Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Say Goodbye to Negative Yielding Bonds

- Quantitative Easing Remains

- Asset Class Performance at a Glance

- Consecutive Negative Returns are a Rarity

- A Look at Equity Valuation

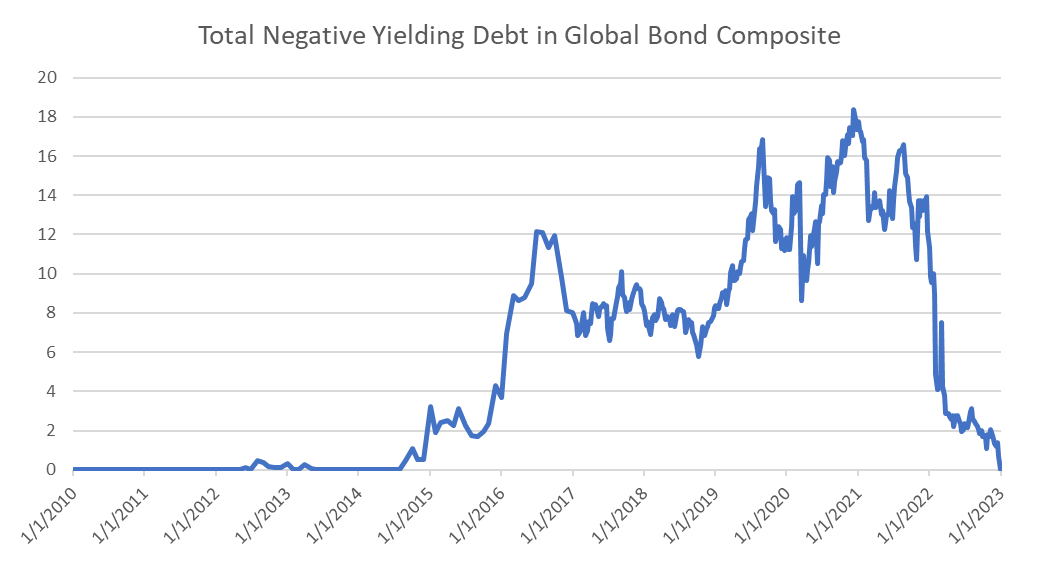

1. Say Goodbye to Negative Yielding Bonds

- The Bank of Japan moved up the yield on their bond buying program, thereby pushing up Japanese yields.

- Now there are no longer negative yielding bonds in the global aggregate composite for the first time since 2010.

- The level peaked at more than 18 trillion only two years ago.

- A big unknown is what this will look like as we progress through the next recession.

