Welcome to Five in Five, a monthly publication from the Investment Team at BTC Capital Management. Each month we share graphs around five topics that illustrate the current state of the markets, with brief commentary that can be absorbed in five minutes or less. We hope you find this high-level commentary to be beneficial and complementary to Weekly Insight and Investment Insight.

This month’s Five in Five covers the following topics:

- Corporate Bonds Offering More Interest Rate Protection

- U.S. Employment Current Levels Best in Decades

- Significant Dispersion in Returns from Style Investing

- Large Cap Tech Stocks Driving Index Returns

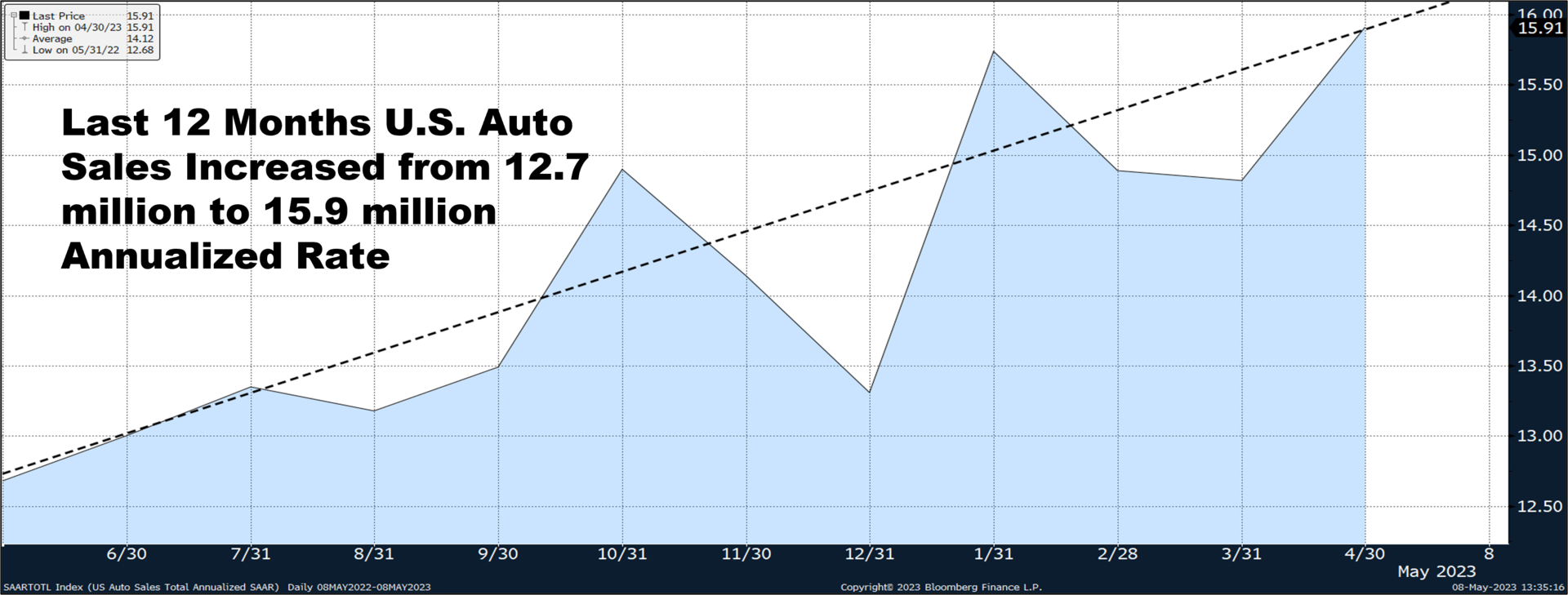

- Last 12 Months U.S. Auto Sales

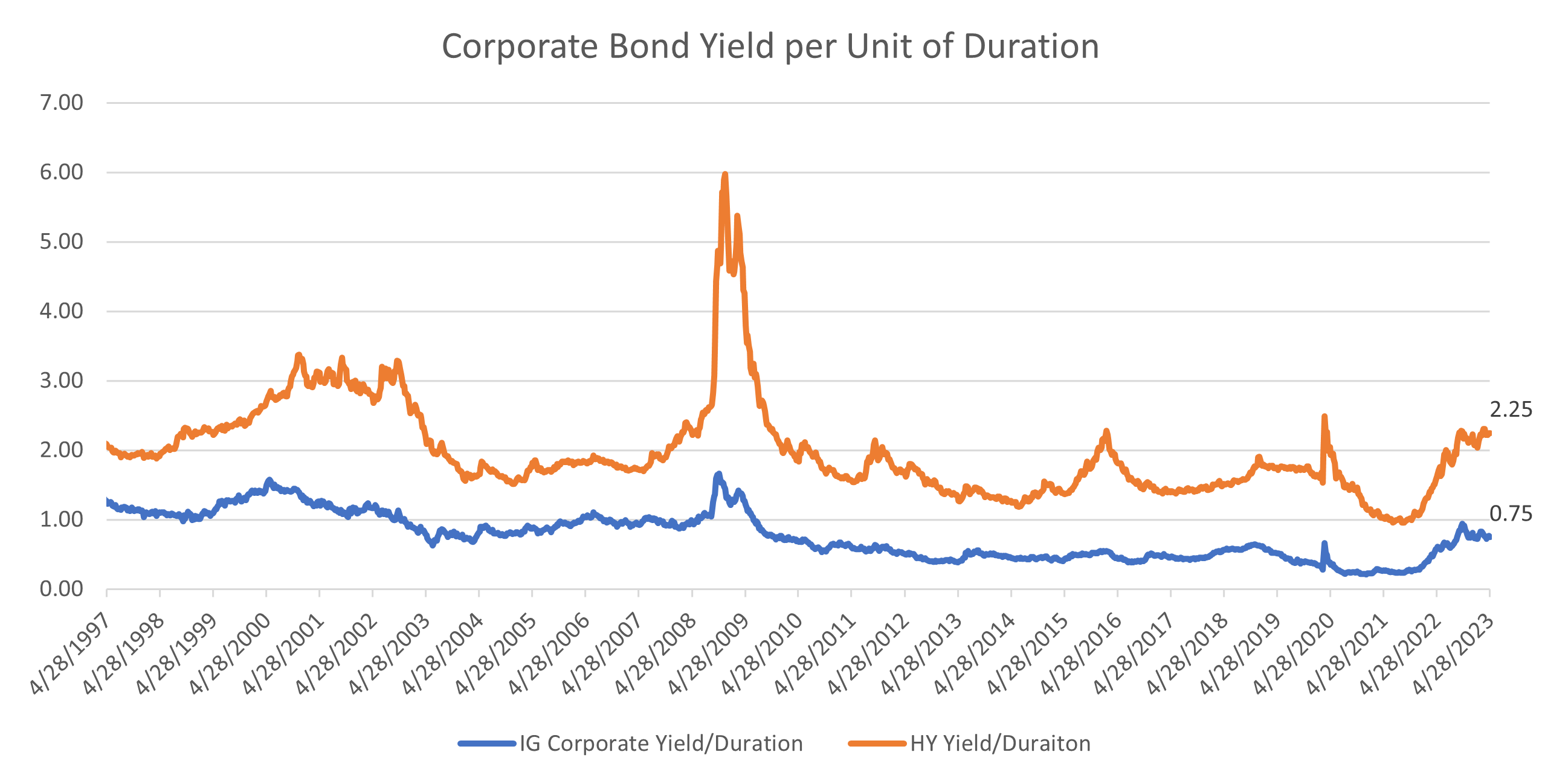

1. Corporate Bonds Offering More Interest Rate Protection

- Corporate bond yield per unit of duration has moved up toward 10-year highs.

- The higher the number, the less interest rate sensitivity.

- Investment grade corporate bonds yield about 5.2% and have a duration of 6.9.

- High-yield corporate bonds yield about 8.4% and have a duration of 3.7.

- High-yield risk-to-reward ratio is attractive.

