The NASDAQ Index Surges to Best Calendar Start Since 2000

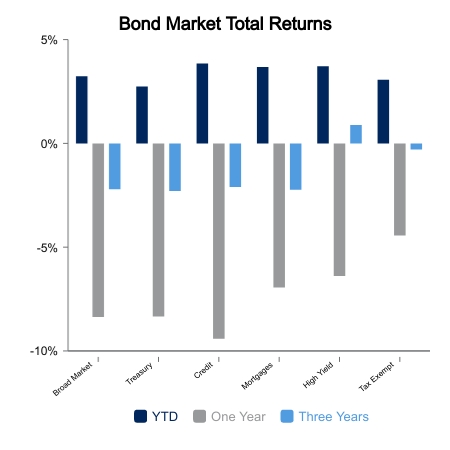

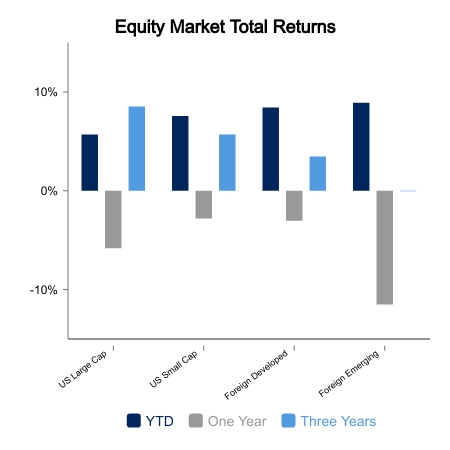

Positive equity momentum continued this week as the S&P 500 gained 2.2%. Despite yields moving higher, the NASDAQ fared even better with a 3.3% advance, which is a little bit of a character change. Fixed income indices were down as yields moved slightly higher. The NASDAQ is up 8.9% this month, its fastest start to a year since 2000.

Almost every breadth thrust indicator has been triggered in recent months, thereby improving probabilities for higher prices as the year progresses. It is worth reminding that the equity market normally goes up as the Fed raises rates. It doesn’t normally begin to fall until shortly before the cutting cycle as economic weakness and earnings weakness are anticipated. This cycle was unusual in how weak equity markets were at the beginning of the hiking cycle. It would be a return to normal for equity prices to move higher until we get closer to the cutting cycle.

Equities are saying the recession is not a 2023 story, which makes sense when you realize the Federal Funds Rate only rose above what many believe to be the neutral rate in September. It is possible the current earnings weakness is mostly tied to lapping superb post-Covid results and have little impact from monetary policy given its long lags. There could be a positive inflection for a couple quarters before the onslaught of rate hikes begins to make a significant impact on earnings and the economy. This possibility is supported by good GDP reports in the last two quarters.

Divergences Everywhere

Economic reports were limited this week, but negative on balance.

- The Leading Economic Index is now down 6% versus the prior, a level always associated with recession.

- Manufacturing surveys, especially new orders, remain extremely weak.

- Jobless claims are falling in noteworthy fashion, which contradicts some of the weak economic data.

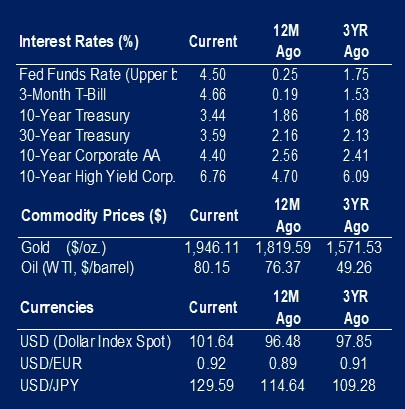

Global central banks are on divergent paths after being in unison during the last year. The Bank of Canada signaled this week that they would pause rate hikes going forward. The U.S. appears to be falling into the 25 basis points per meeting path. And against all odds, the European Central Bank (ECB) is talking as if they have a couple 50 basis points hikes to go. It is worth noting, the ECB is notorious for central bank policy blunders. They raised rates in late 2008 after the Fed had already cut 225 basis points only to quickly reverse course amid the financial crisis. They also mistakenly raised rates in 2011, but again were quickly backpedaling as the Euro Crisis took hold.

|

|

Source: BTC Capital Management, Bloomberg LP, FactSet, Refinitiv (an LSEG company).

The information provided has been obtained from sources deemed reliable, but BTC Capital Management and its affiliates cannot guarantee accuracy. Past performance is not a guarantee of future returns. Performance over periods exceeding 12 months has been annualized.

This content is provided for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. Statements in this report are based on the views of BTC Capital Management and on information available at the time this report was prepared. Rates are subject to change based on market and/or other conditions without notice. This commentary contains no investment recommendations and should not be interpreted as investment, tax, legal, and/or financial planning advice. All investments involve risk, including the possible loss of principal. Investments are not FDIC insured and may lose value.