Sentiment Abating?

Over this past week, yields modestly declined. The yield on the U.S. 10‑year Treasury closed at 4.26%, which was below its yield of 4.33% a week ago.

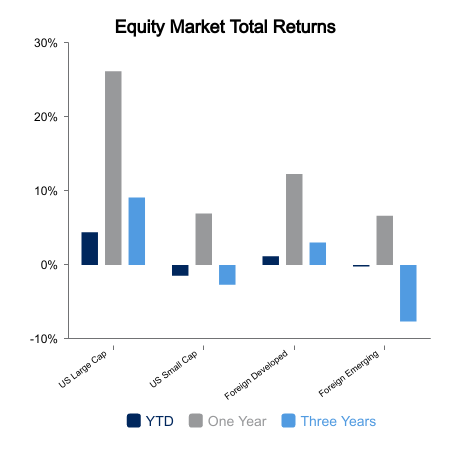

Equity performance was mixed over this past week. U.S. equities declined 0.4%, pulled down by a 1.8% decline in Growth which fully offset the 1.3% advance in Value. Recall year‑to‑date Growth has been the driver of domestic equity performance as Value has continued its relative lag from 2023.

Foreign equities fared well over this past week having outperformed domestic equities. Developed markets rose 2.0%, while emerging markets advanced 1.3%.

Overall, earnings reports for the fourth quarter of 2023 have been mixed. According to London Stock Exchange Group (LSEG), reported earnings for U.S. large cap companies have exceeded analyst estimates by 7.1% and grew 9.4% year‑over‑year (YOY). For U.S. small caps, reported earnings exceeded analyst estimates by 6.4% and increased 5.1% YOY. Outside of the U.S., reported earnings exceeded analyst estimates by 4.4% but contracted 7.8% YOY.

One critical event occurred after the market closed on Wednesday when NVIDIA reported earnings beat consensus estimates by 12.3% and sales beat consensus estimates by 8.4%. NVIDIA is a leader in artificial intelligence, which has been a driver of investor sentiment.

While fourth quarter earnings reports in aggregate have been positive, more companies have issued negative versus positive guidance for the first quarter of 2024. Our review of analyst estimate revisions to calendar‑year 2024 earnings via FactSet exhibits a higher rate of downward revisions (39.0%) for U.S. companies than upward revisions (30.4%). This trend is similar for foreign companies with analyst downward revisions outpacing upward revisions 48.4% versus 31.1% respectively.

It’s All About the Economy…

Regional Fed surveys came in better than expected. The Empire State Index (a monthly survey of manufacturers in New York State) for February came in at -2.4, which exceeded consensus expectations of -11.8 and January’s -43.7. New orders declined and unfilled orders continued to shrink as did inventories. The Philadelphia Fed Index (a monthly survey of manufacturers in the Third Federal Reserve District) for February rose 16 points to 5.2. This is its first positive reading since August 2023, which exceeded consensus expectations of ‑8.5. Firms surveyed reported a decline in employment and what may be characterized as weak pricing power coupled with higher input prices.

Retail Sales for January declined 0.8%, well below December’s revised increase of 0.4% and consensus expectations of -0.2%. Declines were exhibited in Retail & Food Services (0.8%), Motor Vehicle & Parts Dealers (1.7%), Building Materials, Garden Equipment & Supplies Dealers (4.1%), and Gasoline Stations (1.7%).

Industrial Production for January fell 0.1% versus an expected rise of 0.3%. Declines were exhibited in manufacturing, mining and capacity utilization.

Housing starts for January fell 14.8% to a seasonally adjusted annual rate of 1,331,000 versus December’s revised estimate of 1,562,000.

The Producer Price Index rose 0.3% in January after declining 0.2% in December. The Services index rose 0.6%, its largest increase since July 2023, while the Goods index declined 0.2%.

And the Fed Says…

On Wednesday, the Federal Open Market Committee (FOMC) released minutes from its meetings on January 30 – 31, 2024. Per its release, the FOMC stated, “Economic activity has been expanding at a solid pace. Job gains have moderated since early last year but remain strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.”

Committee members reiterated their data-driven approach of assessing inflation to determine if the downward trend will continue to a sustainable level of 2.0%. Members affirmed the appropriateness of their current policy given observed data, which they perceive as a continuation of inflation moving toward 2.0%.

|

|

Sources: BTC Capital Management, LSEG Group, S&P Dow Jones Indices, IHS Markit, FactSet, Federal Reserve Bank (Federal Open Market Committee)

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.