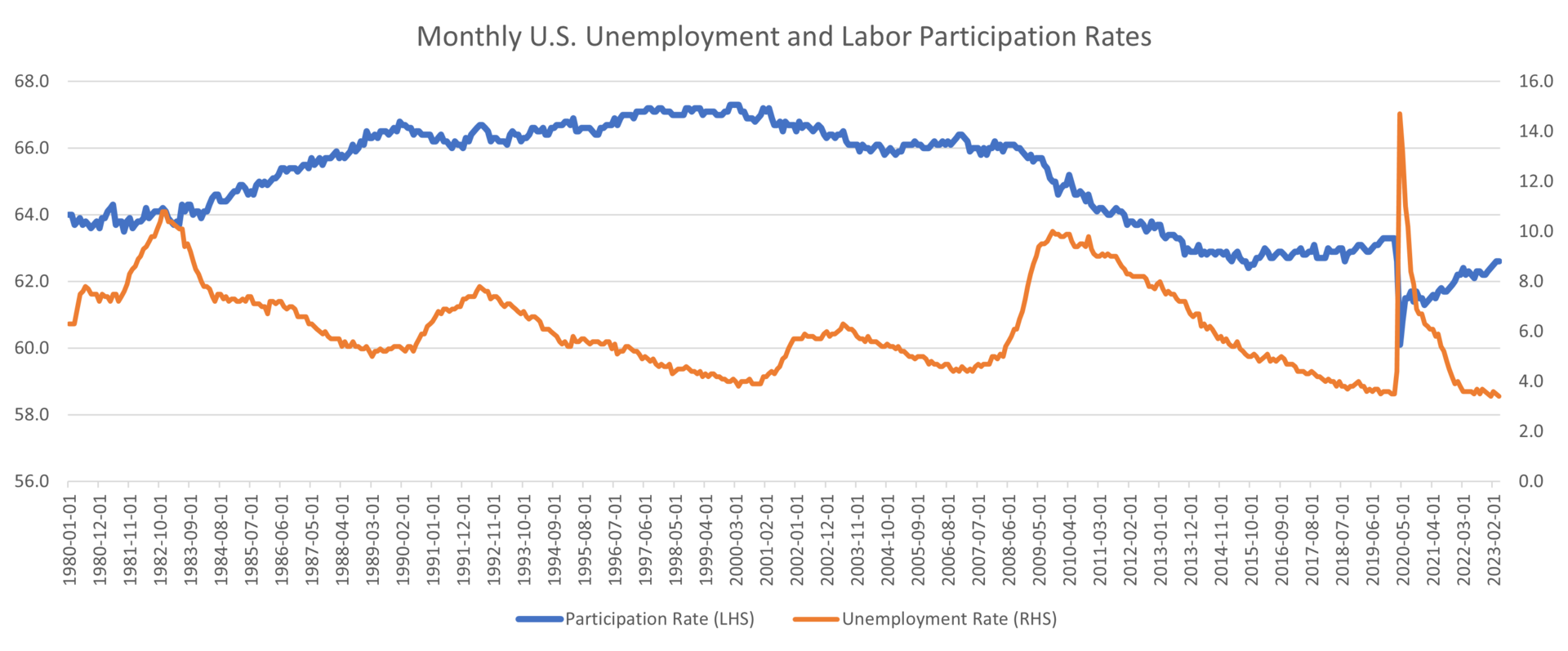

2. U.S. Employment Current Levels Best in Decades

- The latest monthly employment release saw the unemployment rate (right axis) at a multi-decade low.

- Similarly, the labor participation rate (left axis) defined as the percentage of the population either working or actively looking for work has rebounded since the COVID era and is now back to levels not seen since early 2020.

- The relatively strong labor market is one of the key metrics the Federal Reserve is monitoring when considering future rate hikes as it governs its fiscal policy.

