacturing New Orders printing at 67.9 for the month of October. This has consistently outpaced inventories and is suggestive of further strength in the sector. ADP employment was much softer than expected with gains of 365,000 versus expectations of 643,000. Friday will see the release of the Employment Report, and it will take on a bit more significance following a soft read from the ADP report. And not to be left out of the party this week, the Federal Reserve will conclude their meeting on Thursday.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.