Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Federal Funds

- Transitory 2.0

- ISM Data

- More Companies Guiding Down Earnings Expectations

- S&P 500 Performance – First Quarter 2024 Versus March 2024

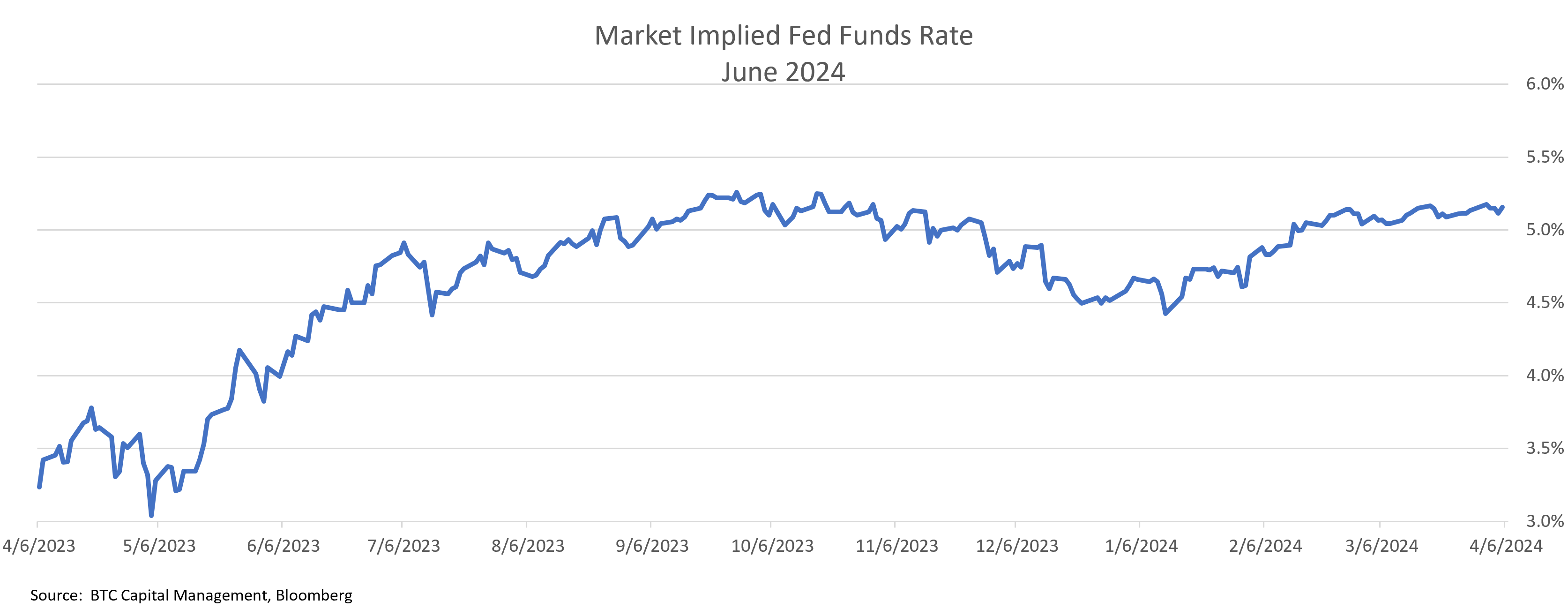

1. Federal Funds

- The market-implied Federal Funds Rate for June has returned to its October level.

- Equities remain 25% above their starting point and corporate spreads are tighter, as well.

- Fed officials have voiced some concern about recent elevated inflation readings.

- The Fed remains in an easing bias.

- Fed rhetoric suggests cuts would come fairly quickly if economic growth falters or financial conditions tighten.