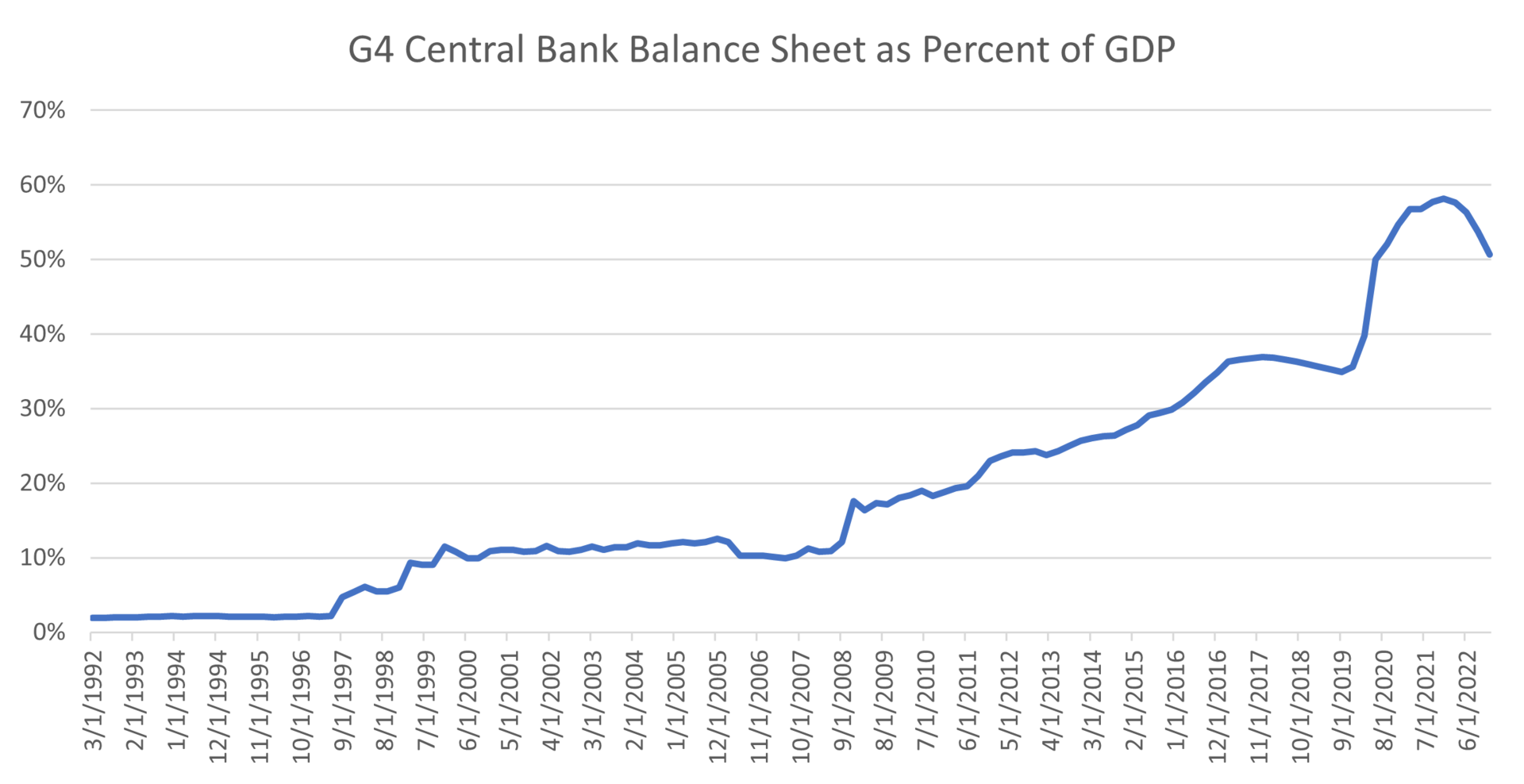

2. Quantitative Easing Remains

- Quantitative Easing is often viewed as the biggest contributor to asset price growth.

- Previous small dips led to decline in global equities.

- The current decline is the largest percentage decrease since this cycle began.

- How low this can go and if it will ever hit new highs remain hotly debated topics.

3. Asset Class Performance at a Glance

- Commodities exhibited the best performance during 2022, advancing 24% year-over-year, and the only asset class to exhibit positive performance.

- Bonds (-13%) and U.S. Large Cap Equities (-20%) faltered, the latter posting their worst performance since 2008.

- We’re seeing some reversal so far in 2023 as bonds and certain equity sub-classes are exhibiting positive performance.

