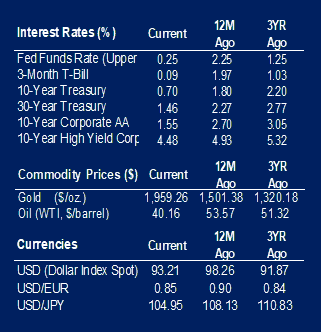

It has been another week with no resolution in congressional stimulus discussions. The positive economic numbers we see may have led to a false assumption the economy is on better footing than it really is. There are concerns the lack of action in relation to additional fiscal stimulus could lead to a more sustained economic downturn. Federal Reserve Chair, Jerome Powell, expects certain areas of the economy will continue to struggle without aid. His comments came on Wednesday after the release of the Federal Open Market Committee September statement. The expectation of a majority of the board is for rates to stay close to zero until 2023, at least. The discussed hurdle for lifting rates is higher than the one for previous downturns. The expectation from officials is for rates to stay low until inflation reaches 2% and unemployment is around 4%.

Initial jobless claims for the week ended Sept. 5 were higher than expected. New unemployment claims were filed by 884,000 people. This number was in line with the previous week’s, but higher than the anticipated 838,000.

Consumer prices were higher than expected in August. Year-over-year (YOY) headline Consumer Price Index (CPI) for the month was at 1.3% versus the expected 1.2%. The numbers hide a lot of underlying price variances. The food category saw an increase in price of 4.1% YOY. Energy declined by 9% led by oil. Excluding food and energy, CPI was up 1.7% in August. Apparel and airline fares are among the biggest drags on inflation. The categories are down 5.9% and 23.2% respectively. Month-over-month, headline CPI was up 0.40% compared to the expected 0.30%, and core CPI was up 0.40% compared to the expected 0.20%.

Hourly earnings for August were up 4.7% over the previous year. As mentioned in previous Weekly Insights, this number is inflated due to a higher number of people who have lost their jobs being on the lower end of the wage scale. This has led to the average of the pool skewing higher.

Retail sales for August were lighter than anticipated. The 0.60% growth reported was less than the expected 1.1%. A contributing factor is the rolling-off of some government stimulus programs.

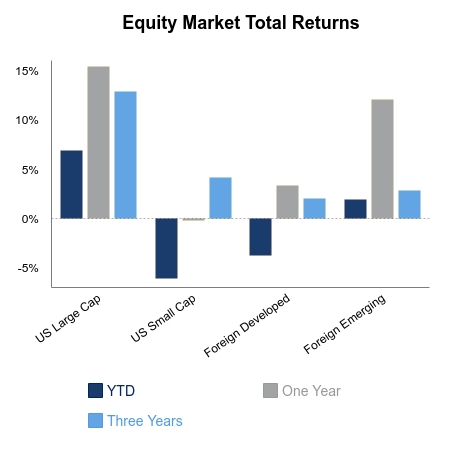

The S&P 500 index was down 0.35% this week. The weakness was led by the information technology and consumer discretionary sectors, down 1.56% and 1.39% this week.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.