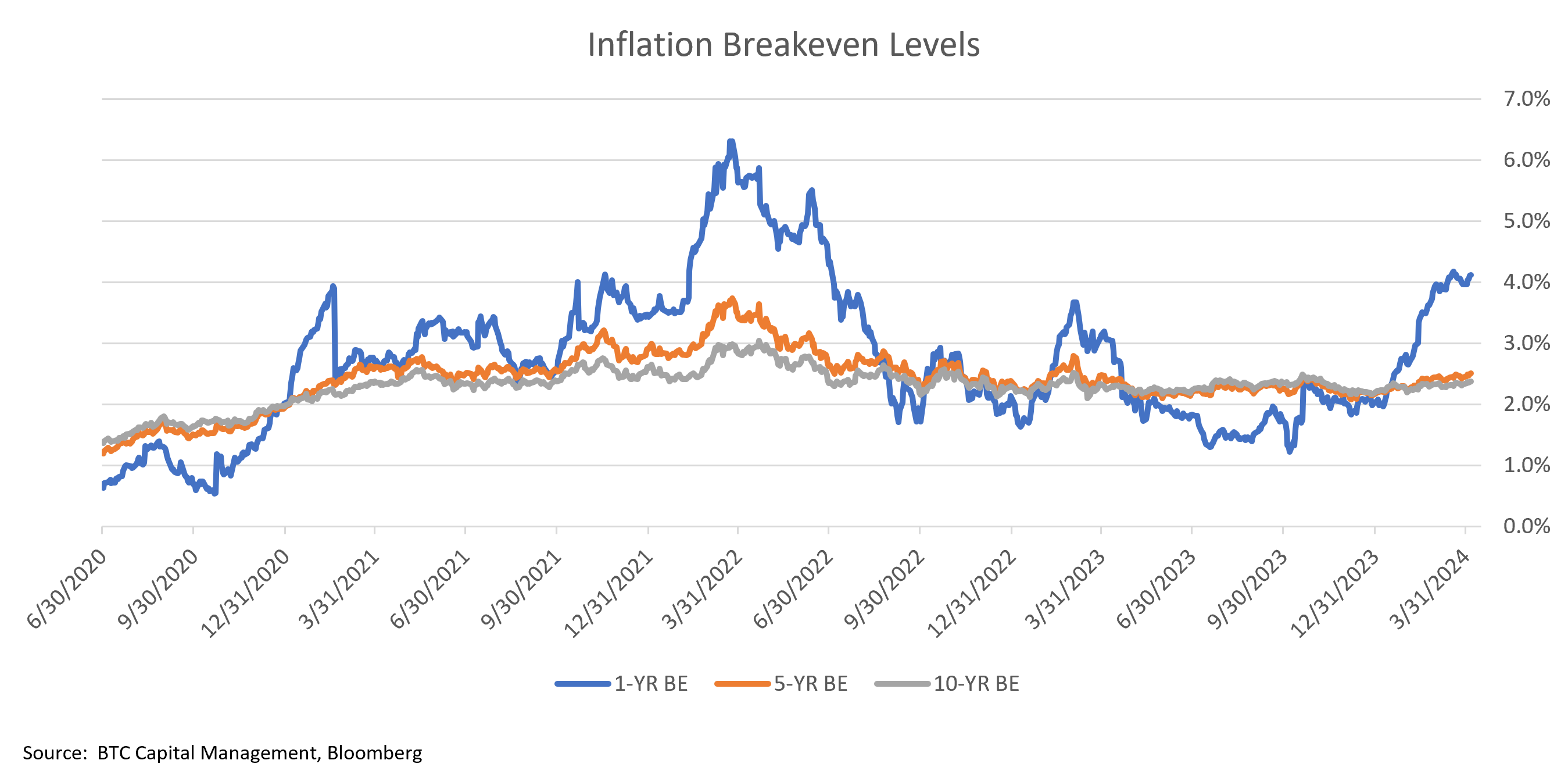

2. Transitory 2.0

- One-year inflation breakeven levels have spiked to reflect actual inflation readings.

- Five and 10-year breakeven levels have moved up modestly but view current inflation readings as transitory.

- The Fed waited until the five-year breakeven approached 3% before raising rates in early 2022.

- Given their growth bias and view they have restrictive policy. It may take a repeat for them to consider hikes.

- Equities peaked right as five-year inflation breakevens jumped up through 3% in late 2021.

- This suggests risk assets don’t need cuts to perform well, instead they need the absence of a new Fed hiking cycle.