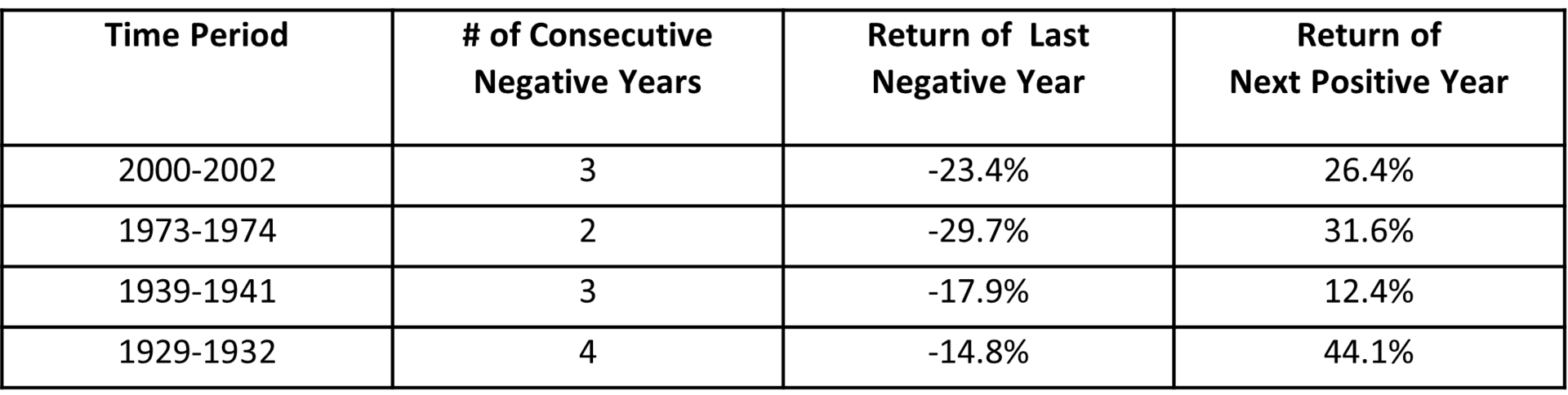

4. Consecutive Negative Returns are a Rarity

- There have only been four periods going back over the last 100 years where the S&P 500 saw consecutive years of negative price returns.

- The longest period of this was four consecutive years of negative returns during the Great Depression.

- The return of the first positive year of returns have often been greater than the prior year’s drawdown, evidencing that investors who have been continually invested have benefited.

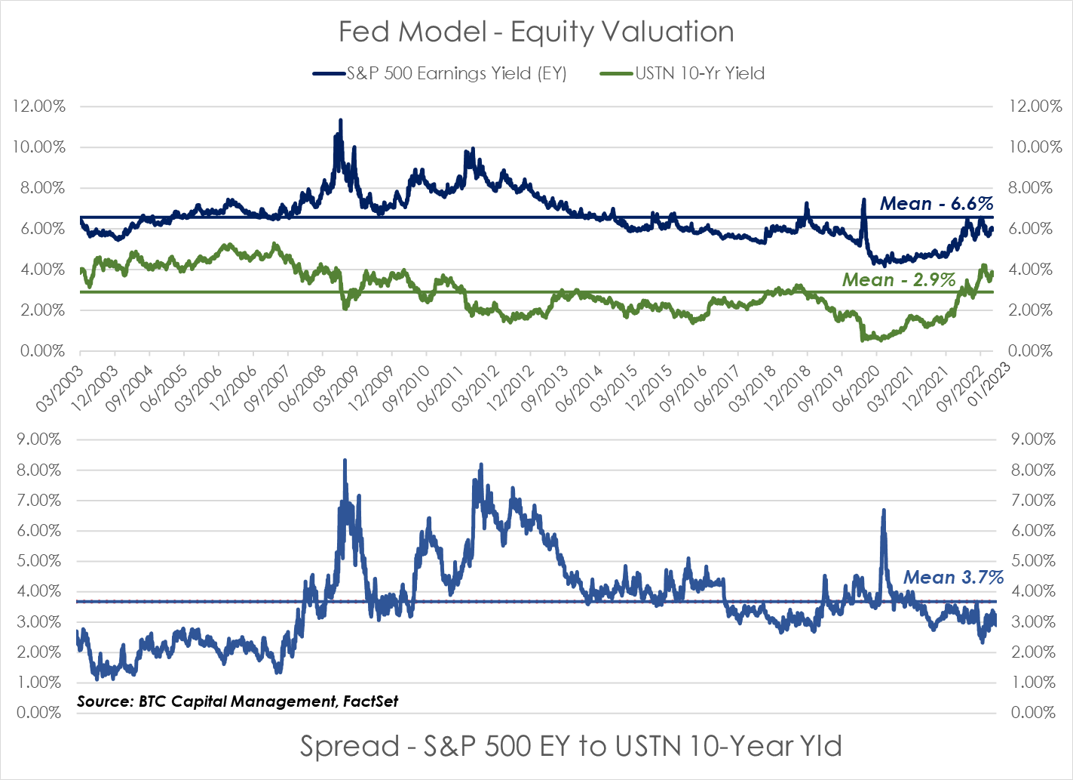

5. A Look at Equity Valuation

- A consistent theme over the last year has been the compression in price-to-earnings (P/E) and the downward trend in analyst revisions.

- Given the congruent movement of the latter two points, the Earnings Yield (EY) for the S&P 500 has increased to 6.0%.

- That said, the yield on the USTN 10-Year has also been increasing to its current yield of 3.7%, making it attractive relative to equities.

- When considering the spread between the USTN and the S&P 500 EY, the valuation of equities to historical spread may appear somewhat inflated.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.