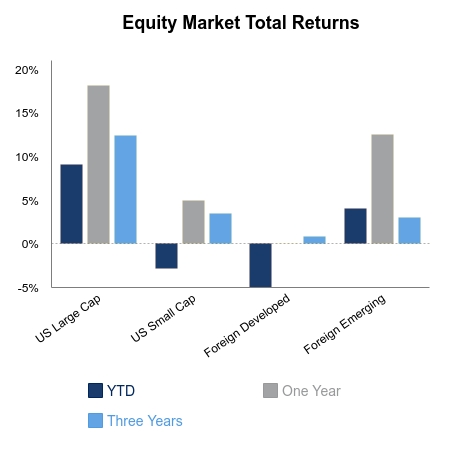

Equity markets drifted lower as stimulus talks continue to be pushed out. Plenty of headlines and no action has whipped the market around for most of the month. For the week, the S&P 500 was down 1.5%. Small caps outperformed the NASDAQ, although both were down on the week. Some high-flying stocks in the solar, electric vehicle (EV) and dynamic technology space had a rough week. The Bloomberg Barclays Aggregate Bond Index was down 0.4% as longer-dated Treasury yields reached their highest level since June.

Initial jobless claims came in at 898,000, which was an increase versus the prior week. The Philadelphia Fed Business Outlook survey was well ahead of expectations. Regional manufacturing surveys continue to be very strong. These can be biased by the direction of the stock market, but it still points to a robust manufacturing sector of the economy. The problem is now the service sector, which has historically been the more resilient of the two. Retail sales came in way ahead of expectations with the core control group rising 1.4% in September versus the prior month. In fact, sales were up 9.1% versus the previous year. It was the largest increase going back to at least 1993. As expected, there was a big drop in clothing stores, gas stations and food services. However, there was a huge jump in sporting goods and online sales.

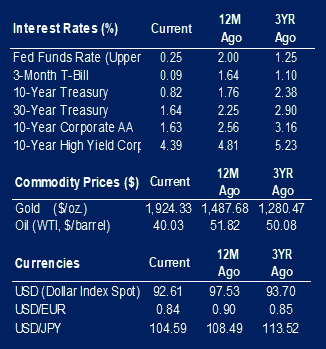

One sobering note is the U.S. Federal Deficit came in at 16% of GDP. During the 40-year period between 1963 and 2003, this averaged just over 2%. And currently the market is on a knife’s edge waiting to see if it gets another shot of stimulus as more debt will be a tailwind to growth over the next couple of quarters. Fed speakers have become more pronounced in acknowledging the precarious situation of letting yields rise substantially or monetizing the debt by becoming the predominant buyer. Under the guise of ensuring a functioning Treasury market, the Fed can fill the large gap between supply and private demand with unlimited capacity. This week saw Fed officials acknowledge they would continue to support asset prices (i.e., not let stocks fall too far) even if it contributes to rising income inequality. They deem rising asset prices as essential in supporting full employment. If there is a catch to this scheme it is likely to be seen in the U.S. dollar, which has been under pressure since March.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.