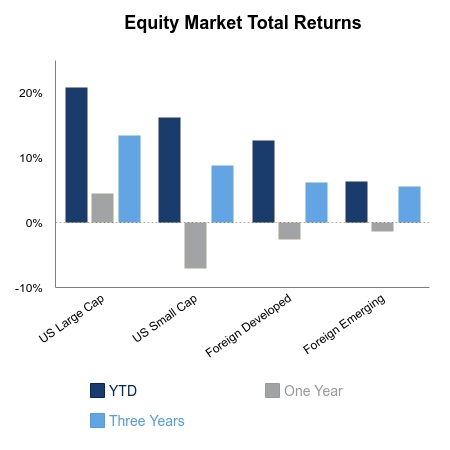

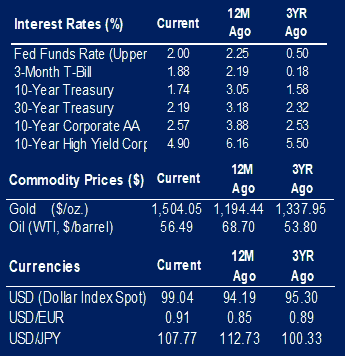

Equities were soft this week with the S&P 500 losing 0.7%. The broad index fared better than both domestic small caps and emerging markets which were down 1.1% and 1.5% respectively. Markets continue to face a plethora of crosscurrents. New this week was the announcement of a Presidential impeachment inquiry. Repo markets seized up last week and sent the overnight rate to levels usually associated with severe financial stress. This week the Federal Reserve (Fed) announced permanent operations to help alleviate the issue. Still, these issues shouldn’t be happening and highlights the fragility of dollar liquidity in the global financial system. Market participants continue to debate the significance of the issue, but consensus is forming it raises the probability of the Fed starting balance sheet expansion, i.e. quantitative, easing sooner than expected.

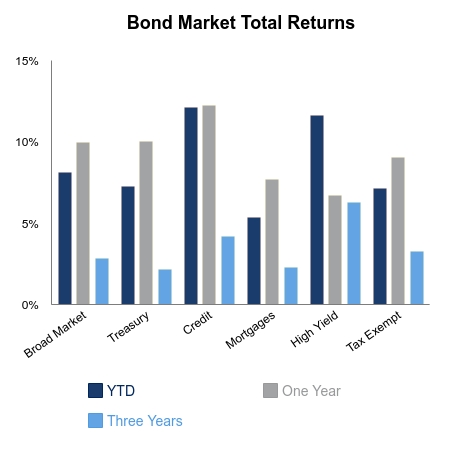

The Bloomberg Barclays Aggregate Bond Index was up 0.3%, showing some stability after a sharp reversal to the downside this month. There continues to be much debate about the direction of interest rates following one of the strongest moves ever based on several momentum indicators.

The Conference Board Leading Economic Index again pointed to economic deceleration on the horizon. The growth of 1.1% from the prior year is down for the eleventh straight month and sharply from the 6.3% reported a year ago. Despite the weakness, 60% of the 10 indicators remain in a growth trajectory. The diffusion index would need to drop below 40% to elevate concerns of an imminent recession. New home sales beat expectations and remain strong due to a 16% drop in the 30-year fixed mortgage rate versus the prior year. It is one of the largest drops since 2000, and as expected is a tailwind to residential housing activity. The Chicago Fed Adjusted Financial Conditions Index has been in easing mode thanks to the large drop in interest rates. Financial conditions would need to tighten by a large amount and/or for a persistent length of time for a recession to become the most likely outcome.

Next week’s focus will be on the ISM manufacturing report which comes out the first of the month. The index has been in free fall of late and fell well below 50 last month. The internals were even worse as new orders printed its lowest level since 2012. A further drop will justify calls we will encounter more than a manufacturing soft patch, whereas a bounce will likely cause a notable move higher in risk assets as downside bets gets covered.

|

|

Contributed by | Justin Carley, CFA, Managing Director

Justin is a Managing Director, providing portfolio management and credit analysis for fixed income strategies. He also manages the firm’s multi-manager portfolio strategies and contributes to the asset allocation framework. Justin has more than 10 years of experience focusing on management, analysis and trading of fixed income portfolios. Previously, Justin was a fixed income portfolio manager at American Trust & Savings Bank. Justin has a bachelor’s degree from Truman State University, holds the Chartered Financial Analyst designation and holds a Fellowship in the Life Insurance Management Institute.

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involved risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.