Hot Fun in the Summertime

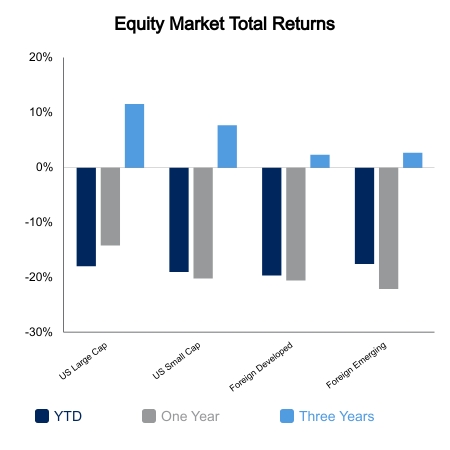

Positive sentiment toward equities continued into August, until it didn’t. Broad equity benchmarks continued their ascent through mid‑month, which began as of the beginning of this third‑quarter. U.S. equities rose through most of the month, only to pull back from mid-month highs and end the month down 3.7%. Foreign equities also fizzled out dropping 4.7% through month‑end.

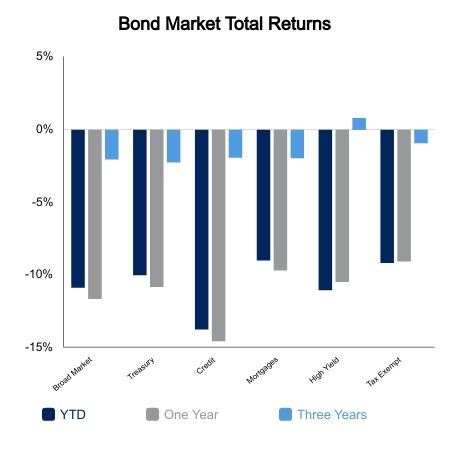

Even bonds were not immune, declining 2.7% for the month.

Muddy Waters

Investor sentiment recently changed from one of “risk‑on” to “risk‑off”. Regarding the macro view, data continues to be fluid and muddled.

The second estimate of second‑quarter GDP was revised to -0.6% from -0.9%. Upward revisions in consumer spending and private inventory investment were partially offset by a downward revision in residential fixed investment. The third and final estimate of second‑quarter GDP will be released on Sept. 29.

Consumer spending appeared somewhat resilient. Personal income for July rose month‑over‑month by 0.2%, below expectations but positive. This translated into a rise of 0.1% in Personal Consumption Expenditures (PCE) for July. That said, the rise of 0.08% in the Core PCE Deflator for July was well below expectations of 0.30% and June’s increase of 0.61%. The broader PCE Deflator fell 0.07%. versus expectations of a 0.05% rise and was materially below June’s report of 0.96%.

Another positive was the upside surprise exhibited by the Index of Consumer Sentiment from the University of Michigan. The final report for August was 58.2, well above consensus expectations of 55.2 and July’s 55.1.

With all this positive news, why the retracement? Questions abound as to inflation, specifically peak inflation in the U.S. and the outlook for the economy. These same concerns exist outside the United States.

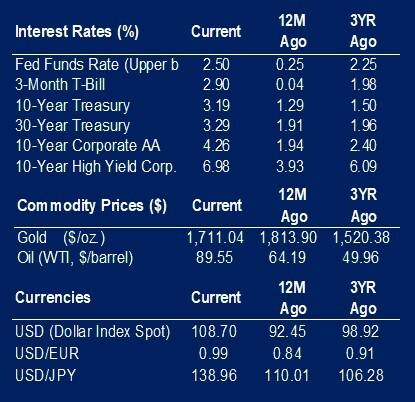

Inflation remains top of mind to the Fed. At last week’s Jackson Hole Economic Symposium, Chair Powell reiterated the goal of the Federal Open Market Committee to “bring inflation back down to our 2% target”. He further stated that “July’s increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting.” These comments specifically resulted in a rise in yields and a fade in equity markets.

Thus, it seemed that investor sentiment for August could be summed up as “the thrill is gone”.

Do You Remember?

As we move into September, a few things warrant consideration. The Atlanta Fed’s GDPNow model currently projects third‑quarter GDP to grow 2.6%, up from 1.6% on Aug. 26. And while analyst revisions for third-quarter earnings have been tempered, according to Refinitiv, analysts are currently projecting growth in both revenues and earnings of 9.9% and 5.3%, respectively. Equities have been positive quarter‑to‑date. As Justin mentioned in last week’s Insight “… should stock prices break higher, many funds will be offsides and the chase may see another run of strong gains.”

|

|

Source: BTC Capital Management, Ibbotson Associates, FactSet, Refinitiv.

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.