Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Fed Expectations Stabilize

- Consumer Price Index YOY

- Equity Volatility

- Valuations

- Air Travel is Increasing

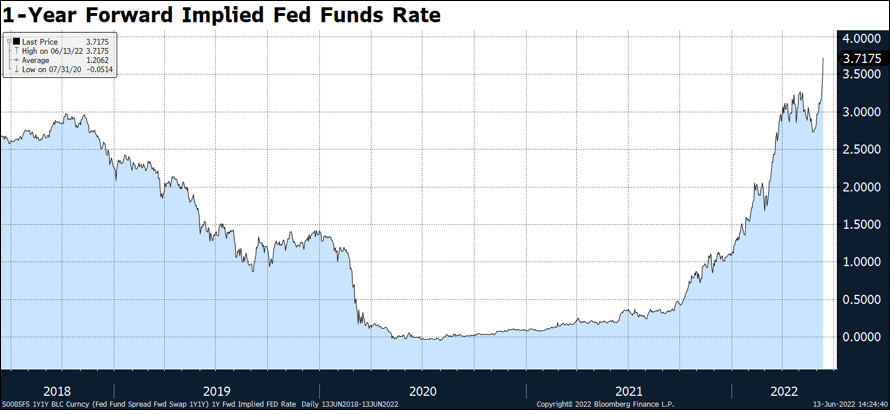

1. Fed Expectations Stabilize

- June 2023 expectations for the Federal Funds Rate has stabilized between 3.50% and 3.75%.

- This followed the largest 10-week increase in series history, which began in 1990.

- The current rate implies 275 basis points of hikes over nine meetings.

- This is the peak rate the market is assigning before cuts begin in 2023.

- Fixed income volatility has also peaked amid stabilizing expectations.

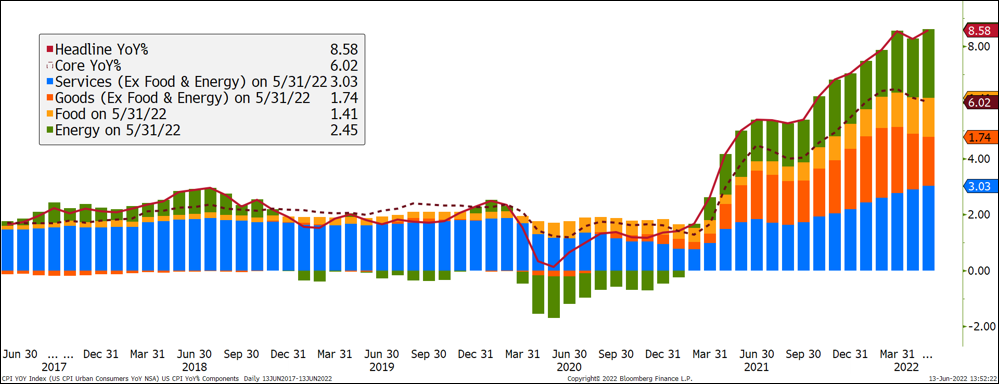

2. Consumer Price Index YOY

- The Consumer Price Index (CPI) 12-month increase of 8.6% was the strongest showing since December 1981.

- Food and energy have shifted from lowering inflation two years ago to being major contributors to recent index increases.

- The largest individual contributors for the year included indexes for shelter, airline fares, used cars and trucks, and new vehicles.

- Core CPI continues to register annual growth levels not seen since 1982.

- “Peak” inflation being delayed in part by continued high demand driven by consumers drawing down savings and increasing their use of credit.