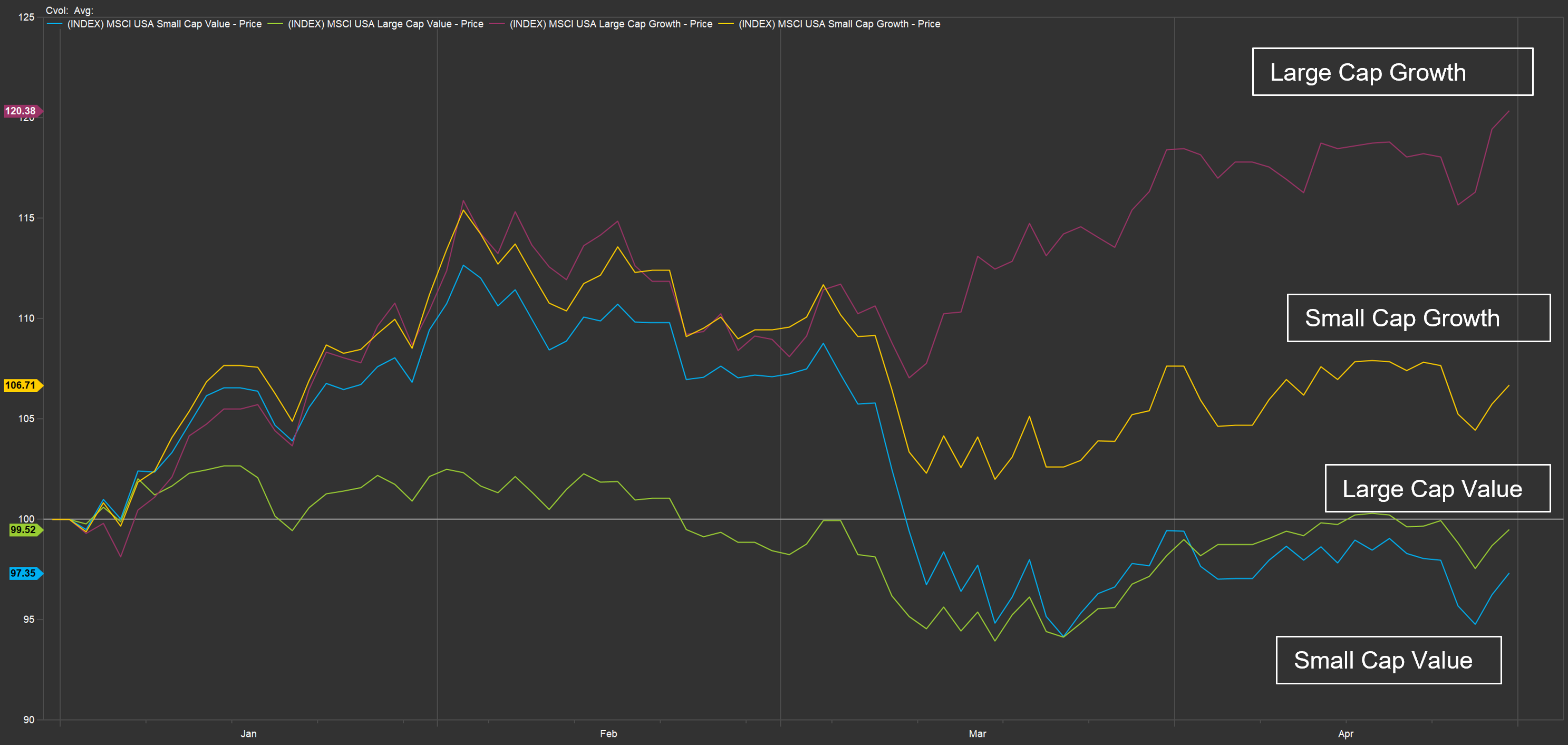

3. Significant Dispersion in Returns from Style Investing

- Year-to-date (YTD), U.S. stock market returns have varied widely depending on size and style.

- The MSCI Large Cap Growth Index is up 20.4% YTD whereas the Large Cap Value Index is essentially flat YTD.

- Similarly, the MSCI Small Cap Growth Index is up 6.7% whereas the Small Cap Value Index is down 2.7% YTD.

- In 2022, Value significantly outperformed Growth for the first time in several years, thus illustrating the need for investors to be diversified not only in asset classes, but also diversified within size/style investing within their equity holdings.

