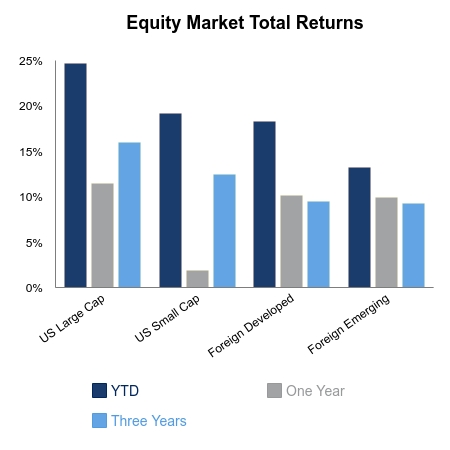

Equities moved higher this week as the S&P 500, Dow Jones Industrial Average and Nasdaq Composite all notched new record highs. The Dow Jones Transportation Average still has more than 5% to go to hit a high and offer solid confirmation that the near two-year consolidation in equity markets is ready for the next sizeable advance. Domestic small caps remain more than 9% from their all-time high and foreign equities are roughly 12% from their 2018 high. Bond yields moved higher on the week amid some roller coaster action.

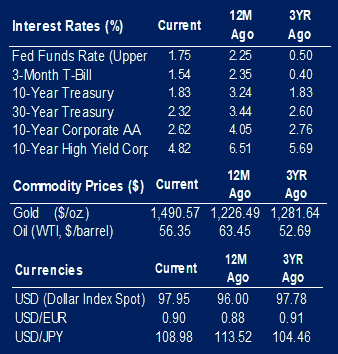

Bond yields fell sharply post the Federal Open Market Committee meeting as the bar for further rate cuts was raised significantly. This would suggest further weakness in the economy won’t be met with additional monetary support in a timely fashion. Therefore, weak economic data could lead to an outsized drop in bond yields. This is what happened when the Chicago PMI came in very soft last week causing the 10-year Treasury to fall 8 bps on the day. The employment report released on Friday was better than expected with upside revisions. The ISM Manufacturing report showed a sequential improvement and finally the ISM Non-manufacturing report came in well ahead of expectations. And just like that, 10-year yields jumped 14 bps in two days. Other leading indicators are signaling a skew toward improvement in the economic data.

According to FactSet, as of November 1, earnings for the S&P 500 have declined 2.7% and is on pace for its first consecutive three-quarter decline since 2016. Not only that, but analysts have finally brought down their estimates of fourth quarter growth to less than zero. If you remember, the analysts had persistently kept their rosy fourth-quarter hockey stick estimates in place, despite notable weakness in earnings growth at the start of the year. On top of this, equity fund flows have been persistently negative despite markets reaching a new high, which is exactly the opposite of what one would expect. If you had a crystal ball at the beginning of the year on the above events unfolding, it would be easy to conclude equity prices would be down in a significant way. Instead they sit at all-time highs.

You may have heard global negative yielding debt reached $17 trillion dollars this year. It continues to be used as a reference point in opinion pieces, but what has been overlooked is this number has fallen to $12.5 trillion in just over two months. If global growth is at an inflection point, a lot of participants remain offsides.

|

|

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this