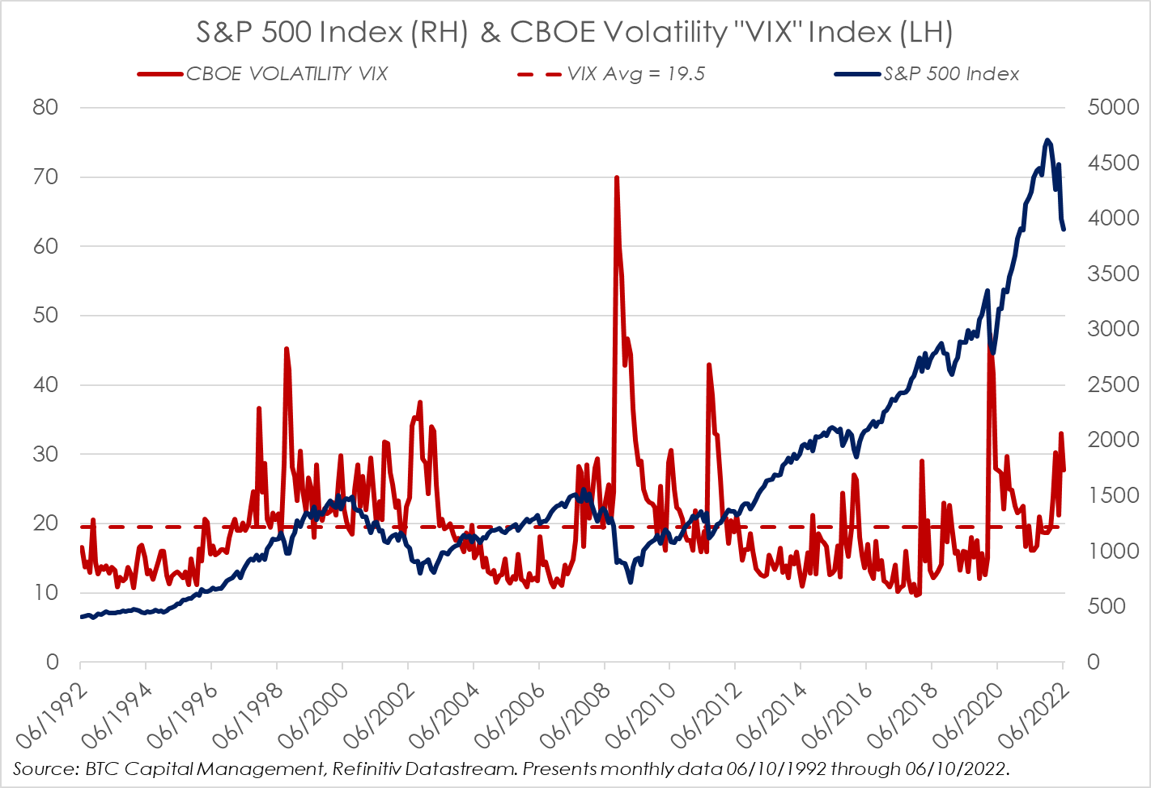

3. Equity Volatility

- As mentioned in our fourth quarter 2021 Investment Insight, we anticipated a rise in equity volatility for 2022, which has been elevated during 2022.

- Equity volatility, as measured by the CBOE VIX Index, has fluctuated to the upside through most of 2022.

- The VIX has remained elevated through most of the first-half of 2022, averaging 21.4 versus its historical average of 19.5.

- Twice this year the VIX has spiked above 30 as seen in May (32.9) and March (30.2).

- This volatility has been driven primarily by the Russia-Ukraine conflict, further enhanced by the uncertainty of economic growth driven by actions anticipated by global central banks relating to monetary policy, interest rates and inflation

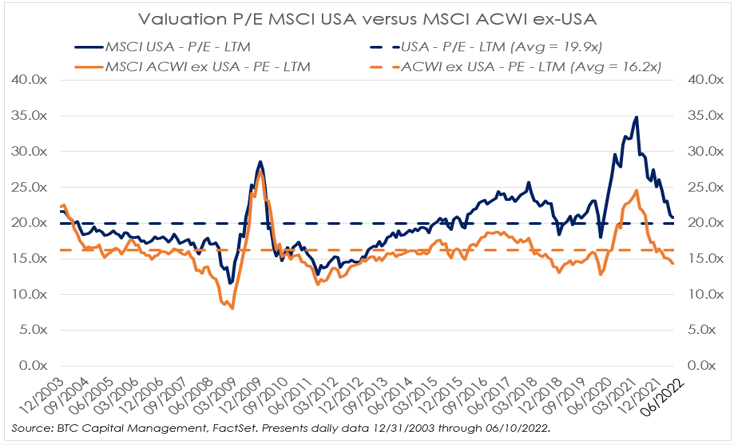

4. Valuations

- Valuations, as measured by the price-to-earnings ratio (P/E), have compressed from highs exhibited in the first quarter of 2021.

- The last 12-month P/E for domestic equities, as measured by the MSCI USA Index, currently stands at 20.7x and is well below the 34.8x observed as of April 2021 yet remains above its 20-year average of 19.9x.

- Concerning foreign equities, as measured by the MSCI ACWI ex US Index, its trailing 12-month P/E of 14.4x is also below that of 34.6x exhibited in April 2021 and below its 20-year average of 16.2x.

