Equity Pullback

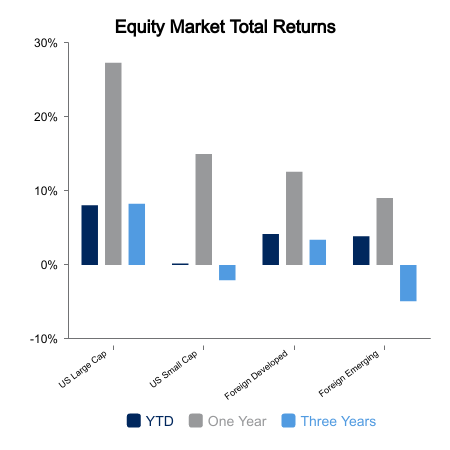

Equity markets declined this week as the reality of fewer prospective interest rate cuts by the Federal Reserve weighed on the minds of investors. Domestic equities, as measured by the Russell 3000 Index, declined 3.9% while small cap stocks fell 6.4%. International equities also weakened as the MSCI EAFE Index returned -2.1% for the week. On a year-to-date basis, domestic stocks are now only 4.8% higher, significantly lower than the 10% return in place at the end of the first quarter.

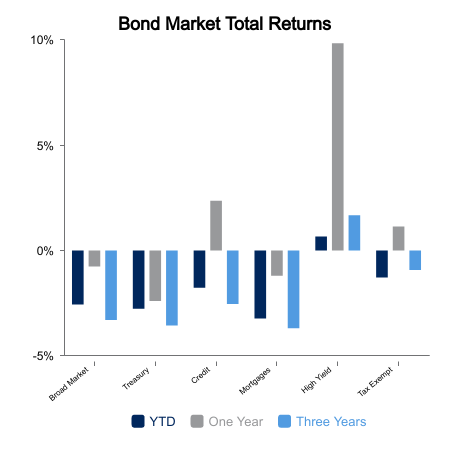

Fixed income was little changed for the week as broad indices returned -0.2%. The return reflects that interest rates were little changed for the period as the 10-year U.S. Treasury began the week with a yield of 4.54% and ended it with a reading of 4.59%.

Economic data released this week painted a picture of the United States consumer that was somewhat confusing. Retail sales showed a larger than expected increase with a move higher of 0.7%. This compares to the consensus expectation of 0.4%. The result was even more impressive when autos are excluded from the measure with a reading of 1.1%. The biggest contributor to this strong showing was online sales which increased 2.7%. Also up strongly was gasoline with an increase of 2.1%. These results continued to illustrate the resiliency of consumers.

Contrasting the strong retail sales data somewhat was the Michigan Consumer Sentiment Index which showed a slight decline in its preliminary reading for the month of April. The decline in the index was small, falling from 79.4 to 77.9. So far this year, the index has shown little change and staying in a range of 76.9 to 79.4. Contributing to the weaker reading this month was an uptick in inflation expectations and concerns about the prospective impact of the upcoming elections later this year.

Housing data released this week revealed the impact of higher mortgage rates and the diminishing prospect of meaningful rate relief this year. Housing starts declined 14.7 percent for the month of March and now register an annualized rate of 1.3 million, less than the consensus expectation of 1.5 million.

First quarter earnings reports began in earnest this week dominated by financial services companies. Next week investors will see the pace of releases accelerate with companies from numerous sectors on the docket. Overall, first quarter earnings are expected to grow 2.7% for the companies in the Standard & Poor’s 500 Index and currently the projected growth for the calendar year is 9.2%.

|

|

Sources: BTC Capital Management, Bloomberg, FactSet, LSEG Index Returns

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.