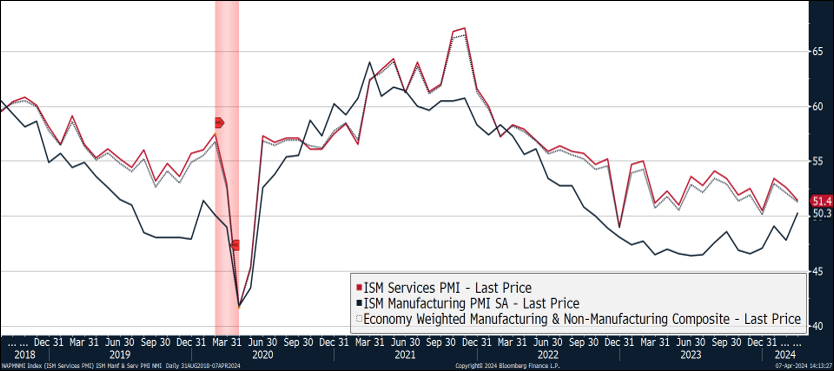

3. ISM Data

- In its most recent report, the ISM Manufacturing PMI registers a reading above 50.0 with a result of 50.3.

- This reading represents the first time the measurement has registered a result above the 50.0 threshold since September 2022.

- When the index has a reading higher than 50.0 it is stating that the manufacturing segment of the economy is expanding versus contracting.

- This month’s higher reading is a result of a rebound in production and an increase in new orders.

- Factory employment, despite the uptick in the index, is still being negatively impacted by layoffs.