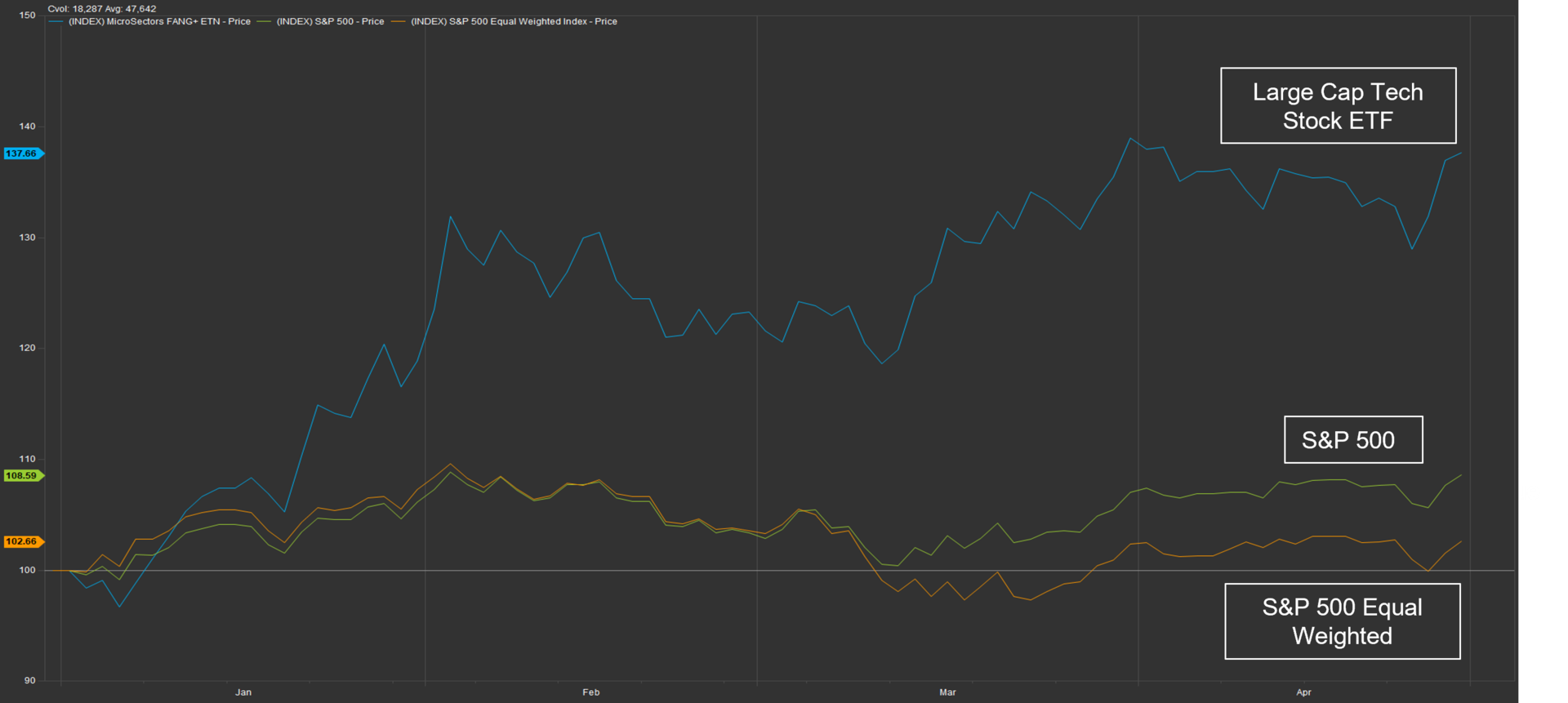

4. Large Cap Tech Stocks Driving Index Returns

- For the first four months of 2023, the S&P 500 gained 8.6%. However, the majority of gains came from large cap tech stocks, which have a larger weight in the index.

- An index of equal weighted stocks in the S&P 500 was only up 2.7% during that time.

- The blue line in the graph above represents the largest technology stocks in the S&P 500, which were up 37.6% for the first four months of the year, helping to drive up the overall performance of the S&P 500.

- The current rally in the markets has not been diversified across sectors, but instead has been limited in breadth to “mega cap” technology stocks.

5. Last 12 Months U.S. Auto Sales

- Over the past year vehicles in the U.S. have trended higher as supply chain pressures have eased.

- Fleet sales are also recovering as the combination of large rental, commercial and government fleets have produced double-digit, year-over-year increases for nine consecutive months.

- The average transaction price in the U.S. for a new vehicle declined to $48,008 in March from $48,558 in February. This price was 3.8% higher than in March 2022.

- While still elevated on an historical basis, wholesale used car prices fell 3% in April.

- Reduced pricing pressure contributes to moderation in the rate of inflation.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This document is intended for informational purposes only and is not an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and you should not interpret the statement in this report as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.