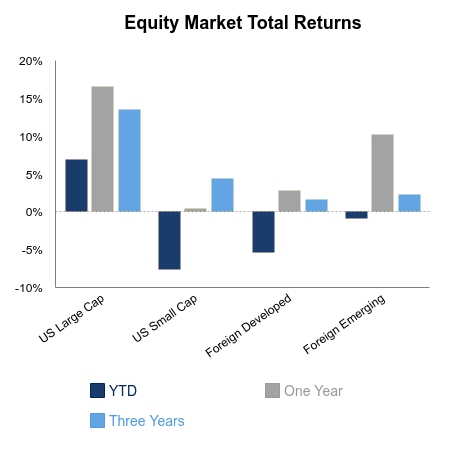

Equities suffered three days of big losses but were bookmarked by a bounce to end the week. The sell-off lacked an easy scapegoat, but a lot of chatter in the financial markets pinned the blame on excessive option buying in the technology sector, that then gave way to an air pocket once the activity dried up. The NASDAQ Composite was down 10% in three days, before ending down 7.6% on the week. Weakness spread to the broader indices as well with the S&P 500 finishing down 5.1% on the week. Of note is the fact that the Bloomberg Barclays Aggregate Bond Index was down 0.4% despite the sharp drop in equities.

Nonfarm payrolls increased 1.371 million for the month of August. The unemployment rate fell from 10.2% to 8.4%. Job openings jumped more than 10% in the month of August to over 6.6 million. The jobs report was good enough to push equities lower on the anticipation that further stimulus will be delayed.

It was a wild week in the technology sector that began when Zoom Technologies put in what some experts are saying was the best quarterly performance by a company in recent memory. The stock finished up 40% on the day, but it also pulled up a lot of peers by double-digit percentage gains. This set-up a quick bear-trap reversal on Thursday with many of these names down 8-15%. Zoom Technologies would fall 27% from its intra-day highs in just five days. Tesla was excluded from the S&P 500 this week, which opted for three other companies instead. This caused their shares to fall 21% in a single day, the largest one-day drop on record. Tesla stock fell 34% from its high in just five days. Prior to the drop, the stock was up more than 80% in 14 trading days. In fact, Tesla’s equity has risen more than 45% in just two weeks on four separate and isolated occasions this year.

The underlying dynamics of the market are undergoing a change driven by the buying preferences of the marginal buyer. Exchange traded fund (ETF) allocations are going up and when ETFs receive money they buy at any price. There is no discretion involved that says a price is above fair value. Also, the stimulus checks ushered in a new wave of investors, and as a group they are risk seekers. Add it all up and momentum stocks have become turbocharged, both up and down. This week provided a good visual representation of these underlying dynamics.

|

|

Source: BTC Capital Management, Bloomberg LP, Ibbotson Associates, FactSet.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

The information within this document is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.