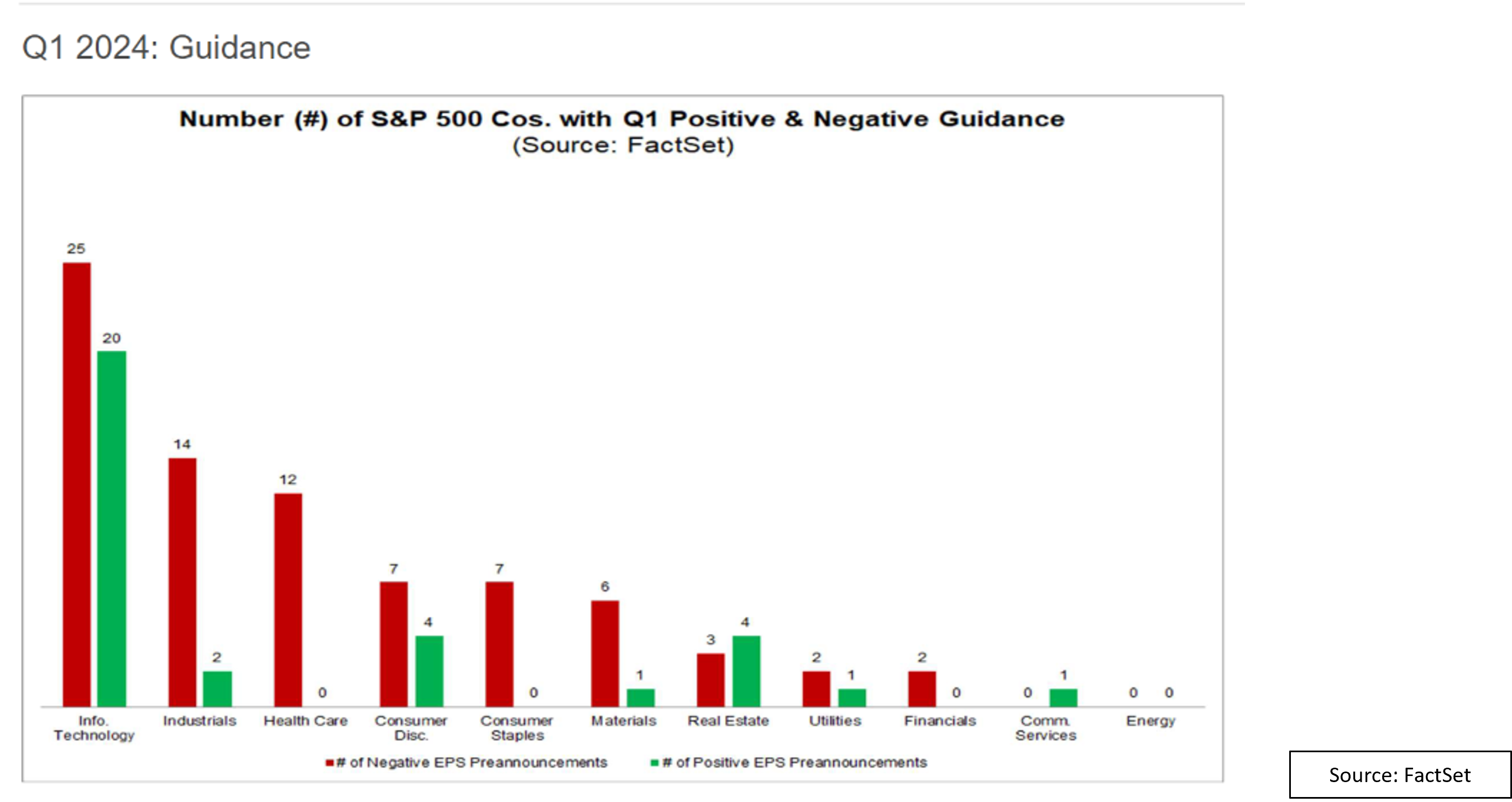

4. More Companies Guiding Down Earnings Expectations

- During fourth quarter earnings reporting season, several companies, including industry bellwether corporations, have lowered their earnings guidance for the next quarter, citing numerous factors (economic headwinds, etc.).

- Most sectors are experiencing significantly more negative than positive guidance announcements. The Information Technology sector, which is currently riding a A.I. wave, has even been seeing more negative than positive guidance announcements.

- Earnings quality remains a key factor in security selection to aid in relative positive performance.

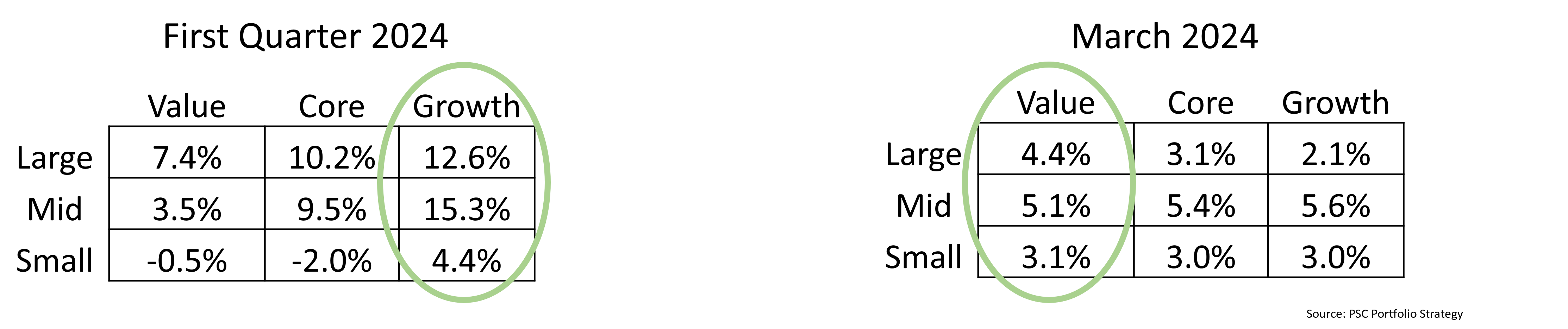

5. S&P 500 Performance – First Quarter 2024 Versus March 2024

- Equity markets rallied in the first quarter of 2024, continuing their trend from 2023.

- Growth stocks were the best performing group across all market caps for the first three months of the year.

- However, specifically during March, Value was the best performing style across large and small cap stocks. Value stocks tend to outperform in relatively higher interest rate environments.

- Investors are wary of the timing and number of potential rate cuts by the Federal Reserve given the recent release of inflation metrics.

Sources: BTC Capital Management, Bloomberg, Institute of Supply Management, PSC Portfolio Strategy, FactSet

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.