- When considering valuations projected for the next 12 months, valuations may appear more opportunistic with the MSCI USA Index at 17.9x while MSCI ACWI ex USA Index currently is at 13.1x.

- As P/E is directly impacted by earnings, the upcoming earnings reports for the second quarter of 2022 will afford some clarity going forward.

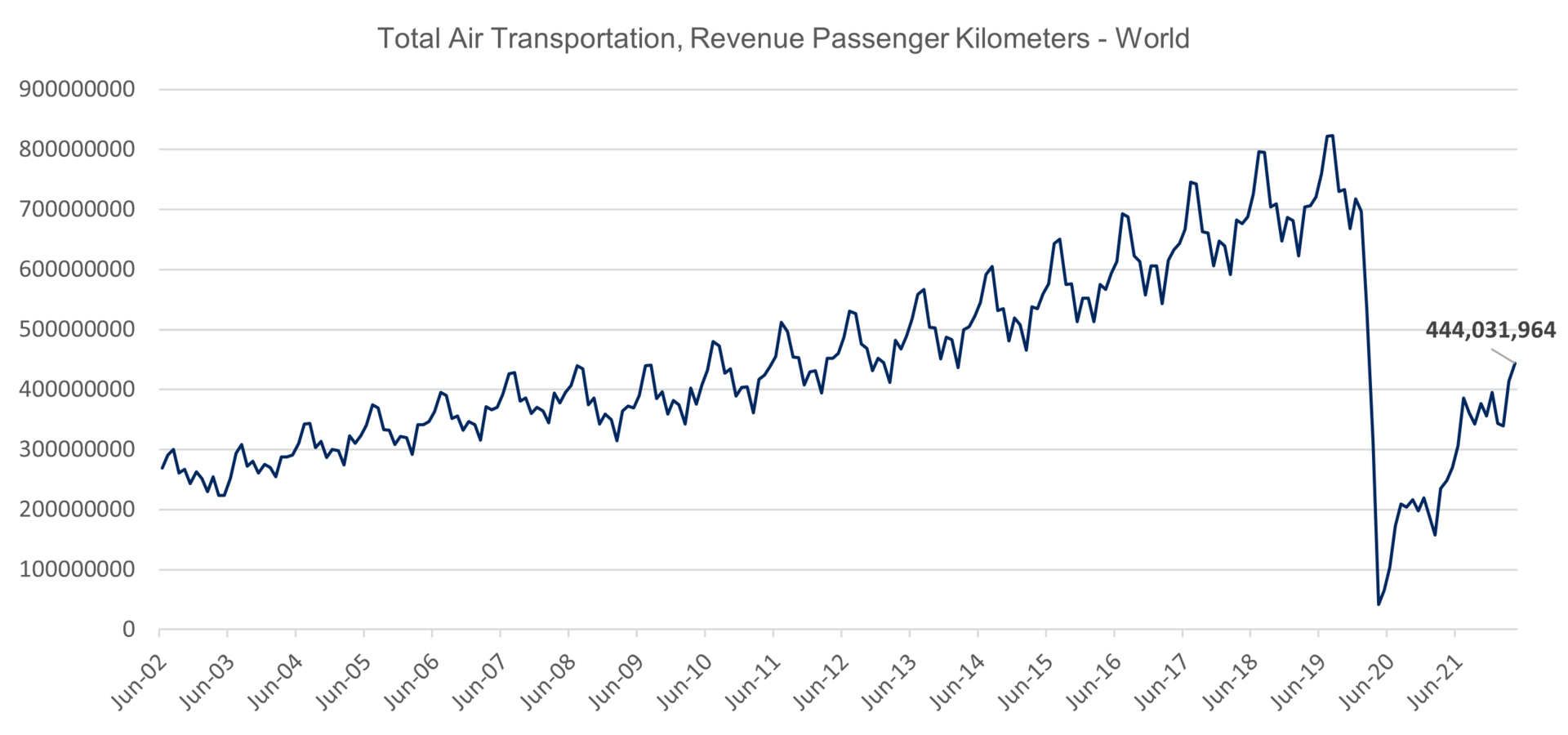

5. Air Travel is Increasing

- Air travel is up in 2022.

- We have gained a little more than half the passenger traffic from 2019.

- Personal travel is returning faster than business travel.

- Ticket prices have shot up as airlines contend with higher gas prices, labor constraints and increasing carry-on capacity.

- Demand for air travel is expected to continue to increase through the year

Source: BTC Capital Management, Bloomberg Finance L.P., Refinitiv Datastream, FactSet

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.